Europe can withstand American and Chinese subsidies for green tech

- In the global market for green technologies, many European countries are worried about losing out to subsidised production in the US and China. However, the EU has a sizeable share of global exports in green goods, although not as large as China’s – and the US is languishing behind both.

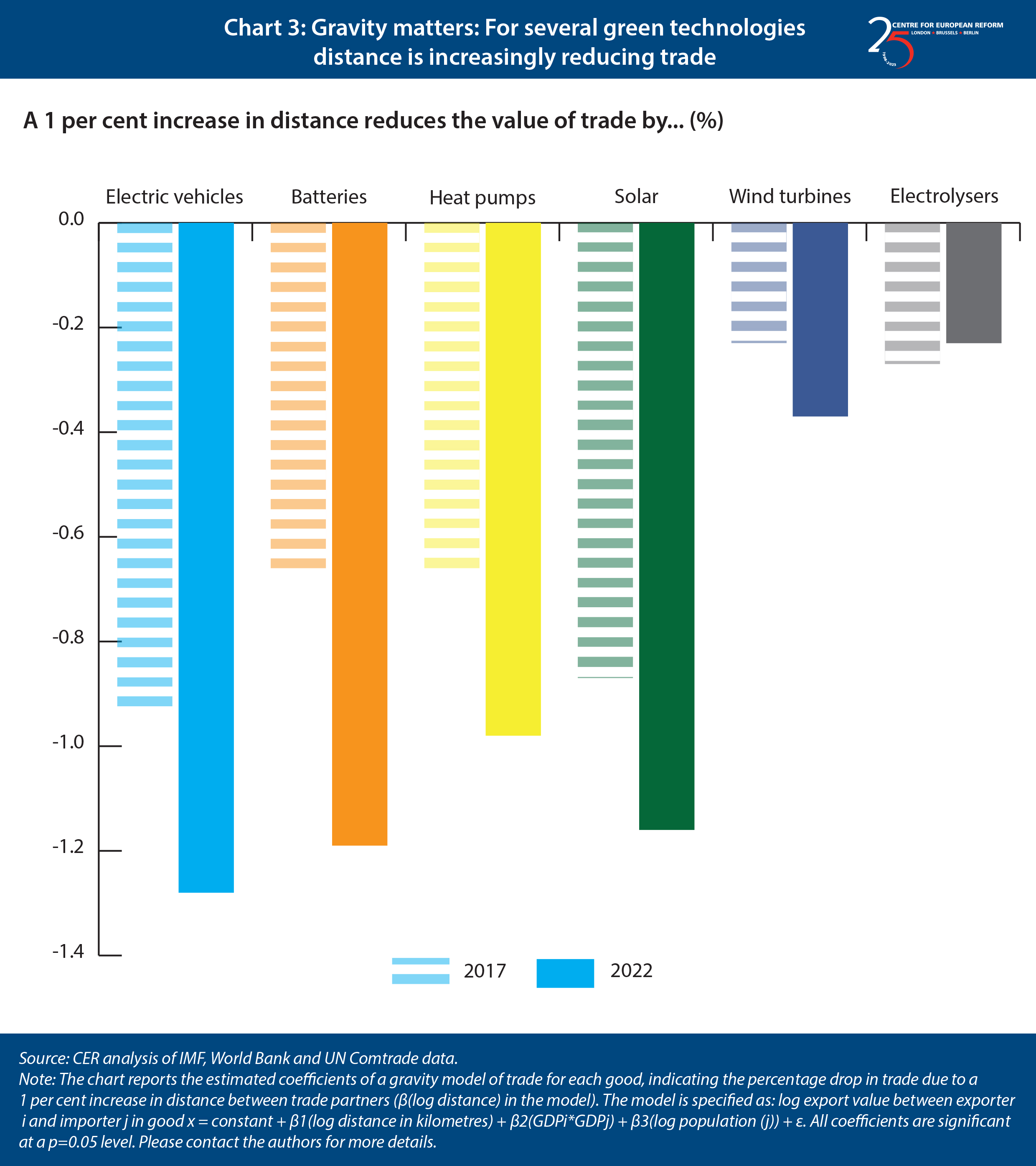

- Across six categories of green goods that are at the heart of US, Chinese and EU green industrial policy (electric vehicles, batteries, heat pumps, solar, wind turbines and electrolysers), in almost all cases the negative impact of geographical distance on trade increased significantly between 2017 and 2022. The EU should continue to excel in domestic production of some of these green technologies, because supply chains are shortening as technologies mature, and companies are expanding production nearer consumers to reduce shipping costs.

- All this suggests that the EU should be cautious about directly subsidising green production, as the US and China are doing. In a world where distance between trade partners is increasingly important, and where markets for green technologies are rapidly maturing, money will be put into companies that would have robust demand for their products anyway. A subsidies race may also distort the EU single market, weaken incentives to innovate, and create excess production capacity. Any protectionist backlash from other trade partners could slow the green transition by driving up the prices of inputs that the EU needs in order to decarbonise.

- The EU should focus its subsidies on sectors where short-term assistance is needed to help infant European industries, such as hydrogen, achieve scale. It should also prioritise support to markets for goods, like wind turbines, in which a global oligopoly or duopoly is likely to arise, and in which a dependence on China would be risky. That way, the EU will help new businesses to grow while minimising handouts to those that do not need them.

Global competition to ’win’ the green technologies race is heating up. Until the mid-2010s, the EU had been in the lead, with policies like the Emissions Trading Scheme (ETS) prompting early innovation in renewable energy and decarbonised steel. But now Chinese exports of green goods are growing rapidly, and the US is subsidising its own producers. The stakes are high, because the first movers in new technologies often (but not always) develop big shares of global exports. What is more, Europe might swap a dependence on Russia and the Middle East for fossil fuels for a dependence on China for green goods, making it harder to stand up to Beijing.

European policy-makers are fretting too much about green competitiveness, however. At present, Europe’s demand for green goods is bigger than its domestic supply capacity, sucking in imports, but that should change once domestic production increases. Europe has a world-leading manufacturing sector. And supply chains are shortening as technologies mature, with companies expanding production nearer to consumers to reduce shipping costs. All this suggests that the EU should be cautious about directly subsidising green production, as the US and China are doing.

Beijing has heavily subsidised manufacturing through its financial system, and its producers benefit from a protected home market where foreign firms do not have the same opportunities to compete. That has allowed Chinese green manufacturing firms to scale up rapidly, dominating global markets in sectors such as solar panels. Brussels fears the same pattern might be emerging in other markets where the EU hopes to lead, like electric vehicles, batteries and wind turbines.

The US has become a competitor too, with its Inflation Reduction Act (IRA). The IRA follows China in providing vast, uncapped subsidies for green technologies, both for R&D and for production, and imposing domestic content requirements (albeit more transparently than China does). That is very different to Europe’s approach of pricing carbon emissions, regulating and subsidising consumption (as opposed to production) to build demand for green tech, and offering targeted subsidies for the development of immature technology. The IRA has therefore triggered European jitters that it will be left behind, spurred on by anecdotes of EU firms choosing – or threatening to choose – America for new investment.1

But the fact that the EU imports totemic products like solar cells from the US and China should not ring too many alarm bells. Solar cells are a mature technology, and they are relatively simple to make.2 Because it has led the industrialised world in curbing greenhouse gas emissions, demand for green goods in the EU has been skyrocketing. This trend was accelerated by Russia’s war-induced energy crunch, which prompted Europeans to adopt technologies like electric vehicles (EVs) and heat pumps. Because the EU cannot yet produce all the green goods it needs, the surge in demand, combined with the fast rise in Chinese EV and battery production, means more Chinese imports.

How competitive is the EU in global green tech markets?

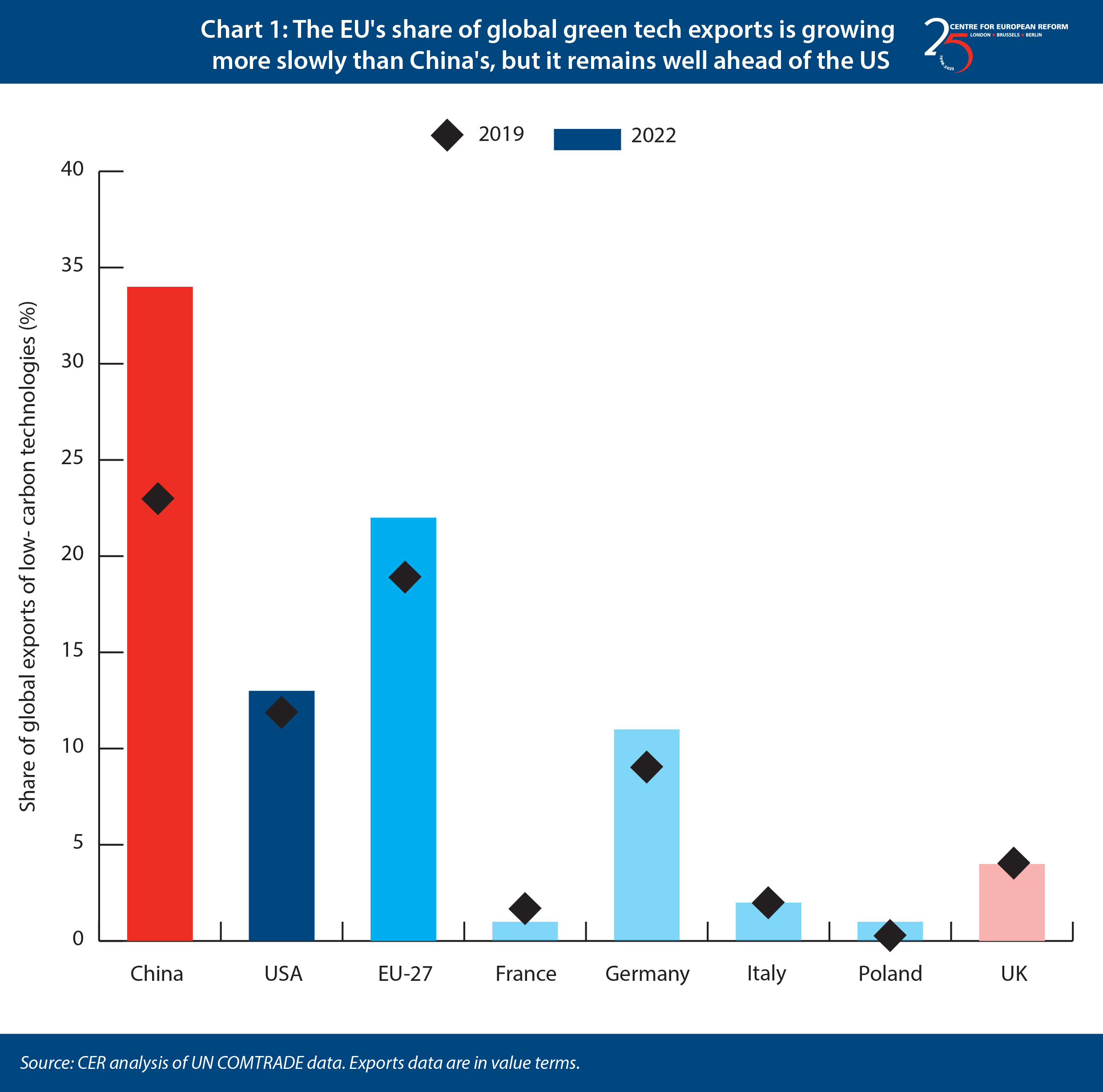

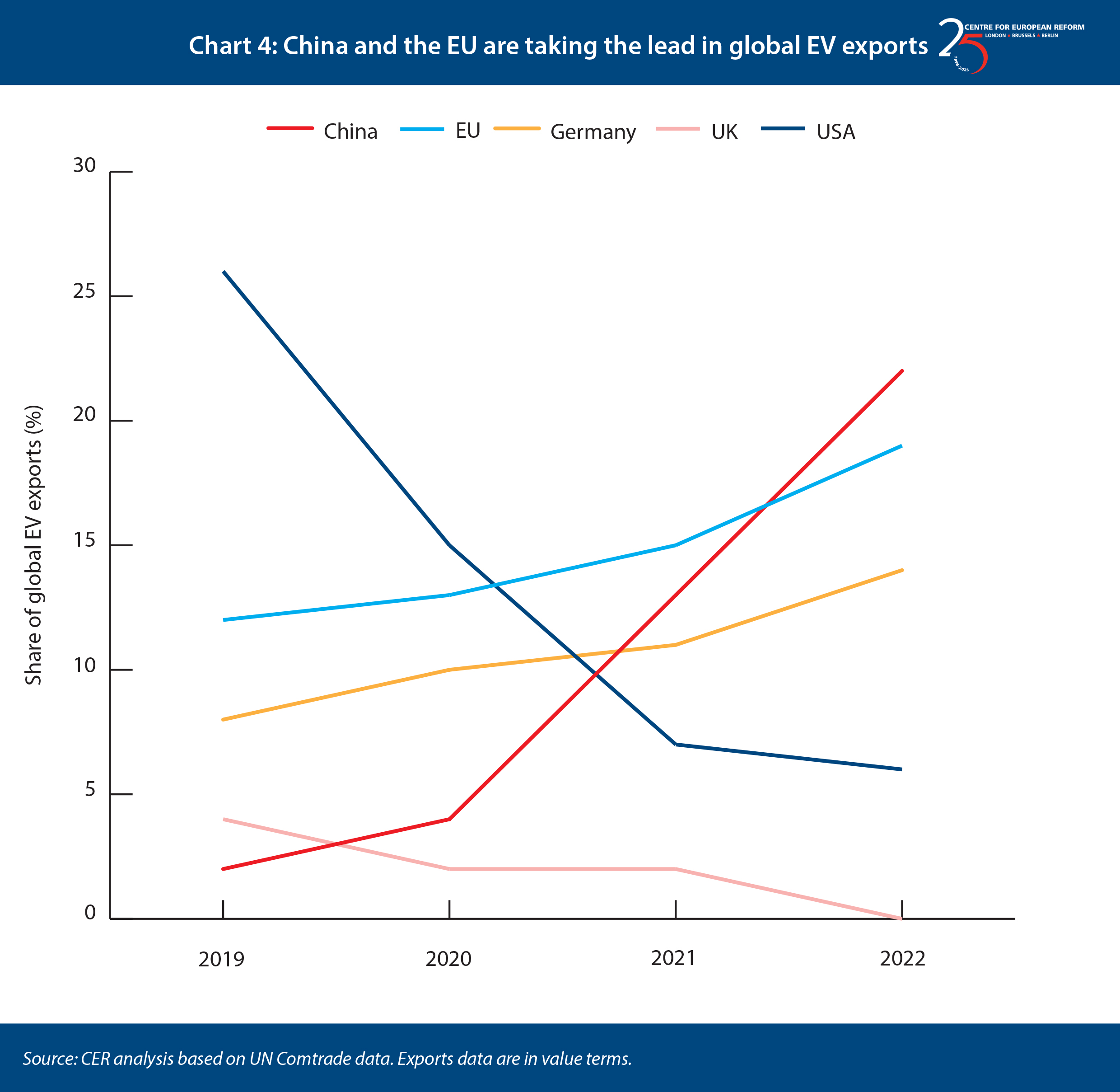

In fact, the EU is already performing well in global markets for green goods, albeit not as well as China, while the US is languishing behind both. The IMF keeps a list of over 220 ‘low carbon technology’ (LCT) goods, defined as technologies that emit fewer greenhouse gases throughout their lifecycles than alternatives.3 The list contains both cutting-edge goods such as electric vehicles and wind turbines, legacy goods needed for the transition like gas turbines and nuclear centrifuges, and more mundane products like insulation materials and thermostats. China’s share of global exports in LCT goods has exploded, from 23 per cent in 2019 to 34 per cent last year, driven by batteries, EVs and solar panels (Chart 1). The EU’s share of global exports in LCT goods has also grown, but much less – from 19 per cent to 23 per cent last year. The US is stuck on 13 per cent of the global market.

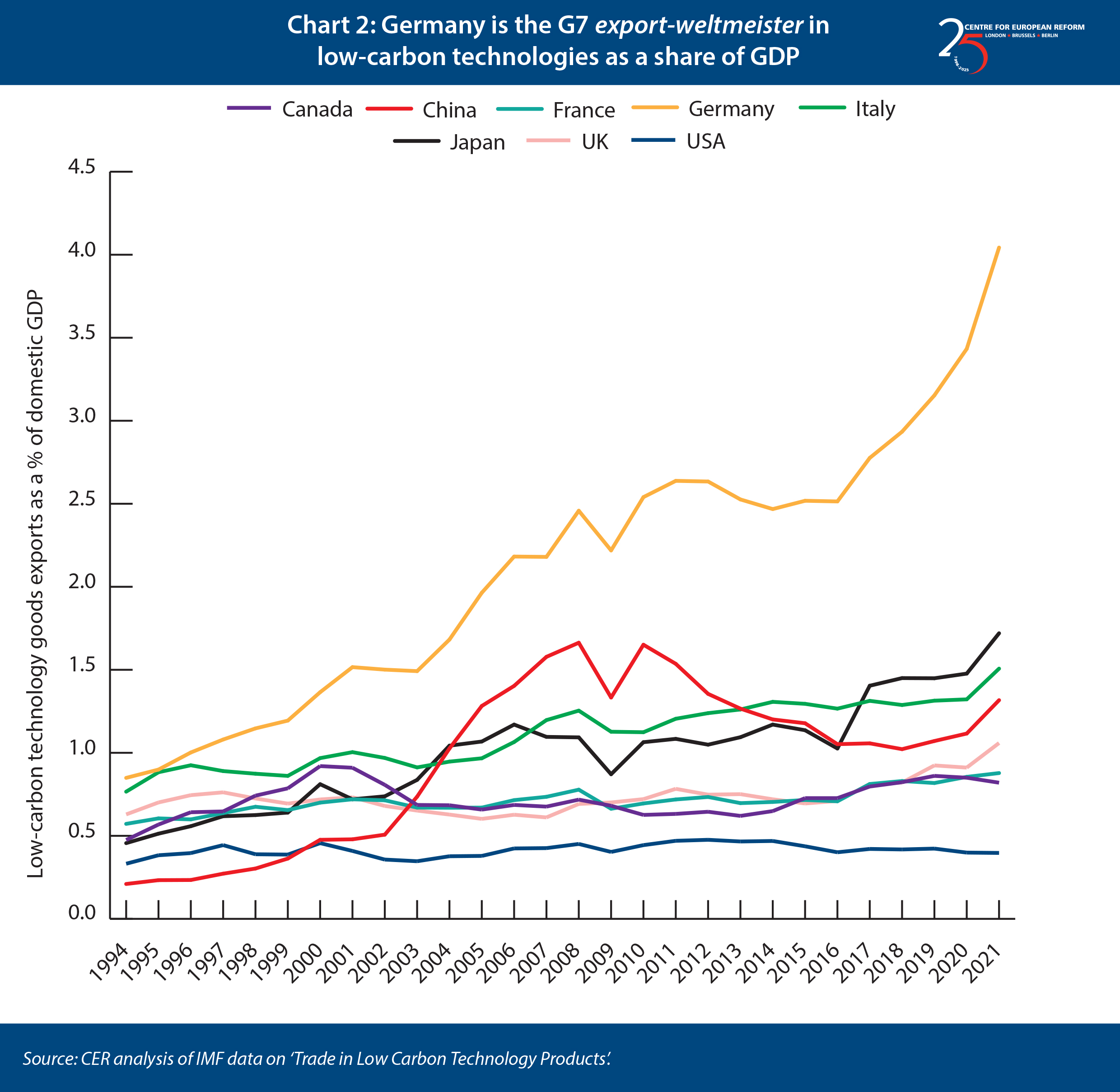

However, many European countries have bigger comparative advantages than China in green goods. As measured by how LCT-intensive their exports are compared the global average, some EU member-states achieve among the highest scores in the world including Germany, along with Slovakia, Hungary, Romania, Czechia, Denmark and, outside the EU, Japan.4 Central Europe seems to be at the heart of cross-border EU value chains in the production of LCT goods: in 2021, no other G7 country – or China – exported more LCT goods than Germany, as a share of GDP (Chart 2). The EU’s comparative advantages in many LCT products show it has the potential manufacturing base to support the green transition at home and to become globally competitive as an exporter.

Moreover, the EU should continue to excel in domestic production of some of these green technologies, because these markets are rapidly maturing and the drag of distance on trade is starting to assert itself. As markets mature, production efficiencies will be found, innovation will provide cheaper, more effective products, and prices and margins will fall.5 Technological differences between competing producers should also narrow. As a result, every cent of efficiency that producers can wring out will become more important. Transporting heavy goods like EVs and their batteries over long distances is expensive, and more local production will meet local demand as product markets expand.

The depressing effects of distance on trade are starting to assert themselves

These dynamics are already playing out. We focus on six key categories of green goods that are at the heart of US, Chinese and EU green industrial policy, namely electric vehicles, batteries, heat pumps, solar panels, wind turbines and electrolysers (which are used in hydrogen generation). We assess the impact of distance on trade among advanced economies in the OECD and China – countries that can produce advanced green technologies at home. That tells us whether countries are becoming more likely to import green tech from nearby trade partners to reduce shipping costs.

Between 2017 and 2022, the importance of distance increased in almost all cases (Chart 3). The chart shows the relationship between the distance between two trade partners and their bilateral exports in each good. For every 1 per cent increase in distance between the two trade partners, exports of EVs fell by 1.3 per cent (up from 0.9 per cent in 2017). That reflects growing production in industrialised countries, which is serving domestic demand (or nearby rich countries). The distance effect is strongest in electric vehicles and batteries, but it is also sizeable for heat pumps, and even solar panels, although they are light and easy to transport.6 Data from these markets strongly suggests that the EU is increasingly meeting its domestic demand for green technology.7

The construction of the EU’s electric vehicle supply chain was well underway before the IRA came along

The development of the EU batteries market illustrates these broader trends. A 1 per cent increase in the geographical distance between trading partners was associated with a 0.7 per cent reduction in exports in 2017. By 2022, that had risen to 1.2 per cent. But, paradoxically, China’s share of total EU imports of batteries (including intra-EU imports) rose from six per cent in 2017 to nearly a third in 2022. Why would the distance effect rise while EU imports from China are booming? The most likely answer is that the EU has so far only built battery capacity to satisfy around half of that rising demand.8 EU demand for lithium batteries is growing exponentially from 25 GWh/year in 2019 to 127 GWh last year, a number that is expected to hit 700 GWh by 2030.9 Total EU imports of lithium batteries rocketed up from $1 billion in 2017 to $63 billion in 2022 as EV sales ballooned. While local battery production has been increasing, the EU has been sucking in Chinese batteries to cover the excess demand. But as local battery production investments increase in the EU, gravity should assert itself: companies will over time prefer to put battery plants next to their growing EV production lines (see Chart 4) to reduce transport costs.

Contrary to fears triggered by the IRA, there are many battery factories being developed around Europe, and they are forecast to meet EU demand by 2030. This optimistic picture should make European policy-makers think twice before lavishing even more subsidies on building plants. Caution is also warranted because national subsidies in response to the IRA might distort the single market, with richer countries being more able to afford them than poorer ones. The single market is a big reason for the EU’s manufacturing prowess, because it intensifies competition and innovation.

When the EU should intervene to counter mercantilism

There are, however, two main threats to the EU maintaining its competitiveness in manufacturing green tech.

First, the EU needs to make sure that its growing green tech industry makes it through the scale-up phase where it has a good chance of having a comparative advantage over the US and China. Where the playing field is not level, there may be unfair competition against EU companies. For example, they may be competing against US firms who enjoy large (potentially uncapped) subsidies or, in China’s case, a home market from which European exporters are excluded.10 China’s strategy of using protected domestic demand to build up scale before starting to export is a particular threat. And US and Chinese mercantilism may lead other countries to follow the same strategy, hindering the EU’s ability to exploit economies of scale.

This has already happened in the solar photovoltaic (PV) industry, where the EU had an early technological lead. China’s subsidies for local producers have led it to dominate the global market and achieve economies of scale that Europe is unlikely to match. It is unclear, however, whether Europe would ever have attained a comparative advantage in solar technology, as it is a relatively simple manufacturing process (compared with EVs, for example) and solar panels are easily stacked onto container ships.

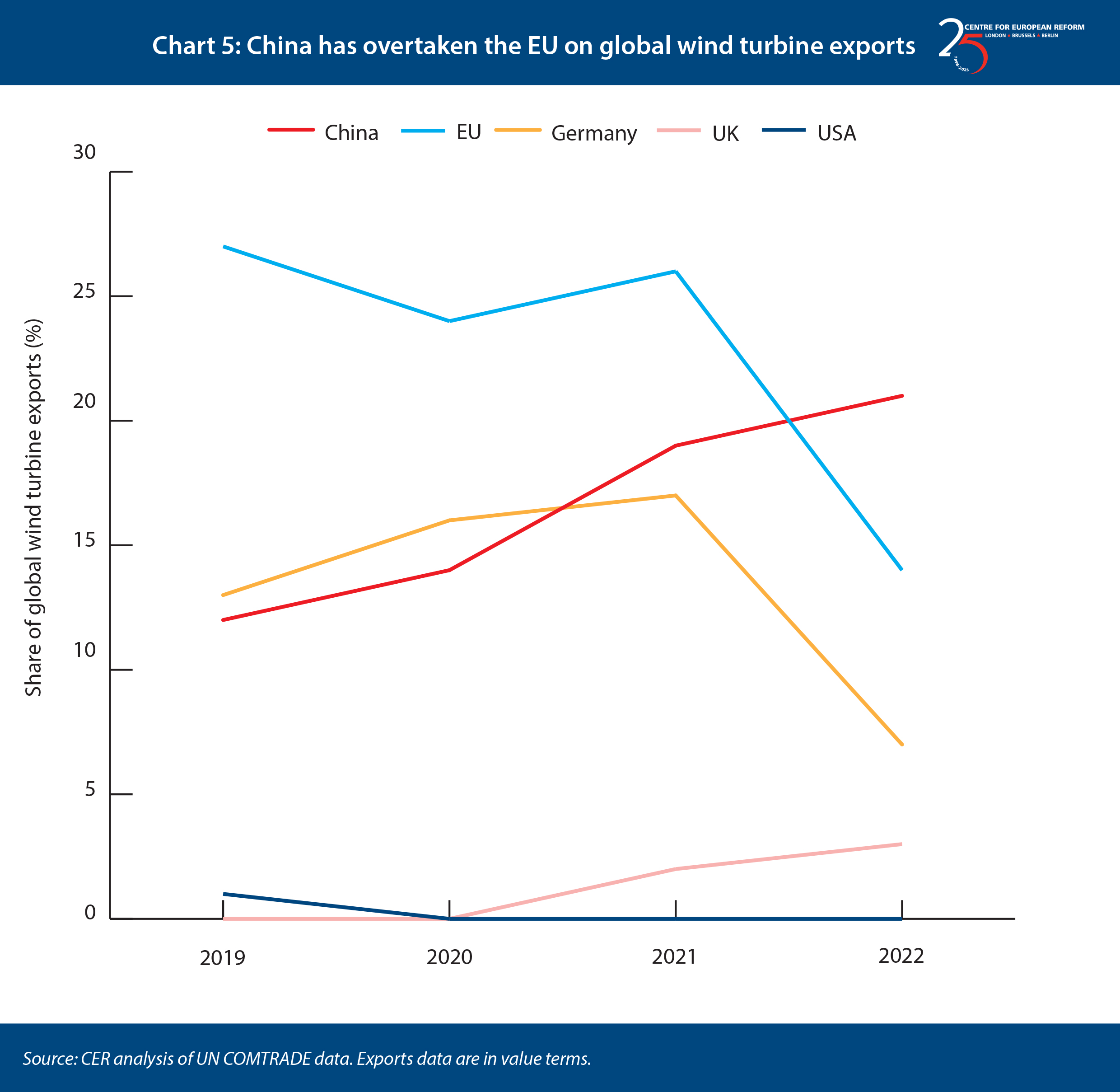

With wind turbines, for example, there is now a risk of China dominating the market as it did with PVs, even though turbines are a more complex product. Between 2020 and today, the EU’s share of global wind turbine production declined from 58 per cent to 34 per cent, while China’s share increased from 23 per cent to 52 per cent.11 Much of this additional production has served Chinese domestic demand, but China’s share of global production of wind turbines has almost doubled, overtaking the EU’s (see Chart 4).12 Meanwhile, distance appears to have a smaller impact on trade for wind turbines than it does for other green goods we analysed. This suggests that Chinese manufacturers may become a threat to Europe’s wind industry, as China eats away at the EU’s export markets, and that it may become a big player in the domestic EU market. In part because of stiff competition, and in part because of soaring costs of inputs, leading European wind companies have been recording losses during the economic recovery from the pandemic, and their profit margins have plummeted compared to healthy margins for their Chinese competitors. Some of these headwinds to Europe’s wind industry may die down on their own once the 2021-2023 EU inflation wave dissipates, input prices stabilise, and margins recover. But the minimal penalty to trading wind turbines across long distances means the EU could consider subsidising wind manufacturing to avoid becoming strategically dependent on China.13

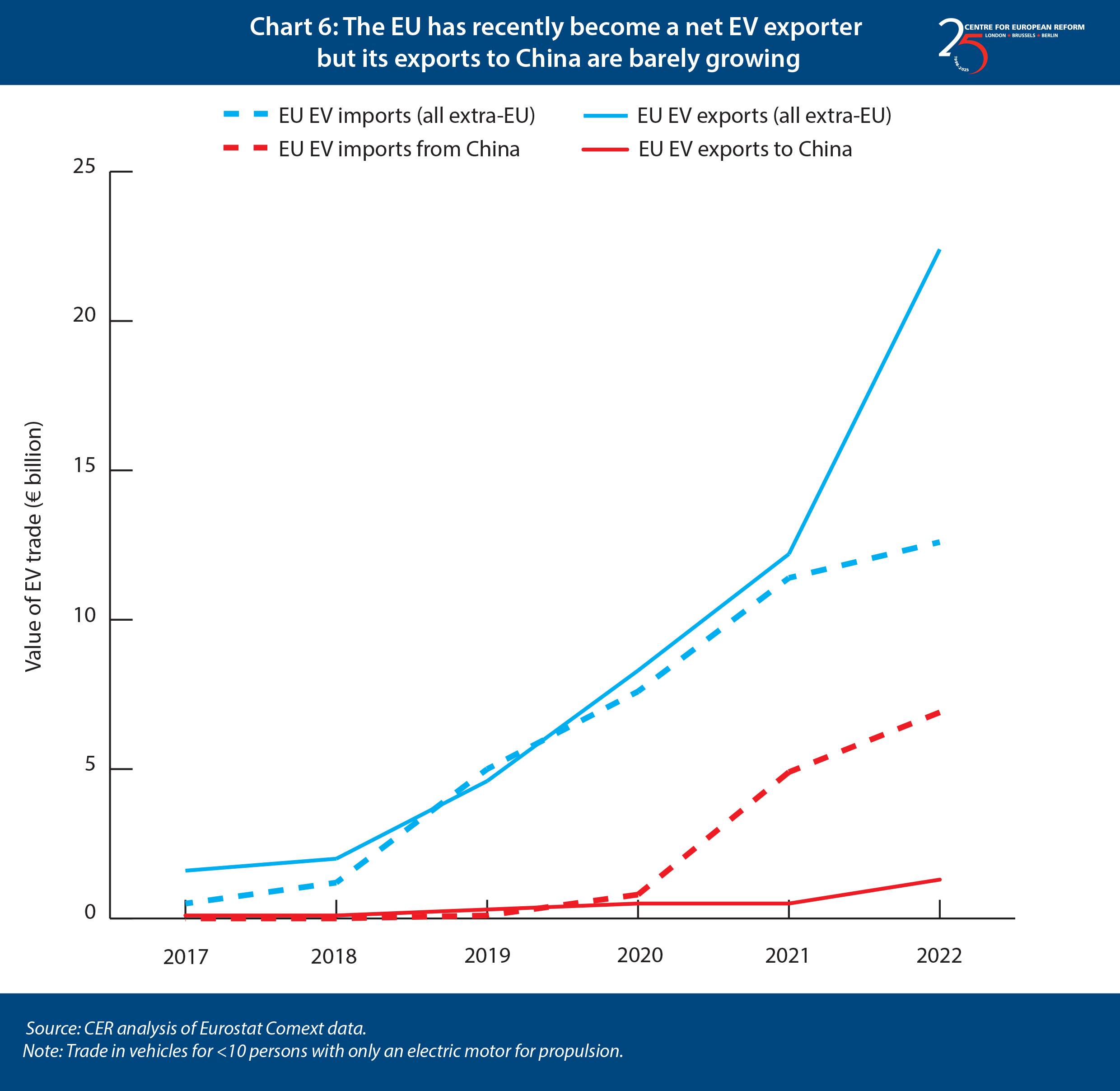

Second, the EU should take corrective action to sectors where it has strong comparative advantages, such as EVs, and where the Chinese, American or another market is markedly less open to EU goods than vice versa. EU producers struggled to keep up with domestic demand for EVs between 2017 and 2020. But by 2022 the Union had become a net exporter to the rest of the world.14 It exports roughly €20 billion worth of EVs outside the EU (Chart 5), while there is also an additional €40 billion in intra-EU trade in EVs. The EU’s EV exports to the US have continued to grow even since the IRA came into effect, and before the Biden administrations re-interpreted the IRA so that leased vehicles were covered (which is expected to benefit EU manufacturers significantly, because a large share of imported European EVs are leased).15 There is no equal access to China’s EV market, however. The EU’s EV exports to China are low and barely growing, while its imports from China, of which many are reportedly cars assembled in China for European companies, have grown rapidly (Chart 5).16

Green tech production subsidies are risky, and there are alternatives

Production subsidies, however, are not always the right instrument to address these challenges. In a world where distance between trade partners is increasingly important, and where markets for green technologies are rapidly maturing, production subsidies are likely to be wasteful. Public money will be put into companies that would have robust local demand for their products, because they can out-compete imports with higher shipping costs. A subsidies race may also create excess production capacity, while any protectionist backlash by other jurisdictions, perhaps by imposing export controls on refined metals, risks slowing the green transition by driving up prices for inputs the EU needs to decarbonise.

There are a few notable occasions, however, when subsidies could have a part to play. First, if some green technology goods defy gravity, as seems to be the case for wind turbines, then the EU could use subsidies to protect its domestic industry and avoid strategic dependency on one country. The wind turbine market appears to have huge economies of scale, like civil aviation: Airbus and Boeing dominate that market globally, and the US and EU have in the past engaged in subsidy wars with one another. Second, if a technology is very immature, time-limited R&D subsidies, and subsidies for building new, larger-scale plants, can help the EU get a technological lead. The uncertainty about the feasibility of a green hydrogen economy, for example, might stymie private sector investments in new production, and the EU and member-states would therefore be more justified in stepping in. But any infant industry subsidies need to be coupled with policies that help preserve that lead. In the past, China piggy-backed on European R&D in sectors like solar PVs and vehicles, by encouraging EU companies to invest in production facilities in China and using joint ventures to extract technological know-how.17 In that context, the EU needs to start screening outgoing foreign direct investment and consider outbound investment restrictions, a topic that EU leaders will consider at their June summit.18

The EU has already put in place some initiatives, such as the ‘foreign subsidies regulation’, which allows the European Commission to investigate whether foreign businesses operating in the EU have benefitted from subsidies in their home country. That may help in situations where firms subsidised by the Chinese or US governments make investments in Europe that distort competition in the single market, although the EU will have to rely on existing and suboptimal tools such as anti-dumping duties to limit heavily subsidised imports making their way to Europe.

Where competitor markets are walled off or there are concerns about subsidised goods hampering EU economies of scale, the EU might also consider subsidising consumption of green technologies with a ‘level playing field’ content requirement. For example, European consumption subsidies could apply only to vehicles that are imported from a country where there is no subsidised production. This would reduce some subsidised Chinese and American imports. Such a scheme, however, would be hard to administer, would require some changes to WTO rules, and would risk counter-measures by the US and China.

Finally, for strategic reasons the EU may want to diversify its supply chain of core inputs, especially metals, that are fundamental for the energy transition. The EU is seeking trade deals with a variety of partners, making it easier to mine certain materials in Europe, and increasing recycling.19 However, it is ultimately up to private firms to decide whether these initiatives warrant diversifying their supply chains. Absent regulation, they are likely to diversify only if cheaper or less risky sources than China emerge.

Conclusion

As the US and China increase their green ambitions, the EU is understandably fearful that its early lead in manufacturing green goods will continue to fall away. The EU should not over-react: currently, markets for many green technologies are nascent, and it is unsurprising that the EU’s policies to cut emissions have led to skyrocketing demand for green tech that EU manufacturers cannot yet fulfil. In the long run, normal market dynamics will resume. The EU should focus its subsidies on sectors where short-term help is needed to enable European industries to scale up, and to avoid dependencies on other countries in key goods where markets show signs of descending into global oligopoly or duopoly, like wind turbines. That way, the EU can fulfil its green tech potential while minimising the waste of public money.

2: Bret Boyd, ‘Solar power technology is mature’, Grayline, August 21st 2017.

3: ‘Low carbon technology harmonized system codes’, International Monetary Fund, November 15th 2021.

4: Simon Black, ‘Trade in low-carbon technology products’, in International Monetary Fund, ‘Data for a greener world: A guide for practitioners and policy-makers’, April 2023.

5: ‘Will a price war accelerate the switch to electric cars?’, Financial Times, May 7th 2023.

6: Mohammad Dehghanimadvar and others, ‘Economic assessment of local module assembly in a global market’, in Cell Reports Physical Science, February 16th 2022.

7: Anh Bui and others, ‘Power play: Evaluating the US position in the global electric vehicle transition’, International Council on Clean Transportation, June 2021.

8: ‘Europe’s battery supply to ramp up by 2030’, EV Market Reports, January 2023.

9: ‘European battery cell production expands’, in IPCEI Batteries, ‘Battery cell production market report’, Q4 2021.

10: ‘The Chinese challenge to the European automotive industry’, Allianz Research, May 2023.

11: ‘Solutions for a resilient EU raw materials supply chain’, European Commission Joint Research Centre, March 2023.

12: Andrew David, ‘China emerges as a major exporter of wind turbine nacelles’, US International Trade Commission, March 2021.

13: Alex Blackburne, ‘China’s increasingly cheap wind turbines could open new markets’, S&P Global Market Intelligence, September 26th 2022.

14: ‘Trade in electric cars steadily increasing’, Eurostat, December 2nd 2022.

15: ‘Chad Bown, ‘Industrial policy for electric vehicle supply chains and the US-EU fight over the Inflation Reduction Act’, Peterson Institute for International Economics, May 2023.

16: ‘‘China’s exports of electric vehicles to Europe reach record levels’, Inside EVs, January 4th 2023.

17: Jie Bai and others, ‘Did joint ventures help China’s automobile industry?’, VoxDev, February 1st 2023.

18: ‘EU leaders will discuss China relations during June summit’, Reuters, April 24th 2023.

19: ‘Critical raw materials: Ensuring secure and sustainable supply chains for EU’s green and digital future’, European Commission, March 16th 2023.

John Springford is deputy director and Sander Tordoir is senior economist at the Centre for European Reform

June 2023

View press release

Download full publication