The EU Emissions Trading System in a larger EU

- The EU should include candidate countries in its Emissions Trading System (ETS) to provide them with a strong incentive for decarbonising their carbon-intensive electricity mix and heavy industries. But this should be done gradually to prevent a high carbon price from crippling their economies.

- Due to the looming EU Carbon Border Adjustment Mechanism (CBAM), EU candidates have an additional incentive to establish a national or regional carbon price, as they will soon be subject to carbon fees when exporting certain carbon-intensive goods to the EU.

- But few candidate countries have implemented carbon pricing, and regulatory readiness for the EU ETS remains limited.

- Implementing a gradually increasing national or regional carbon price in candidate countries would be a stepping stone towards joining the EU ETS. It would also provide the right price signal to accelerate the much-needed decarbonisation of electricity and heavy industry.

- The Commission should put in place safeguards for the ETS to withstand higher demand for emissions permits. It should also increase dedicated funds to support producers and consumers in new member-states, which still have relatively low GDP levels, in adjusting to a new carbon price.

Integrating the more carbon-intensive economies of new EU member-states in the EU’s climate policies is an important challenge. The EU Emissions Trading System (EU ETS) is the EU’s carbon market. To meet 2030 climate targets, the ETS’s emissions cap has recently been tightened. But should the EU embrace more member-states, the cap would need to be revised again, and so would the speed at which emissions are expected to drop.

Enlargement forces the EU to rethink the ETS – balancing climate ambition with economic reality. The ETS cap must translate into a meaningful carbon price. At the same time, it must reflect the fact that industry and power sectors in candidate countries are more carbon intensive than in the EU-27. Being exposed to an explicit carbon price will accelerate the decarbonisation of these economies, but it is important that this happens gradually to prevent it from crippling them.

Enlargement forces the EU to rethink the ETS – balancing climate ambition with economic reality.

This paper outlines where EU candidate countries stand in terms of meeting the climate policy requirements necessary to join the EU, focusing on current candidates from the Western Balkans and Eastern Europe (Albania, Bosnia and Herzegovina, Moldova, Montenegro, North Macedonia, Serbia and Ukraine) and excluding Türkiye, whose accession negotiations have stalled.

It considers the potential impact of carbon pricing on the economies of current EU candidates, and on how the EU should adjust the ETS for it to provide a gradual but consistent decarbonisation incentive for new entrants.

What are the climate policy requirements for enlargement and where do countries stand on them?

Candidate countries need to meet specific requirements to prove their alignment with EU climate policy to join the EU. These are a commitment to respecting the Paris Agreement through specific emissions reduction targets (generally embedded in a national climate law), and the development of national energy and climate plans.

But among candidate countries, only Moldova had inscribed climate neutrality by 2050 in national legislation as of October 2024. The specific targets embedded in climate laws provide the legal basis for implementing a carbon price, be it through a carbon tax or through an emissions trading system like the ETS. These delays have direct repercussions on candidate countries’ progress towards joining the EU ETS.

Candidate countries must also meet ETS-specific requirements, including establishing systems for monitoring, reporting and verifying greenhouse gas emissions (MRV systems). Essentially, these systems are a way to credibly quantify greenhouse gas emissions from power generation and industry, to then be able to price them. Finally, establishing carbon pricing requires institutional capacity to either gather carbon tax revenues, or to oversee the functioning of an emissions trading scheme and auction its allowances – the permits associated with pollution emissions.

Most EU candidate countries have an additional incentive to set up the regulations needed to join the ETS, given they are members of the Energy Community – an international organisation founded in 2005 which now includes the EU, Albania, Bosnia and Herzegovina, Georgia, Kosovo, Moldova, Montenegro, North Macedonia, Ukraine and Serbia (while Armenia, Norway and Türkiye have observer status). Parties to the Energy Community commit to EU rules on energy, environment, competition and renewables.

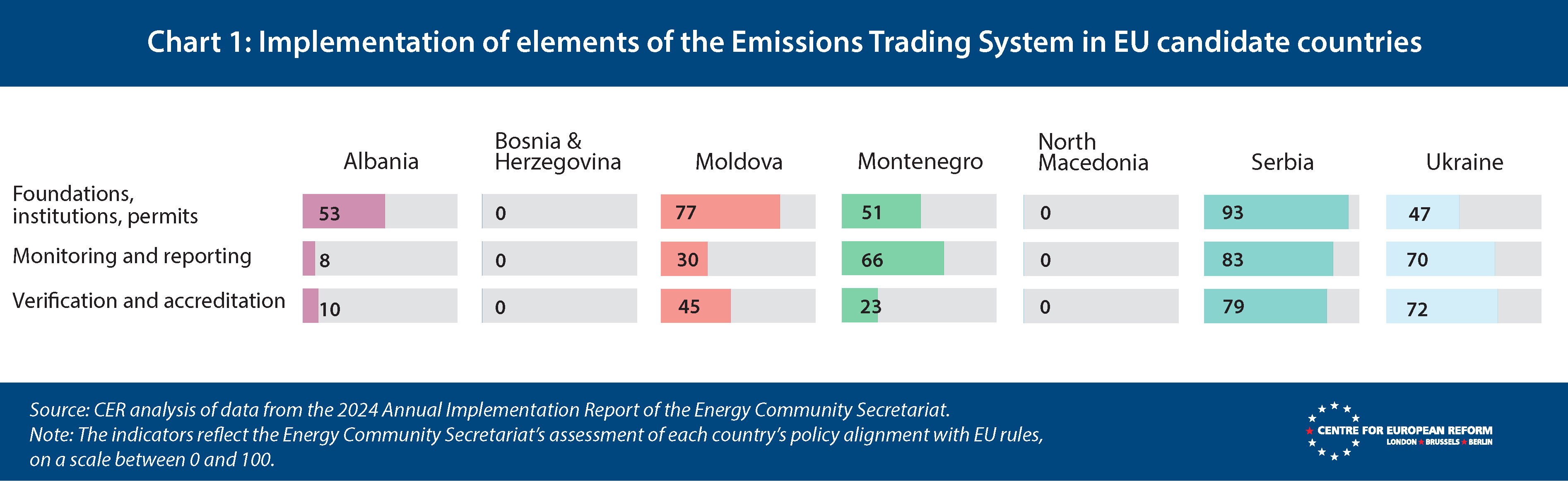

Building on the Energy Community Secretariat’s assessment in November 2024, Chart 1 indicates that progress on implementing EU regulations to join the ETS is very uneven across candidate countries. As of late 2024, Bosnia and Herzegovina and North Macedonia were lagging behind. Albania and Moldova are more advanced in institution-building than in establishing MRV systems, while the opposite is the case in Ukraine. Only Serbia and Montenegro had operational MRV systems.

What is the status of carbon pricing in candidate countries?

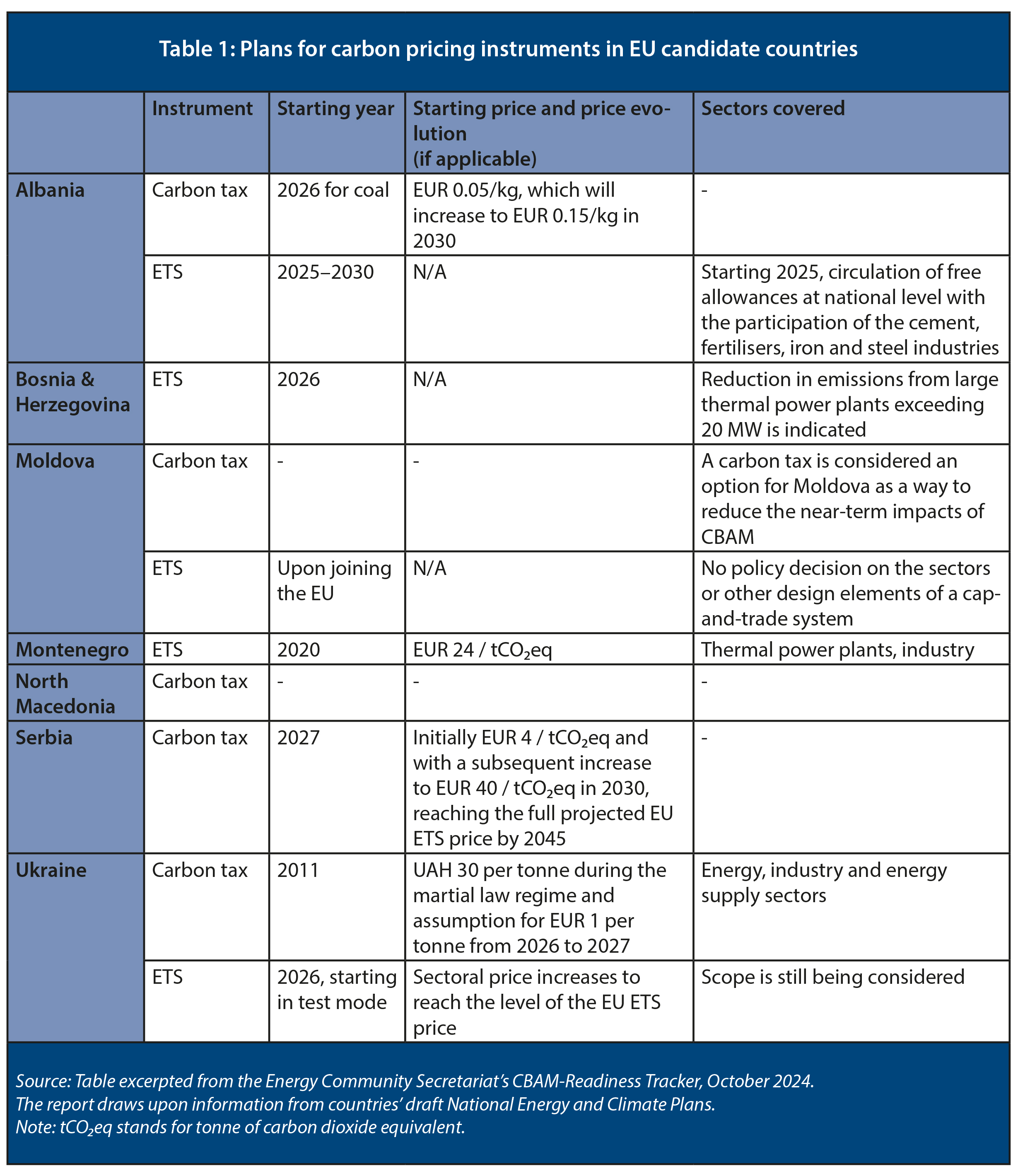

Carbon pricing is still largely a work-in-progress among EU candidate countries, as illustrated in Table 1. A carbon price is only in force in two candidate countries: Ukraine implemented a carbon tax in 2011, and Montenegro implemented its ETS system in February 2020. But emissions trading systems (also called cap-and-trade systems, given that they involve a cap on emissions and the possibility for regulated entities to trade permits to emit) are being planned in Albania, Bosnia and Herzegovina, Moldova and Ukraine, whereas Moldova, North Macedonia and Serbia are considering a carbon tax.

Existing carbon prices, however, are currently too low to provide a strong decarbonisation incentive, and considerably lower than the current EU carbon price, which is around €70 per tonne. As indicated in Table 1, Ukraine’s now longstanding carbon tax, which applies to industry and electricity generation, was set in mid-2022 at UAH 30 per tonne (around €0.6) and is set to rise to €1 per tonne in 2026. The minimum carbon price relative to Montenegro’s ETS, which also applies to industry and electricity generation, is €24 per tonne.

Additionally, a cap-and-trade scheme in a small country is bound to face some additional hurdles. Montenegro’s ETS was designed to apply to thermal power plants and industry, amounting to three installations (ETS jargon for production plants): the Pljevlja coal plant, the KAP aluminium plant and the Tosčelik steel mill. The limited number of businesses concerned hampers emissions trading and limits competition in auctions of allowances. Like in the EU ETS, the giveaway of free allowances in the initial stages of implementation also dampens the scheme’s decarbonisation incentive. In Montenegro’s case, free allowances even served as state aid, helping to temporarily prop up a failing aluminium producer. Since 2020 however, two installations have closed due to energy price increases, leaving the coal power plant as the sole installation subject to the ETS.

How would joining the EU ETS affect candidate countries?

EU enlargement countries face both challenges and opportunities in the decarbonisation sphere: they have highly polluting industries and electricity generation, but at the same time, they have a great potential for the deployment of renewable energy to decarbonise the energy sector, and of technologies to curb industrial emissions.

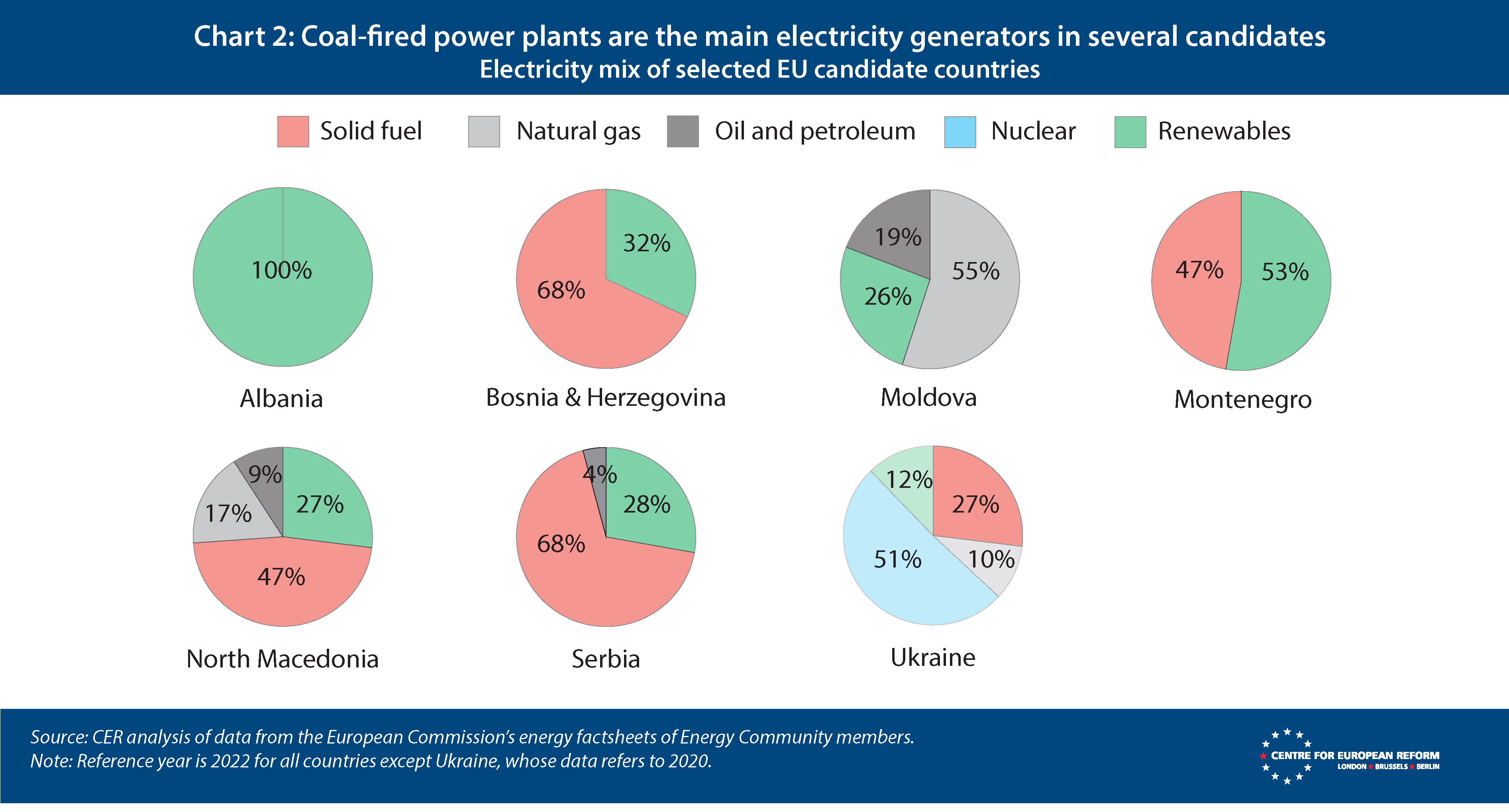

EU candidate countries are heavily reliant on fossil fuels for electricity generation, as can be seen in Chart 2. Bosnia and Herzegovina, Montenegro, North Macedonia and Serbia rely on coal for half to two-thirds of their electricity generation; Moldova instead largely relies on natural gas and oil. This makes these countries particularly vulnerable to power price increases once a carbon price starts applying to electricity via the EU ETS – a sensitive topic in countries where electricity prices are heavily subsidised.

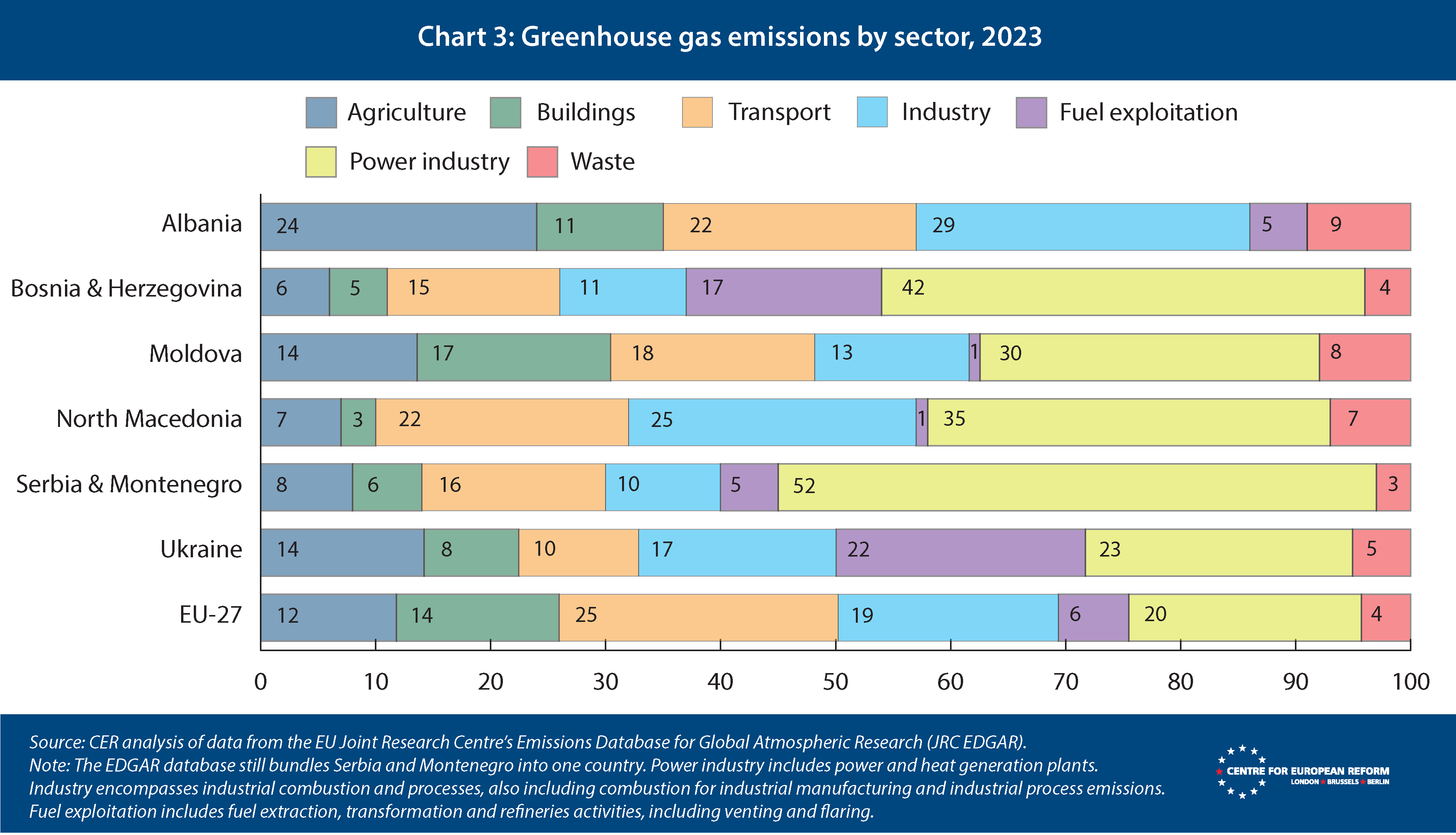

As shown in Chart 3, fossil fuel dependence in power generation means that the power industry accounts for most greenhouse gas emissions in candidate countries (except for Albania, which entirely relies on renewable-based electricity). Industry, fuel exploitation (largely of solid fossil fuels like coal) and transport are the next largest emitting sectors.

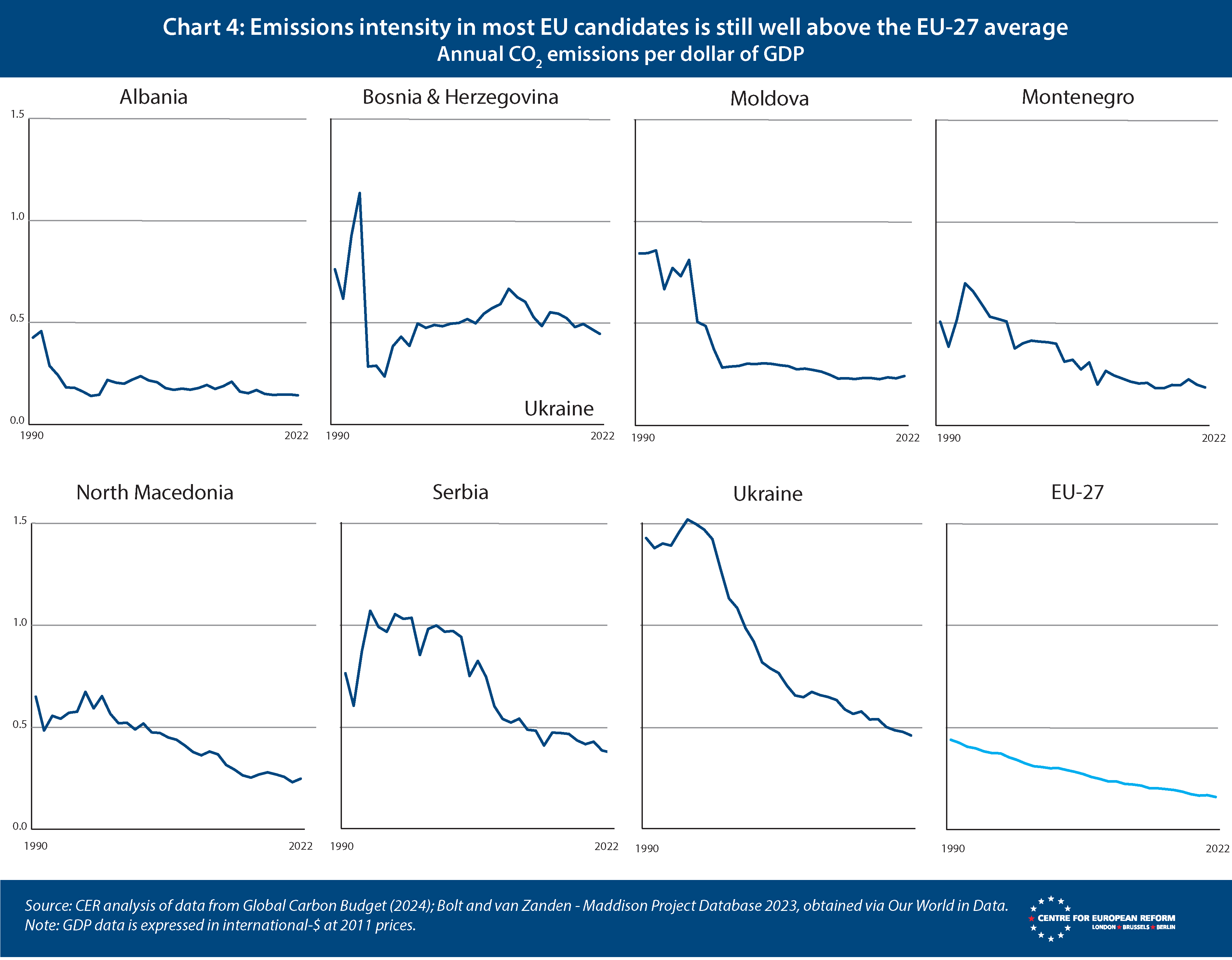

How exposed candidate countries will be to the burden of carbon prices once they become part of the EU ETS also depends on how carbon intensive their industry is. The key measure is how much carbon they emit per unit of output produced. Since 1990, the carbon intensity of industry in candidate countries has been on a downward trend, but in 2022 it remained above the EU-27 average in most of them (Chart 4).

Across the Western Balkans and Ukraine, in 2018 the vast majority of the 23 Mt (million tonnes) of fossil fuels were used in energy-intensive industry. Of these, 20 Mt were associated with the production of iron and steel (of which 18 Mt were in Ukraine, which still exploits some older, inefficient open-hearth furnaces), and 2 Mt used in cement.

Adopting national carbon pricing would help candidate countries align with the ETS and accelerate decarbonisation. The CBAM provides an additional incentive: the EU will charge candidate countries’ carbon-intensive exports a fee aligned with the EU ETS carbon price. Specifically, the goods subject to CBAM are cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. Fees will kick in starting in January 2026, proportional to the carbon content of exported goods. Today, coal-based electricity from thermal power plants in the Western Balkans flows to the EU without paying a carbon price under the EU ETS.

Adopting national carbon pricing would help candidate countries align with the ETS and accelerate decarbonisation.

As part of the Energy Community, candidate countries are seeking a CBAM exemption for electricity trade. If granted, this would remove CBAM fees on their electricity exports to the EU. But the EU has set several requirements for countries to obtain such an exemption: completing market ‘coupling’ with the EU electricity market; implementing a climate law and strategy aligned with 2050 carbon neutrality; and establishing a system to prevent indirect imports of electricity into the Union from third countries which do not fulfil the CBAM exemption criteria.

Coupling electricity markets means that electricity trade across borders is made seamless by aligning the rules that govern power exchanges. Candidate countries are making slow progress in this area: while most have an operational day-ahead electricity market (to trade electricity for delivery the next day), that is not the case for the intraday electricity market (for delivery the same day, which is important to facilitate trading of renewable energy, given the intermittency of renewables which makes their availability harder to forecast).

Carbon neutrality by 2050 is also not yet formalised across the climate policies of all candidate countries. So, given their overall slow progress towards the requirements, it seems unlikely that they will obtain a CBAM exemption by the time fees start applying in January 2026. EU candidate countries should start preparing for parts of their economy to face the EU carbon price.

CBAM fees will reflect the EU ETS price, so as of 2026, CBAM sectors exporting to the EU will face the same price as if they joined the ETS itself. Of course, once EU candidate countries join the ETS, that carbon price will apply to a broader set of industries than the handful which are subject to CBAM.

In this sense, adopting a national-level carbon price would provide at least two benefits. First, it would increase EU candidates’ preparedness to face CBAM fees as of 2026, and ETS prices once they join. Second, it would allow them to retain carbon pricing revenues domestically as opposed to paying them to the EU through CBAM fees. This is because the EU would allow the national carbon price to be deducted from CBAM fees, in order to avoid it being counted twice.

A joint initiative for carbon pricing involving several countries would allow governments to share the administrative costs that come with implementation, particularly burdensome for small countries, and increase the heft of the carbon market. This is the reason why members of the Energy Community are considering options for a ‘regional carbon price’ initiative. The inclusion of more carbon-intensive economies in the ETS will have systemic effects – not just for the new entrants, but for the ETS itself.

How should the ETS evolve to fit a larger, initially more carbon-intensive union?

The inclusion of new member-states will significantly increase the supply and demand of ETS allowances – and could risk disrupting the carbon price. The Commission will need to assess the possibility of disruptions associated with enlargement, be it gradual or involving multiple countries at once, and ensure that existing safeguards are adequate for the ETS to withstand an increase in allowances. The starting point for this is the market stability reserve: this is the mechanism designed to adjust the number of allowances auctioned every year in the ETS to avoid large price shocks, activated in specific circumstances not to leave any discretion to the Commission or member-states. While recent EU enlargements (Romania and Bulgaria in 2007, Croatia in 2013) had minimal impact on the EU carbon market, today’s context is significantly different.

First, EU candidate countries’ emissions from ETS-covered sectors (excluding maritime and airline emissions) totalled 215 million tCO2eq, representing a non-negligible 15 per cent of the EU’s 1.38 billion allowance cap. Second, following the 2023 reform of the EU ETS, the rate at which the emissions cap is decreased every year has increased from 2.2 to 4.3 per cent, indicating an acceleration in expected emissions cuts in ETS sectors. Third, the EU ETS allowance price has risen from under €20 per tonne in the early 2020s to approximately €70 today, with significant volatility. Fourth, beginning in 2026, CBAM fees will start applying and free allowances for EU-based producers will be gradually phased out.

All in all, candidate countries will face a larger ETS bill upon accession, unlike current members who benefited from extensive free allocations during lower price periods. The Commission is already supporting candidate countries in preparing for carbon pricing, including through co-operation with the Energy Community. Scaling up support for decarbonisation investments in power and industry in EU candidate countries is the best way to mitigate the impact of their entrance in the ETS itself.

Candidate countries will face a larger ETS bill upon accession, unlike current members who benefited from extensive free allocations during lower price periods.

A gradually rising carbon price would be a stepping stone for candidate countries to advance towards the EU ETS, especially if the proceeds are used to fund grid upgrades and coal phase-out. Alternatively, candidates could be invited to join the ETS ahead of full accession, once they meet requirements on MRV. Joining the ETS would expose them to a high and possibly volatile carbon price. To smoothen the price impact on the power sector, new member-states could initially make use of the existing possibility to temporarily provide free allowances to power generators, on condition of investing in modernising the power system, aiming to rapidly phase out coal power generation.

Managing distributional impacts of carbon pricing also calls for dedicated policies. Lower-income new members would become major recipients of the Modernisation Fund – which aims to channel a part of the ETS revenues to finance the decarbonisation of lower-income member-states. Similarly, the relatively poorer households of candidate countries would be disproportionately affected by carbon prices on road transport and building heating, which will be rolled out through the new ETS2 as of 2027. Once they join, they would need support from the Social Climate Fund, which aims to combat energy poverty across poorer member-states. Finally, regions where the coal sector provides lots of jobs should benefit from the Just Transition Fund, which supports regions and workers most affected by the energy transition. These EU funds will be under pressure to support a larger set of lower-income countries and households: they should increase accordingly, to ensure social support for the energy transition does not dwindle.

Ultimately, a gradually rising national or regional carbon price would help candidate countries prepare for EU ETS membership. It would also send the right signal to accelerate the decarbonisation of electricity and heavy industry. At the same time, the EU should ensure that existing safeguards for the ETS are adequate to withstand the increase in allowances that would come with enlargement. It should also increase the funds needed for new member-states to withstand the burden of a new carbon price. If the ETS is to remain the EU’s flagship climate tool, it must be ready for a bigger, more diverse Union – and help its newest members decarbonise without delay.

Elisabetta Cornago is a senior research fellow at the Centre for European Reform.

This article has been supported by the European Climate Foundation. Responsibility for the information and views set out in this article lies with the author. The European Climate Foundation cannot be held responsible for any use which may be made of the information contained or expressed therein.

Add new comment