Is the eurozone really out of the woods?

Can the eurozone avoid another crisis without further significant reforms? Much will depend on the longevity of the current upturn and the depth of the next downturn.

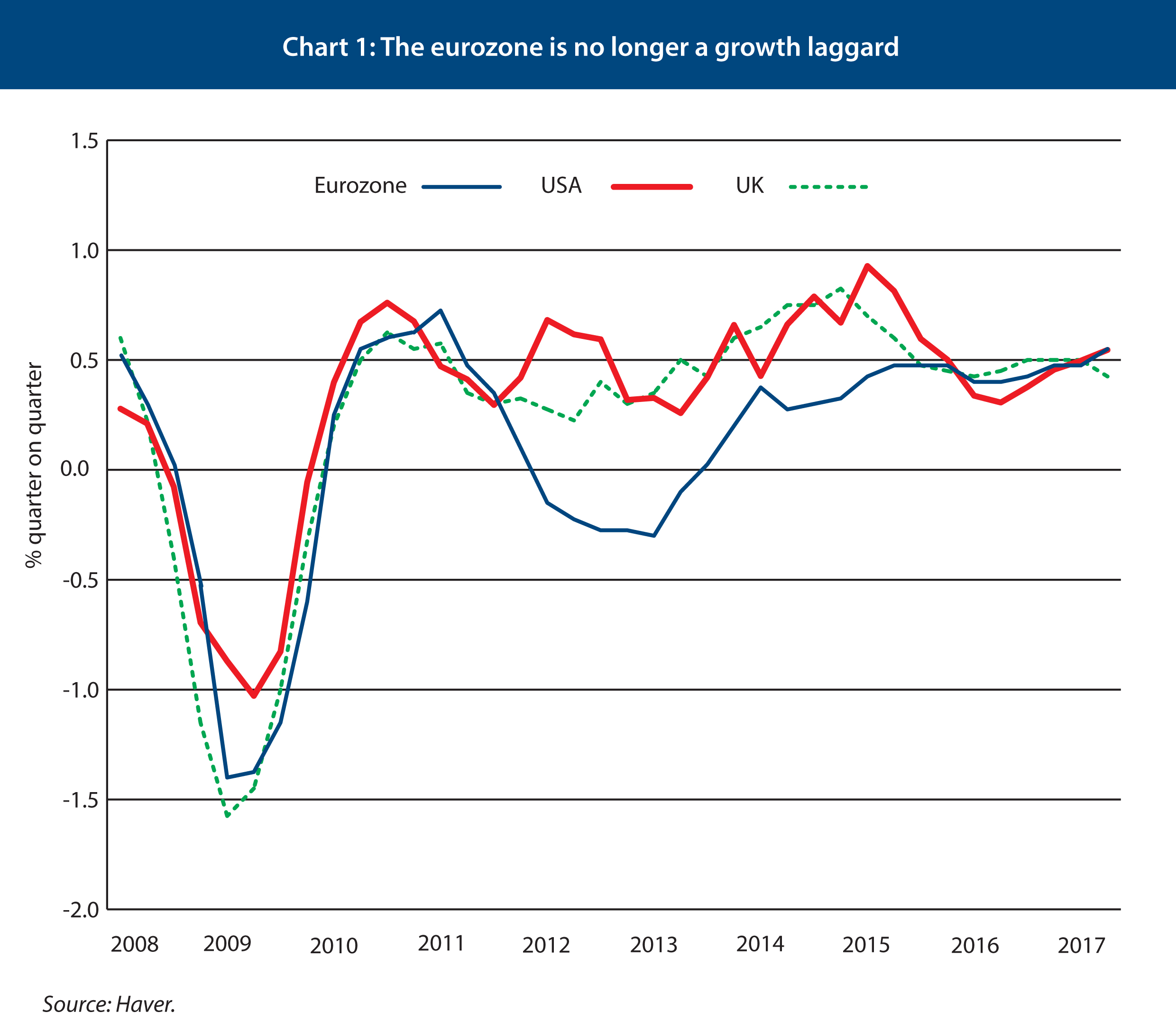

The eurozone economy is now growing at a healthy clip. It should expand by around 2 per cent this year, following growth of about that in 2016. The IMF and the European Commission expect similar growth rates in 2018 and 2019. This is a long way from a boom, but certainly constitutes a reasonable cyclical recovery (see chart 1). There are sizeable differences in growth rates between member-states, but all, with the exception of Greece, are sharing in the recovery. Growth is also increasingly broad-based, with domestic demand – that is, consumption and investment – providing most of the impetus. Does this mean that the eurozone is out of the woods? Can it survive without further significant reforms? Much will depend on the longevity of the current upturn and the depth of the next downturn.

The initial impetus to the recovery was a combination of monetary stimulus, an end to austerity, the weakness of the euro and very low oil prices. The ECB responded to deflationary pressures by holding interest rates at record low levels and launching a programme of quantitative easing (QE) so large that the ECB now has more assets on its balance sheet than the US Federal Reserve. Despite open hostility to this strategy from some national governments at times, the ECB has stuck to its guns, and deserves most of the credit for the improved economic climate. An end to austerity across most of the currency union was also a significant factor in driving the recovery, especially in Spain, but also France and Italy. It was partly helped by the ECB pushing down refinancing costs for governments. The cheap euro drove a strong pick-up in exports to non-eurozone markets, while a period of very low oil (and other commodity) prices boosted disposable incomes and hence consumption, as well as corporate profits.

Monetary policy remains expansionary, and the ECB is doing a decent job of convincing investors that it will remain so, and not tighten at the first sign of incipient inflationary pressure. The easing of austerity was a one-off and is no longer contributing to growth to any significant extent. The euro has risen strongly in recent months and is now back to its long-run trade-weighted average. Oil prices have bounced back, and commodity prices as a whole are recovering.

Eurozone recovery is not just down to one-offs; it has legs. The question is how long it will last.

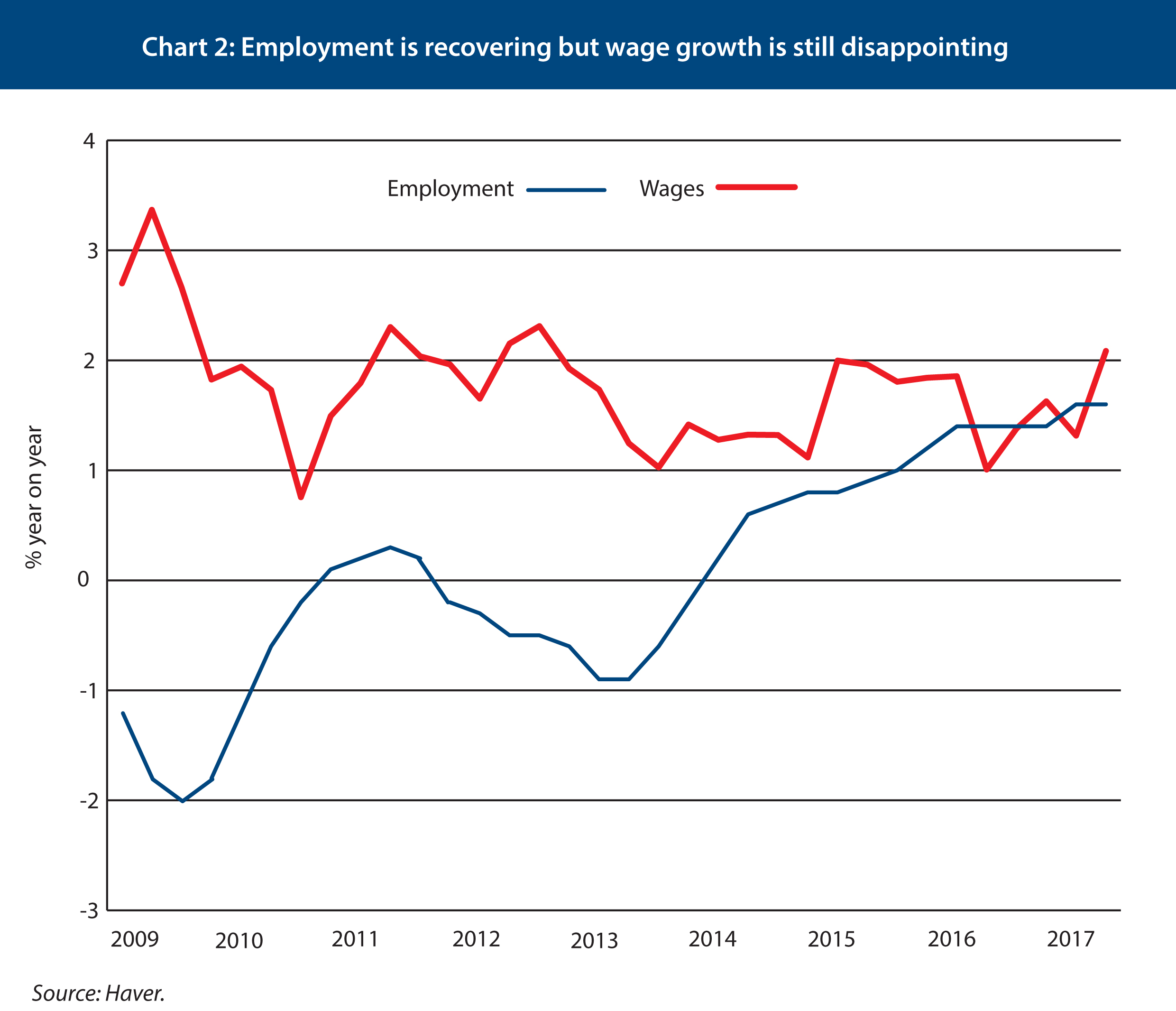

But despite the reversal of many of the factors that kick-started the recovery, eurozone economic growth has gained momentum. Wage growth remains disappointingly low, but a strong recovery in employment is boosting consumer confidence and with it spending (see chart 2). There is plenty of pent-up demand: after such a long period of weak consumption, many durable consumer goods, especially car fleets, are old. The recovery in consumption has contributed to rising business confidence and a pick-up in investment. Both households and firms have rediscovered some appetite for borrowing. Consumers show greater readiness to borrow to purchase big-ticket items, while record low mortgage costs are underpinning stronger construction activity in many member-states. Business borrowing is picking up relatively strongly, suggesting that business investment will remain relatively robust. As yet, there is little indication that the rise in the value of the euro is depressing exports. Of course, the recovery is still modest given the scale of the downturn. The eurozone economy is only 4 per cent bigger than it was in the first quarter of 2008. But the recovery is not just down to one-off factors; it has legs.

The big unknown is how long the recovery will last. Because of the long period of economic stagnation in the eurozone, it is impossible to know whereabouts in the business cycle the currency union currently stands. However, there is little reason to believe that just because the eurozone is probably several years into the cycle that it will come to an end after 7-8 years – the long-term average length of the cycle. There is plenty of spare capacity across the currency union as a whole. And we’re a long way from over-investment in unproductive assets that often mark the fag end of a cycle.

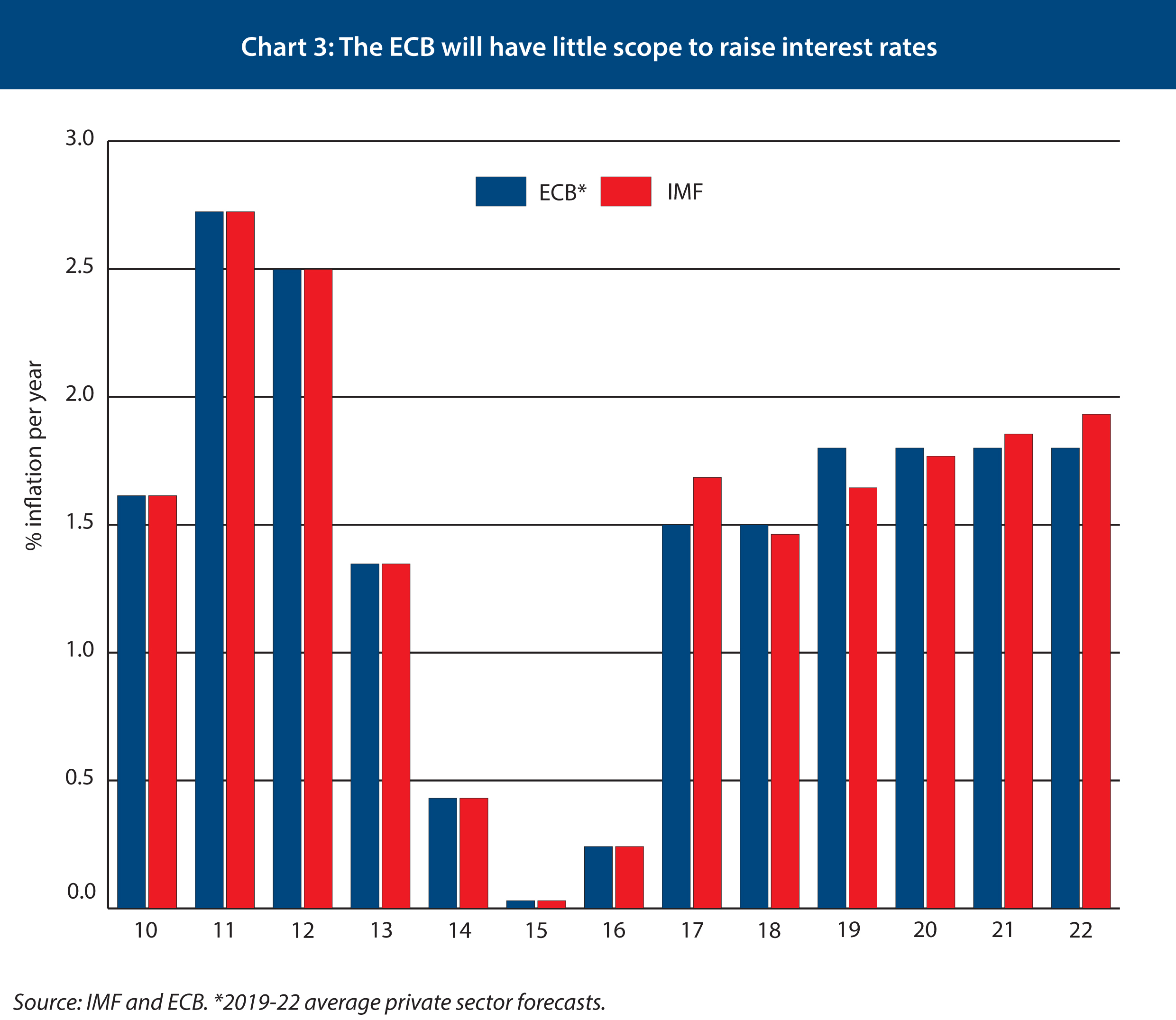

The longer the upswing lasts, the greater the likelihood of the eurozone surviving the next downturn without a further serious crisis. Fiscal positions will be stronger and the ECB will have been able to raise rates from the current lows, and therefore have some scope to lower them to counter the downturn. The more growth we see, the more progress will have been made in cutting non-performing loans (NPLs) weighing on banks, and the less likelihood that the bank resolution mechanism will be seriously tested. Conversely, if the recovery is relatively short-lived, many eurozone governments will lack the fiscal space to boost spending to mitigate the downturn and the ECB will be unable to cut rates. For example, the ECB expects inflation to be just 1.5 per cent in two years’ time, and hence well below its 2 per cent target. Five years hence it expects inflation of 1.8 per cent (see chart 3). And the ECB forecasts assume no further rise in the value of the euro, which would have a dampening effect on inflation.

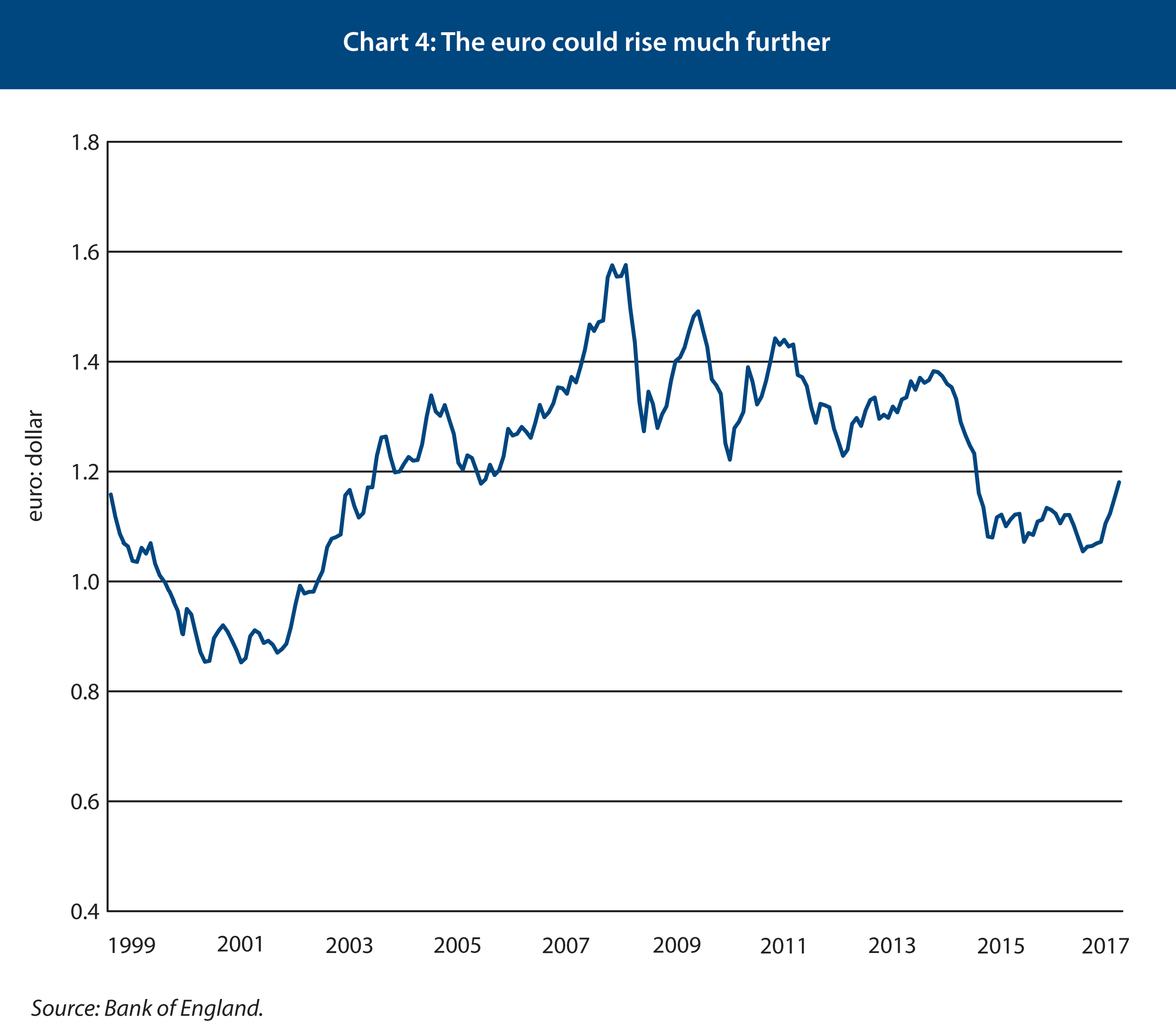

What could prevent the cautiously optimistic scenario painted here becoming reality? The biggest external threat is probably a loss of confidence in the dollar as US growth disappoints and investors take fright at the Trump administration. A rise in the euro against the dollar, perhaps as far as €1.5:$1 from the current level of 1.2$:1€ would pose a serious challenge for the eurozone. Not only would it hit exports hard, especially those of weaker members (whose exports are most sensitive to price changes), but it would push down eurozone inflation, undermining the ECB’s drive to raise expectations of future inflation and hence the effectiveness of monetary policy. Such a surge in the value of the euro is unlikely, but far from impossible; the euro hit such values against the dollar in 2009 (see chart 4).

A surge in global protectionism, perhaps triggered by the US, would also cast doubt over the sustainability of the eurozone recovery. Net exports (exports minus imports) may no longer be contributing as much to eurozone growth as they were two years ago, but the eurozone is running a record current account surplus with the rest of world of around 3.5 per cent of GDP, by far the biggest surplus in the world in absolute terms. A big chunk of it is with the US, helping to explain Trump’s bilious criticism of European, especially German, trade practices. Any significant increase in global protectionism will hurt every economy, including the US, but the eurozone has more to lose than most.

Another major external threat is posed by the possibility of a full-scale Chinese financial crisis. For the last 100 years, only a financial crisis starting in the US has caused serious problems in Europe, owing to the size of the US economy, Europe’s dependence on it, and the centrality of the US to the international financial system. The size of the Chinese economy and its degree of integration into the global economy are still some way short of the US’s, but that is changing rapidly, and China is suffering from a very rapid build-up of both public and private debt. At the very least, China could face a period of much weaker growth and renewed deflation pressure, with serious implications for the global economy and with it the eurozone.

Other external threats would comprise a security crisis in central and eastern Europe triggered by renewed Russian aggression, a crisis in the Middle East, leading to a surge in oil prices, and a collapse of Brexit negotiations between the UK and the EU. It is hard to see the first of those derailing the eurozone recovery, assuming that military conflict between NATO and Russia is avoided. A surge in oil prices would pose a much bigger threat. With the cost of renewable energy falling rapidly, leading to large-scale investment in these energy sources, oil prices are unlikely to rise sharply on the back of stronger demand. But conflict in the Middle East could certainly curtail oil supplies (and hence push up prices), notwithstanding the emergence of the US as a major oil exporter. The UK crashing out of the EU with no deal would pose grave financial, economic and legal problems for the UK, the eurozone’s biggest single export market. This would no doubt hit the pace of growth in the eurozone, but there is little reason to believe that it could derail the recovery.

External threats to EZ recovery are $ weakness, US-led rise in protectionism & Chinese financial crisis

What about internal threats to the recovery? Perhaps the biggest would be a premature tightening of monetary policy. The ECB, and Mario Draghi in particular, have been at pains to stress that the eurozone recovery is still young and that underlying inflation pressures, for example from wages, remain weak. But the ECB works within a political context, and that context is likely to become steadily more uncomfortable as the recovery continues. German criticism of the ECB will intensify, especially if the next German government consists of Angela Merkel’s CDU/CSU and the hawkish FDP rather than a renewed 'grand coalition' with the Social Democrats. The Germans are expected to push hard for Jens Weidmann, the current head of the Bundesbank, to replace Mario Draghi when his term as ECB President comes to an end in October 2019. Draghi has succeeded in making the ECB less Germanic in outlook by winning the intellectual arguments and stabilising the eurozone. A Weidmann presidency probably would not succeed in turning back the clock, but it would at the very least raise fears that the central bank could increase interest rates prematurely, which could be enough to undermine the effectiveness of monetary policy.

Could the all but certain failure by the French and German government to agree substantive reforms of the eurozone threaten the recovery? They may agree to create a eurozone finance minister, but he or she will be largely symbolic. It is just possible that they will agree to the creation of a small unemployment insurance scheme, but little chance that they will reach agreement on the creation of a common deposit insurance scheme for bank deposits, let alone any mutualisation of debt or even a more flexible fiscal regime. But there is little reason to think this failure will derail the recovery, however desirable those reforms would be for the long-run health of the currency union, and for its ability to cope with the next downturn.

What about Italy? The Italian economy is recovering much more slowly than the eurozone average. And with inflation very low, the country is making next to no progress in reducing public debt. It is not impossible that the next general election will produce a governing coalition that includes populists. It is just possible that such a government could call a referendum on euro membership, opening the way for a banking crisis in Italy as deposits fled the country. But it looks increasingly unlikely. Italian populists are tempering their hostility to the eurozone, and a return to growth – however tepid – should at least take some of the sting out of Italy politics and popular antipathy to the EU.

The eurozone needs to use the opportunity presented by the economic recovery to make the union more resilient. First, it should apply tougher capital standards for banks and mandate banks to finance their loan book with bonds that can, in crisis, be written down. Second, they need to make sure that banks and investors diversify away from their home markets. Banks need to hold fewer domestic government bonds on their balance sheets and capital markets need to be further integrated. Third, the eurozone should turn the European Stability Mechanism into a European Monetary Fund, with the European Council and European Parliament having a say on who is appointed to its board. The EMF would have the right to borrow, helping to address concerns that the ESM has neither the resources not the flexibility to deal with a crisis. It is just possible that Germany and other conservatively-minded member-states such as the Netherlands, might sign up to this. A combination of these steps would not crisis-proof the eurozone, but reduce the risks posed by the next downturn.

Premature ECB tightening poses the biggest internal threat to the eurozone recovery.

The eurozone economy is not booming and there is little to suggest it’s about to boom. But there are good reasons to expect the current cyclical recovery to continue for several years. This will be the case irrespective of whether the French and German governments can strike a deal on major reforms of the currency union. If the upswing is short-lived for one or a combination of the reasons outlined here, the eurozone will struggle to avoid a crisis come the next downturn. Fiscal policies will be too tight, the ECB will not be able to cut rates and the European Stability Mechanism (ESM) will have neither the resources nor flexibility to address debt crises. The longer the upturn lasts, the more fiscal and monetary ammunition will be available to counter the downturn, the stronger the banks will be, and a serious crisis will be less likely.

Simon Tilford is deputy director of the Centre for European Reform.

Add new comment