EU climate and energy policy after the energy crunch

- The energy price spike started in summer 2021, as energy demand strongly rebounded after Covid lockdowns ended. The spike worsened when Russia started cutting down natural gas flows to Europe, particularly after its full-scale invasion of Ukraine in February 2022.

- Since then, Europe has diversified its gas supply. This has improved energy security, but Europe’s increased reliance on liquefied natural gas (as opposed to piped gas) makes it more exposed to price fluctuations on the global gas market.

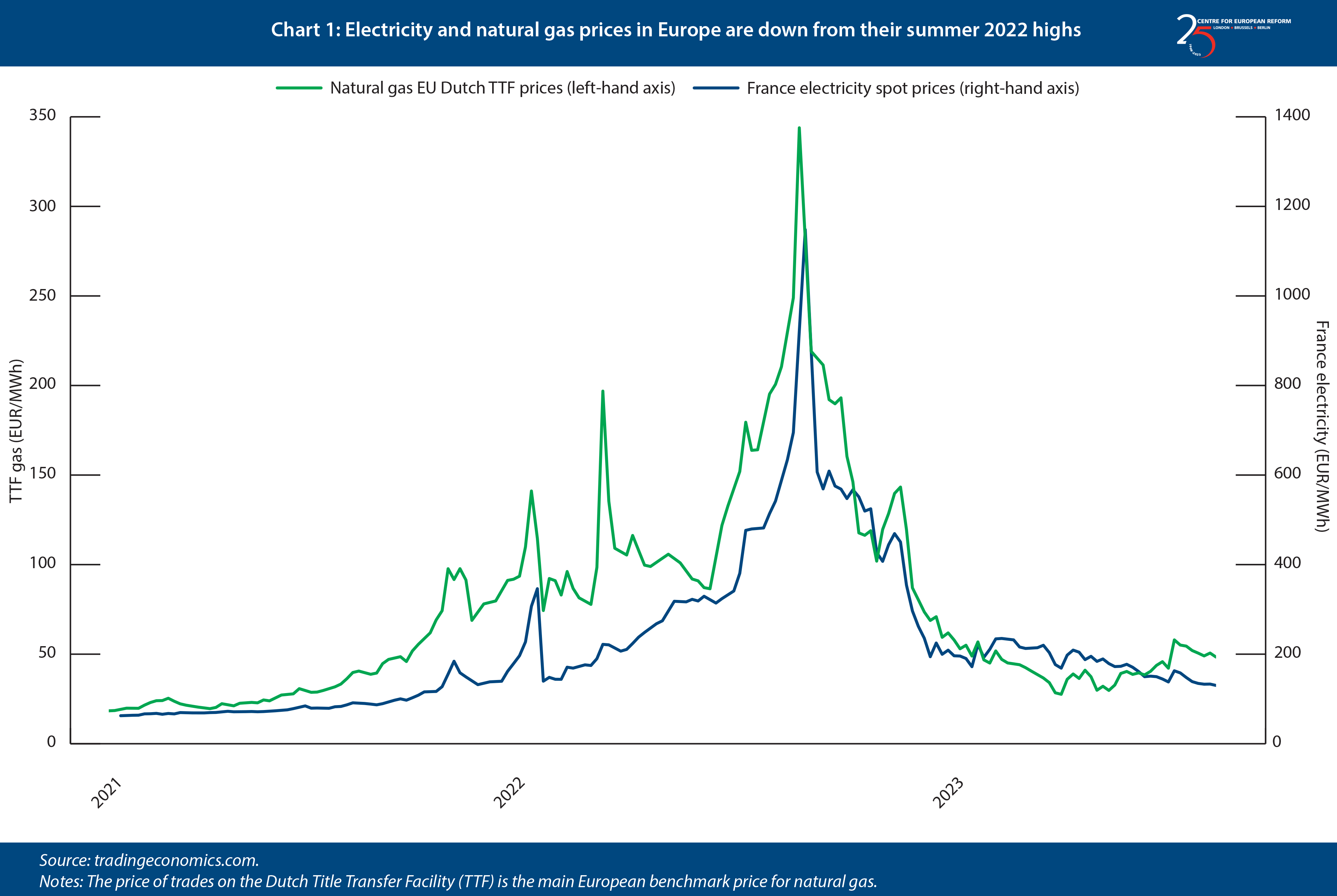

- Both gas and electricity prices have come down substantially from their 2022 highs, which means energy should be more secure and affordable in the coming winter.

- The overall macroeconomic impact of the 2021-2022 energy crunch has been rather muted: while some feared an industrial meltdown, the European economy has shown resilience and adaptability. Energy-intensive industrial sectors in some parts of Europe like Germany scaled down their production, but this did not plunge the entire economy into recession, as some had feared.

- The energy price spike has, however, impacted public budgets. Governments enacted important market interventions and spent large sums to protect consumers and businesses. Governments may have to roll back some of the temporary subsidies and other price-suppression mechanisms for fiscal reasons, but this will be politically difficult.

- The crunch made it painfully clear that, as long as electricity generation at times of high demand largely depends on gas power plants, power prices will spike when gas prices do. This has prompted the EU to launch a reform of its power market design, now reaching its final stages. It aims to standardise national policies to support investment in renewables across the continent, to ultimately reduce dependence on fossil-fuelled power generation.

- The crisis also highlighted how crucial the energy union is for EU energy security. Countries facing a shortfall in power generation, like France, were able to avoid blackouts partly thanks to cross-country grid interconnections allowing them to import more from neighbours. At the same time, the crisis unveiled the weaknesses of grid infrastructure: congestion on the gas grid contributed to high prices. To shift from a fossil-fuelled economy to a largely electrified and renewables-based one, the EU needs greater co-ordination on expanding power grid infrastructure, including grid interconnectors across countries.

- The EU has not downgraded its climate policy ambitions. But now member-states need to implement the many revised or new climate policies that have recently come into effect. Different implementation efforts could emerge at national level: the European Commission needs to be tough in enforcing a common European framework.

- Public funding for climate investment and the energy transition is limited. Both EU and other public funds remain fragmented and overall inadequate to meet decarbonisation goals.

European energy markets today are in a very different situation from a year ago.1 Judging by Commission President Ursula von der Leyen’s annual State of the Union speech, it may even seem that the energy crisis is over.

Europe has diversified its gas supply following Russia’s aggression on Ukraine and the ensuing energy price spike. A more diverse gas supply mix is a structural improvement for EU energy security, but it has also made Europe more exposed to global gas market fluctuations. While Europe used to import most of its natural gas from Russia via pipeline, it is now increasingly reliant on imports of liquefied natural gas (LNG) which is traded on global markets, characterised by more volatile commodity prices. Still, both gas and electricity prices have come down substantially from their 2022 highs, making energy more affordable.

This policy brief looks back at the past two years and assesses how EU energy and climate policy has changed because of the energy crunch. Some changes have been temporary, while others are likely to affect the European energy market for longer. This brief concludes that the EU should be more ambitious in facilitating investments in energy efficiency, renewables and power grids, increasing and rationalising the funds it devotes to supporting such investments. The Commission should also strengthen its oversight of member-states’ progress towards energy and climate goals and policy implementation. It should monitor and push for climate investments in its regular interactions with member-states – for example as part of the National Energy and Climate Plans and of the European Semester.

The impact of the energy crunch on energy markets

Natural gas and electricity prices have come down substantially from their August 2022 peaks (Chart 1). In the first half of 2023, average natural gas prices in the EU were more than six times lower than at the peak, and electricity prices were more than four times lower.2 Yet, energy prices are still fluctuating substantially. What explains these price dynamics?

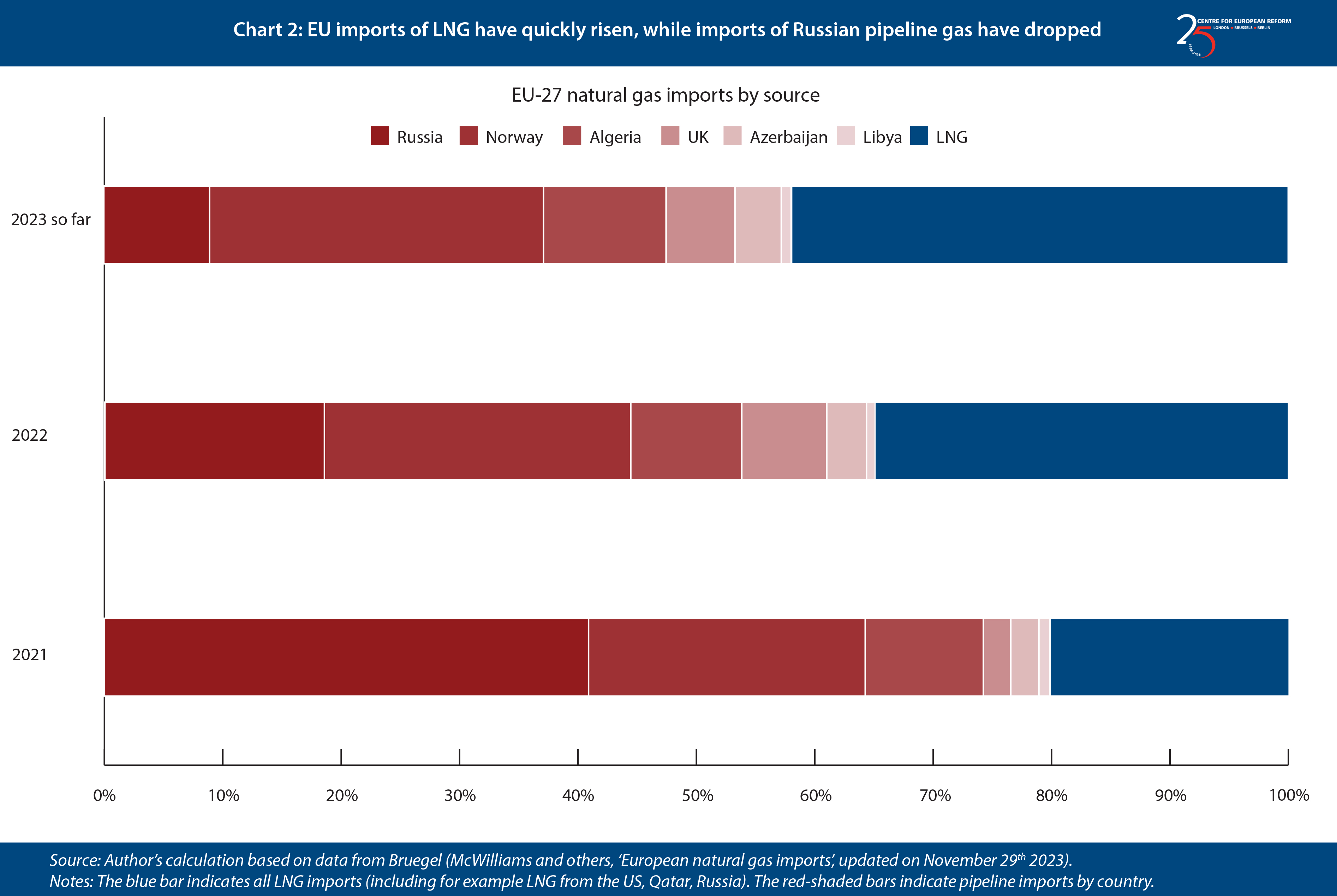

First and foremost, Europe’s gas supply mix has changed considerably. While Russian pipeline gas accounted for 41 per cent of EU natural gas imports in 2021, this has dropped to 9 per cent, as shown in Chart 2. Much of this shortfall was covered by a sharp increase in imports of LNG from the US and elsewhere, supplementing an already robust increase in pipeline imports from long-standing suppliers like Norway. As a result, Norway and the US have become the main gas suppliers for the EU, providing respectively 30 and 18 per cent of natural gas imports, up from 24 and 6 per cent in 2021.3 As Europe has become more reliant on LNG imports as opposed to pipeline gas, it has become more exposed to price fluctuations on the global gas market.

Gas storage in Europe today is essentially full ahead of the 2023-2024 heating season, reducing pressure on prices.4 This puts the EU in a safer position with respect to last year, when it feared gas shortages if Russia completely cut off the limited gas supplies it was still sending to Europe. A shortfall in supply could still occur but it would require a particularly unfortunate set of circumstances: an especially cold winter, a further reduction in pipeline gas flows from Russia, and a reduction in global LNG supplies.5

Gas demand in Europe has also fallen. Over winter 2022-2023, demand was 18 per cent lower than the average of the previous five years.6 Mild weather helped Europe by reducing gas demand for heating in buildings. However, some changes in gas demand appear to be longer-lasting and might become structural. This is particularly visible in falling industrial gas demand, which was largely driven by production cuts in gas-intensive sectors such as chemicals manufacturing.7 As long as gas prices in Europe remain higher than before the energy crunch, production in these sectors might not return to pre-war levels.

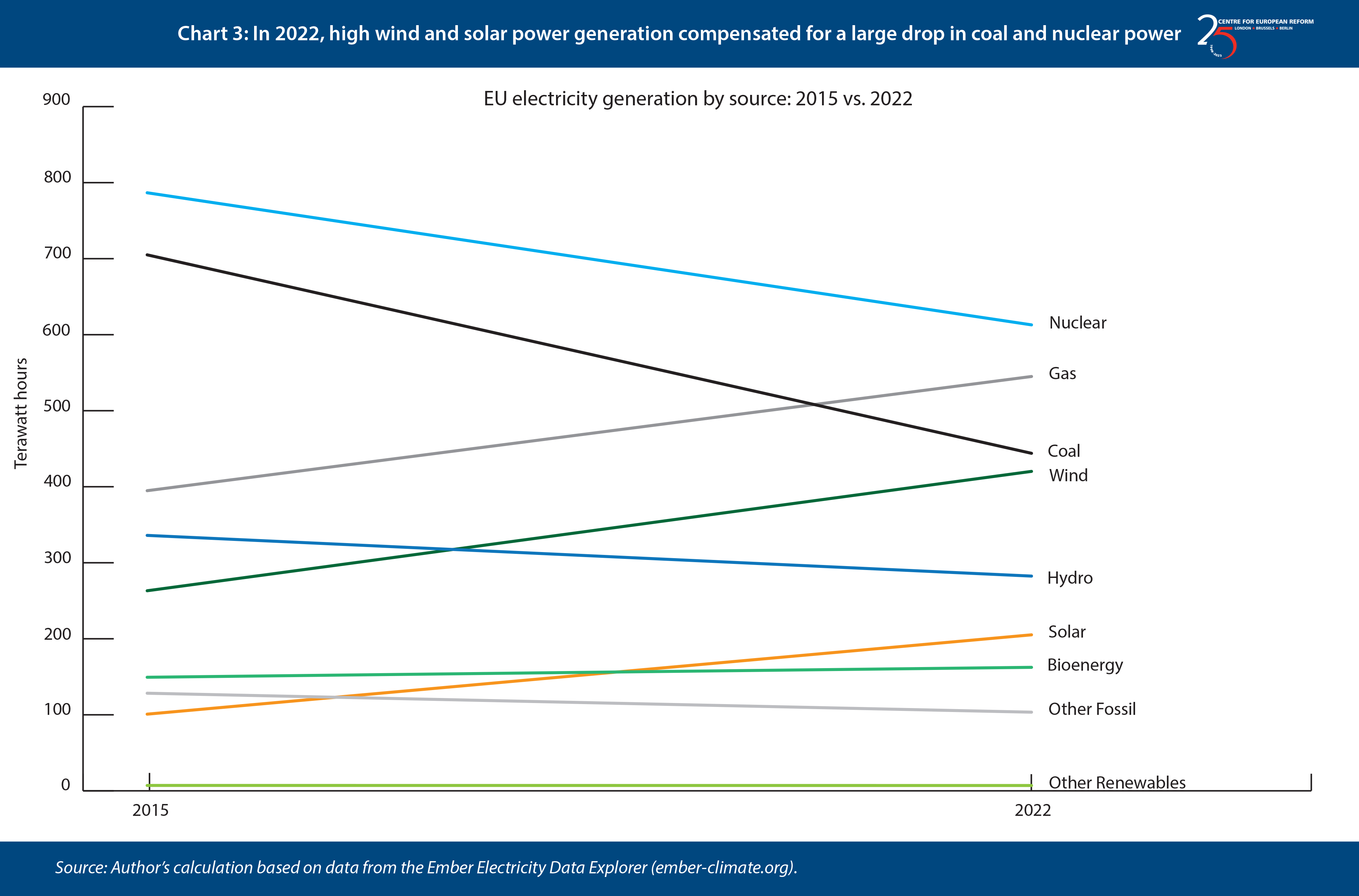

Electricity demand also dropped in 2022, largely due to non-weather factors, as industry cut its consumption.8 Since their summer 2022 peak, power prices dropped thanks to lower gas prices, but also higher generation from renewables, which has filled part of the gap left by lower nuclear and hydroelectric generation in 2022 – a trend illustrated in Chart 3.9 French nuclear energy generation is up again after hitting a 30-year low in 2022 due to a combination of reactor corrosion issues and slow maintenance, a ‘perfect storm’ that is unlikely to recur with this magnitude.10 The energy crisis did not reverse Germany’s nuclear power phase-out, however: its last remaining nuclear plants were shut in April 2023.

The macroeconomic impact of the energy crunch

In the early days of Russia’s full-scale invasion of Ukraine, proponents of a more hawkish approach to sanctions suggested that the EU implement a full embargo on Russian natural gas as well as oil, to deprive the Kremlin of an important source of revenue. But many counterargued that Europe could not quickly forgo Russian gas. Many manufacturing sectors feared that Russia cutting off gas supplies to Europe would mean an outright industrial meltdown and, undoubtedly, a recession.11 Ultimately, the EU did not embargo cheap Russian gas, but still had to find a way to live without large quantities of it.

Fast forward to today, and the European economy has adapted remarkably well to the new state of energy markets. The sharp increase in both gas and electricity prices triggered both businesses and households to reduce their consumption. This helped Europe to avoid outright energy shortages.

On a macro level, the continent has so far averted a recession, although growth did slow down markedly. In their autumn 2023 economic forecasts, the European Commission, the IMF and the OECD all revised downwards their projections for economic growth in the EU in 2024, largely due to the effect of slowing but persistent inflation. Nonetheless, the situation is far from the sharp drop in output that some warned against.

Growth rate forecasts vary substantially across EU countries. More energy-intensive and manufacturing-reliant economies, such as Germany, have suffered more from the energy crunch than economies with a larger tourism or service sector, such as Portugal and Spain, and are rebounding more slowly from it.12 At the same time, even manufacturing-heavy Germany has shown the capacity to grow despite using less gas. The production cuts in gas-intensive sectors (up to 20 per cent in the chemicals sector, for example) have not led to feared spillover effects across the economy, showing that efficient substitution of production inputs can happen swiftly after such a price shock.13

While energy prices have come down from their 2022 highs, forward markets indicate that energy costs in Europe will remain higher than in the US and China for the foreseeable future. If Europe wants to keep energy affordable and to be more competitive and resilient, it should use its energy and climate policy strategically to drive down energy costs. The EU should be more ambitious in supporting investments that can reduce reliance on fossil fuels, from renewables to energy efficiency, ensuring that member-states do not cut back on such investments, especially once Next Generation EU funds run out at the end of 2026.

The investment impact of the energy crunch

The energy crisis has changed energy investment patterns in Europe in at least three visible ways.

First, it prompted many European countries such as Germany, who previously relied largely on gas imports by pipeline, to quickly invest in infrastructure to import LNG via ships. These investments were deemed necessary for Europe to secure gas in the short term, as long as its heating systems and heavy industries largely depend on gas. But there is a tension between the short-term need to find alternatives to Russian pipeline gas and medium to long-term climate goals. In line with the EU’s decarbonisation plans, buildings and industry will also need to decarbonise: as a consequence, it is still unclear whether new gas-related investments will see returns or whether they will become stranded assets as Europe eventually winds down its fossil fuel consumption.

Second, the crisis boosted investment in renewable energy capacity: in 2022, wind power installations in the EU grew by 40 per cent relative to 2021,14 while solar installations grew by 47 per cent year-on-year.15 Installations of solar panels by utilities and domestic consumers have been driving the trend, whereas installations of wind turbines are progressing more slowly as the turbine industry struggles with increasing costs for materials and components. These supply chain issues are holding back the full potential of renewables.16

Third, investment in energy efficiency measures has risen, as energy price spikes meant efficiency measures offered more value for money. Heat pump sales in Europe grew by over 40 per cent both in 2021 and 2022. Europe also led the global increase in energy efficiency investments in buildings over 2022.17

The policy impact of the energy crunch

Governments and the Commission responded to energy price spikes with subsidies and price suppression measures

On the energy policy front, governments intervened in energy markets with a heavy hand in 2022 and 2023. The Commission allowed national-level interventions such as energy consumption subsidies, price caps and taxes on operators’ windfall profits.

Energy-poor households, unable to adequately heat their home, increased by 35 per cent between 2021 and 2022.

The impact of such national emergency measures is very visible: EU member states allocated €540 billion to insulating consumers against high energy prices, with Germany alone earmarking €158 billion.18 The design of emergency interventions to protect consumers varied substantially across countries, as well as their generosity, their relative focus on households or industry, and the extent to which they targeted poorer households or took more of a blanket approach.19 The energy crunch has therefore had important distributional impacts, as some consumer groups were more heavily affected than others. The amount of energy-poor households, who are unable to adequately heat their home, increased by 35 per cent year on year in 2022, reaching over 9 per cent of the EU population. This issue was particularly acute in southern and central-eastern Europe.20

Among businesses, energy-intensive manufacturing has suffered the most from the energy price spike – but it has also largely proved capable of adapting to it. Germany is a case in point: industry reduced production, improved energy efficiency or replaced domestic manufacturing with imports where needed to cut its gas demand.21 These dynamics have prompted Europe’s industrial policy efforts to ensure that import dependency does not lead to overreliance on single suppliers, such as China.

The European Commission also broke a taboo by allowing an EU-wide ‘market correction mechanism’ which would cap gas prices at €180 per MWh under certain conditions (though market prices have not yet reached that cap). The approval of this measure followed a lengthy debate, with critics saying it might distort price signals and promote gas overconsumption. EU members only agreed by making the mechanism temporary and due to expire at the end of 2023, but the Commission just proposed extending the measure by one year as ‘insurance’ against more turmoil on gas markets.22 Provisions for governments to roll out extraordinary state aid measures to support businesses burdened by high energy prices have also been extended to mid-2024.23 This points to a potentially longer-lasting legacy of the energy crisis: the lingering appeal of price controls and more generous state support.

The crunch has kickstarted a reform of electricity market design

One of the EU’s biggest concerns after the energy crisis is how to mitigate the distributional impacts of high energy prices. This is reflected in the proposal to reform the EU’s electricity market that the Commission tabled in March 2023. The reform, which is currently being debated by the European Parliament and the Council of Ministers, will change both electricity retail and wholesale markets.These respectively involve final consumers and electricity retailers, and retailers and electricity generators. On the retail market front, the reform puts forward some common guidelines that member-states would have to follow in rolling out consumer support in case of future energy crises.

The lingering appeal of price controls and more generous state support could represent a longer-lasting legacy of the crisis.

This signals one of the shifts prompted by the crisis: the Commission now sees a degree of government intervention in energy prices as inevitable in the event of price spikes, and it aims to standardise these interventions. There is merit to this proposal: targeting interventions towards the neediest consumers is a good idea, as is setting ‘tiered’ prices to encourage households to reduce excess consumption instead of capping prices at the same level regardless of how much a household consumes. At the same time, because the size of interventions on energy prices is decided by each government, they may still unbalance the single market’s level playing field.

On the wholesale market front, the reform aims to mainstream long-term contracts for low-carbon electricity generation, to stabilise prices and improve the business case for low-carbon power generators. This means that member-states would offer contracts for difference (CfDs) – long-term contracts with set prices for delivering low-carbon electricity – as the default public support scheme for new installations. Such set prices give investors in clean electricity some certainty about their expected returns. After a long stalemate, EU energy ministers agreed on October 17th that CfDs could also be used to provide public support to lifetime extensions of existing plans, such as nuclear power plants. This was a key issue for France because of the financial problems troubling its fleet of nuclear plants. At the same time, member-states extended to 2028 the ongoing remuneration for fossil fuel power plants (for providing scalable power during peaks in demand, a role renewables are not yet as capable of fulfilling).

In contrast with the Commission, governments also favoured continuing to cap the revenues of (non-gas) electricity generators. The cap was implemented in 2022 to extract some of the unexpectedly high profits of lower-cost power producers in – again – a redistribution effort. However, prolonging this controversial measure may not be worth it: investors claim it creates a ‘one-way bet’, where generators lose out if energy prices drop, but cannot benefit if they increase. Revenues raised so far through that measure have been lower than expected, so it is unclear whether the expected benefit outweighs the perceived ‘threat’ to new investment.24

The crisis spurred a more centralised approach to EU energy security

The energy crisis spurred not only a wave of national-level efforts to support consumers, but also an EU-level wave of measures to improve the bloc’s energy security.

To insure against a shortfall if Russia cut pipeline gas exports to Europe, member-states accepted higher targets for storage filling rates ahead of the start of the heating season. The regulation requires that gas storage sites be filled to 90 per cent by November 2023, which was successfully achieved ahead of time.

The EU has used both compulsory and voluntary measures to ensure energy solidarity across the continent.

On the demand side, EU governments agreed to voluntary energy-saving targets. Member-states met these targets to different extents in winter 2022-2023. On the whole, EU countries overachieved on cutting back total gas demand, successfully reduced electricity demand at peak times (when it is highest), but struggled to further reduce overall electricity demand. Energy-saving targets have been extended to winter 2023-2024. It would be sensible to keep them beyond this date, and this would be in line with the revised energy efficiency directive.

This directive aims to support investment and encourage users to consume less energy by introducing a binding EU-wide energy efficiency goal. However, while it requires member-states to translate it into national level goals for energy efficiency improvements, these remain indicative as opposed to binding.

Over the past 18 months, the EU has used both compulsory and voluntary measures to ensure energy solidarity across the continent.

For example, in April 2022, the Commission set up a platform to aggregate gas demand of EU member-states and jointly procure gas to meet it, with the aim of simplifying buyer-seller negotiations and lowering prices by buying in bulk. So far, the platform has matched demand and supply for a seemingly small total of 35 billion cubic metres of gas (just above 10 per cent of total EU gas imports in 2022).25 Its effect on prices is so far unknown,26 but this approach could simplify gas procurement, making it easier for smaller member-states to handle negotiations and consequently lock in decent prices. Moreover, the idea of joint purchases could also be applied to sourcing other crucial inputs, like hydrogen and critical raw materials.

Greater co-ordination on planning infrastructure for the energy transition is necessary

Finally, the crisis has shown that insufficient or overloaded gas and electricity interconnections across Europe threaten the Continent’s energy security and risk soaring energy prices. The EU used to import most of its gas via pipeline from Russia to eastern Europe, which would then make its way to western Europe. Today gas imports are a more balanced mix of pipeline gas and LNG from different suppliers (see Chart 2), with the latter increasingly docking at LNG terminals on Europe’s west and northern coast, and then making its way to the rest of Europe. In 2022, bottlenecks on the gas grid slowed these flows and contributed to the price spike, particularly in countries left most exposed to the reduction in Russian gas flows, such as Italy, Austria and Germany.27 This realisation prompted governments to rush to expand their LNG import capacity, building new facilities where there used to be few or none, and to ease bottlenecks, building or strengthening interconnections across different EU countries.

At the same time, new investments in gas import and transmission networks come with their own challenges: as the EU plans to be climate-neutral by 2050, the economic importance of fossil fuel networks will diminish, and gas transmission networks will probably be decommissioned. This raises questions about how to pay for new investments needed in the short term: historically, the cost of utility assets are recovered via customer bills over many decades. Discussions on how to best achieve decommissioning have also started both at EU and national level, but given the major shift they entail (making redundant an infrastructural network as the energy system decarbonises), there are no best practices yet.

On the electricity front, grid interconnections between EU countries and with the EU’s neighbours have proven crucial at ensuring security of supply and smoothing prices. For example, as the output from France’s nuclear power plants fell due to maintenance issues, France made use of its grid interconnections and became a net electricity importer. Looking forward, as electrification of heating and road transport advances, power demand will increase by 60 per cent between now and 2030. Successful electrification at this pace requires investments in grid expansion to connect regions with different patterns of electricity demand and supply. Investment needs are estimated at over €580 billion.28 It would be more efficient to fully plan and co-ordinate those at the EU level.

EU climate policy ambition has so far not been downgraded since the energy crunch

The energy crisis has not slowed down the EU’s climate ambitions so far – despite fears and even demands to the contrary. Most policies within the Fit for 55 package – the policy framework for the EU to curb its greenhouse gas emissions by 55 per cent by 2030 – have been approved and are now in force.

In this context, the EU has agreed to reform and expand its carbon pricing. Free emissions allowances for heavy industry under the EU Emissions Trading Scheme (EU ETS) will be gradually phased out between 2026 and 2034, as the carbon border adjustment mechanism (CBAM) is phased in. This mechanism will ensure that importers of key goods that are already subject to carbon pricing in Europe – such as steel or aluminium – will have to pay the same price when importing them into the EU, levelling the playing field between domestic and foreign producers. The new emissions trading scheme (EU ETS2), which will include road transport and heating, will be implemented in 2027. But the directive introducing ETS2 stipulates that full implementation of this new carbon market could be delayed to 2028 if oil or gas prices are exceptionally high in 2027 – a visible signal of caution coming out of the crisis.

Fit for 55 climate policies now risk being implemented with varying speed at national level.

Higher deployment targets for renewable energy and energy efficiency have been approved as part of the renewable energy directive and energy efficiency directive, respectively. These are steps forward, though the energy efficiency target remains ambitious given investments in efficiency are progressing more slowly than in renewables.

Lastly, negotiations focusing on how to boost energy efficiency in the building sector are still ongoing, partly clouded by national blunders. For example, Italy spent a whopping €105 billion on the ‘Superbonus’ subsidy scheme for home renovations, but without conditioning handouts on income levels or minimum energy efficiency improvements.29 Germany had to backtrack on its heating decarbonisation ambition, delaying the phase-out of gas boilers to 2028.30

Fit for 55 climate policies now need to be implemented at national level. This could lead to multi-speed implementation on the ground, as governments of different political colours and countries with different degrees of dependence on fossil fuels embrace the urgency of energy decarbonisation to different degrees. While some may argue that slowing down on climate action could prevent backlash against green policies at large, it is a risky argument, as Europe needs the contribution of all member-states to comply with its climate goals.

At EU level, with consensus on what the policy pathway to 2030 should look like, discussions are now shifting to 2040 climate targets. Following the resignation of Frans Timmermans, Maroš Šefčovič has been appointed as Executive Vice-President for the European Green Deal and former Dutch minister Wopke Hoekstra as Commissioner for Climate Action. During their hearings at the European Parliament, they both pledged to cut the EU’s greenhouse gas emissions by at least 90 per cent by 2040.

It is important that the Commission keeps scrutinising member-states’ compliance with 2030 goals. In March 2023, member-states had to report back on their progress towards long-term goals set out in the National Energy and Climate Plans (NECPs). The European Court of Auditors’ analysis of these reports indicates that the gap between the ambition of 2030 policy targets and policy initiatives on the ground is increasing.31 Emissions reductions need to accelerate, and while progress on deployment of renewable energy is encouraging, many EU countries are lagging behind in the achievement of energy efficiency goals and in building power grid interconnectors.32

The European Court of Auditors also warns that NECPs do not indicate investment needs to meet energy and climate goals. This is particularly critical at a time when investments in decarbonisation of laggard sectors – from heavy industry to buildings to road transport – need to increase quickly. Stronger Commission scrutiny over governments’ energy and climate progress should include the investment sphere, as also suggested by other observers.33 This investment oversight should be a key part of the regular reporting on NECP progress – a bi-yearly exercise – but also of the European Semester process – a yearly exercise whereby the Commission monitors member-states economic and social policies.

But EU and other public funds for climate investment remain inadequate and fragmented

Emissions reductions and technology deployment targets set the long-term goals, policies chart the pathway to reach those goals, while investments are necessary to implement those policies. The Commission estimates that, to decarbonise the European economy, there is a need for an average yearly investment of €1040 billion throughout the 2020s.34 Most of those investments should be backed by private funds – but the role of public finance should increase too. On average, the annual national public spending for the energy transition should be about 1 per cent of GDP between 2021 and 2027 among EU countries. Considering how much of that is financed with different EU funds, that leaves a national public spending gap of 0.73 per cent of GDP.35 Simply put, this means that EU public spending for the energy transition today is insufficient, and the EU average hides important differences across countries.

The EU needs a permanent Climate Investment Fund to avoid high costs of capital and insufficient investment.

The Recovery and Resilience Facility (RRF) devoted a large part of its funds to investments for the energy transition, enabling projects that might otherwise not have taken place. There is a risk of a ‘fiscal cliff’ once that source of public funds runs out in 2026: member-states with limited fiscal space might cut back on strategic investments in what would be European public goods, from installing additional capacity in renewable energy generation to expanding power grids. It is true that EU cohesion funds for the years 2021-2026 have been disbursed more slowly than usual as member-states prioritised RRF projects instead.36 This sort of substitution effect may push back the fiscal cliff risk a bit, but cohesion funds do not have a specific energy or climate focus. Through conditional grants and loans, the RRF ensures that EU-level priorities directly translate into national and local-level investments. This degree of co-ordination ensures European public goods are not overlooked, and brings down the cost of capital for countries that might otherwise face higher interest rates. As the CER has long argued, to avoid a fiscal cliff, high costs of capital and insufficient investment, the EU should put in place a permanent Climate Investment Fund.37

Simultaneously, public budgets need to be climate-proofed: while through the energy crunch governments increased energy subsidies, these should not linger on. Fossil fuel subsidies should be removed from both EU and national budgets (as Hoekstra has said he would). It is important to remove fossil fuel subsidies and to align energy taxes with the carbon content of fuels, to provide consumers with the right price signals.

Conclusion

The energy crunch has prompted some unusual emergency policies at EU and national level. While these have come with large fiscal costs and dubious market impacts, Europe has survived the shock with overall limited macroeconomic trouble, as opposed to a feared industrial meltdown.

The temptation to keep in place price suppressing measures to keep volatile prices in check should be avoided. The EU should focus instead on long-term reforms needed to reduce its dependence on fossil fuels. These include reforms facilitating investments in energy efficiency, renewables and power grids. But investments in such European public goods need to involve both private and public investors. EU-level funds for climate investment and the energy transition remain fragmented and overall inadequate to meet decarbonisation goals: the EU should rationalise its budget and make it climate action proof, putting its money where its climate leadership ambitions are.

The EU has not slowed down on its climate policy, but there is a risk that some member-states will do that as they implement the latest batch of climate policy initiatives. The European Commission regularly monitors governments’ progress towards energy and climate goals as part of the National Energy and Climate Plans. It needs to complement these efforts with scrutiny over whether governments are undertaking sufficient investments to make such goals a reality, and support them to ensure they do.

2: European Commission, ‘State of the energy union report 2023’, October 2023.

3: European Commission, ‘State of the energy union report 2023’, October 2023.

4: Shotaro Tani and Alice Hancock, ‘Energy companies turn to Ukraine to store gas as EU nears capacity’, Financial Times, November 1st 2023.

5: International Energy Agency, ‘Medium-term gas report 2023’, October 2023.

6: European Commission, ‘State of the energy union report 2023’, October 2023.

7: Peter Zeniewski and others, ‘Europe’s energy crisis: What factors drove the record fall in natural gas demand in 2022?’, IEA commentary, March 2023.

8: International Energy Agency, ‘Electricity market report update, outlook for 2023 and 2024’, July 2023.

9: Peter Zeniewski and others, ‘Europe’s energy crisis: What factors drove the record fall in natural gas demand in 2022?’, IEA commentary, March 2023.

10: Jon-Michael Murray, ‘The 2022 French nuclear outages: Lessons for nuclear energy in Europe’, Clean Air Task Force article, July 2023.

11: Prognos, ‘Halt to Russian gas supply – consequences for German industry’, study commissioned by the Bavarian Industry Association, June 2022.

12: International Monetary Fund, ‘Regional economic outlook. Europe: Restoring price stability and securing strong and green growth’, November 2023.

13: Benjamin Moll, Moritz Schularick, and Georg Zachmann, ‘The power of substitution: The great German gas debate in retrospect’, Brookings papers on economic activity, September 2023.

14: WindEurope, ‘Wind energy in Europe 2022: Statistics and the outlook for 2023-2027’, February 2023.

15: SolarEurope, ‘EU market outlook for solar power 2022-2026’, December 2022.

16: Rystad Energy and WindEurope, ‘The state of the European wind energy supply chain’, April 2023.

17: International Energy Agency, ‘World energy investment 2023’, May 2023.

18: Giovanni Sgaravatti and others, ‘National policies to shield consumers from rising energy prices’, Bruegel Datasets, first published November 4th 2021.

19: Elisabetta Cornago and John Springford, ‘Europe needs both fiscal and energy solidarity’, CER policy brief, March 2023.

20: European Commission, ‘EU guidance on energy poverty’, October 2023.

21: Benjamin Moll, Moritz Schularick, and Georg Zachmann, ‘The power of substitution: The great German gas debate in retrospect’, Brookings Papers on Economic Activity, September 2023.

22: European Commission, ‘Commission prolongs energy emergency measures by 12 months’, news announcement by the Directorate-General for Energy, November 28th 2023.

23: European Commission, ‘Commission adjusts phase-out of certain crisis tools of the State aid Temporary Crisis and Transition Framework’, press release, November 20th 2023.

24: European Commission, ‘Report from the Commission to the European Parliament and the Council on the review of emergency interventions to address high energy prices in accordance with Council Regulation (EU) 2022/1854’, June 2023.

25: European Commission, ‘State of the energy union report 2023’, October 2023.

26: Alex Barnes, ‘EU joint purchasing of gas – an assessment’, OIES paper, September 2023.

27: Timera Energy, ‘Prices across Europe’s gas hubs diverge’, May 2nd 2022.

28: European Commission, ‘Grids, the missing link - An EU action plan for grids’, November 2023.

29: Valentina Romano, ‘Italy overturns ‘superbonus’ scheme for housing renovation’, Euractiv, February 23rd 2023.

30: Nikolaus Kurmayer, ‘Germany adopts watered-down fossil boiler ban for 2028’, Euractiv, September 8th 2023.

31: European Court of Auditors, ‘EU climate and energy targets. 2020 targets achieved, but little indication that actions to reach the 2030 targets will be sufficient’, June 2023.

32: European Commission, ‘Assessment of progress towards the objectives of the Energy Union and Climate Action’, October 2023.

33: Leonardo Meeus and others ‘Energy policy ideas for the next European Commission: from targets to investments’, November 2023.

34: European Commission, ‘Stepping up Europe’s 2030 climate ambition. Investing in a climate-neutral future for the benefit of our people’, September 2020.

35: Agora Energiewende, ‘EU climate funding tracker’, database and visualisation tool, version 1.0, June 2023.

36: European Court of Auditors, ‘EU financing through cohesion policy and the Recovery and Resilience Facility: A comparative analysis’, January 2023.

37: Elisabetta Cornago and John Springford, ‘Why the EU’s recovery fund should be permanent’, CER policy brief, November 2021.

Elisabetta Cornago is a senior research fellow at the Centre for European Reform

December 2023

View press release

Download full publication