Weighed down by gravity: UK trade policy after Brexit

The post-Brexit vision of a UK finally free to do trade deals around the world is giving way to reality: free trade agreements deliver marginal benefits and little influence, particularly for the UK’s service-oriented economy.

After Britain’s decision to leave the European Union, the government and Brexiteers argued that the UK’s new ability to cut trade deals around the world would not only compensate for any loss of access to the EU’s single market, but also free the UK to strike deals with high-growth economies in Asia and with the US. The UK government set out to quickly replace the extensive network of EU free trade agreements (FTAs) and expand it with new agreements with countries such as Australia, India and the US, as well as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) regional agreement for countries on either side of the Pacific.

Overall, these negotiations were very successful. The UK quickly established a new Department for International Trade and rapidly sealed an impressive number of FTAs between 2019-2020. When the UK left the EU customs union on 31 December 2020 it was able to largely replace the trade relations it had as an EU member with new, UK-specific ones. A very impressive 36 UK FTAs entered into force in 2021, including the EU-UK Trade and Co-operation Agreement (TCA). The UK also concluded completely new agreements with Australia and New Zealand and is set to join the CPTPP. The success of these negotiations has become emblematic of post-Brexit trade policy and helped propel then trade minister Liz Truss to the position of Prime Minister.

However, the successes of the UK’s post Brexit trading policy should not be overplayed. The vast majority of UK FTAs are continuity agreements that simply replicate prior agreements. This helps avoid disruption by preserving the status quo as much as possible but it does not give new market access. At the same time, the hoped-for trade deal with the US failed to materialise, largely because of the increasingly protectionist mood in Washington.

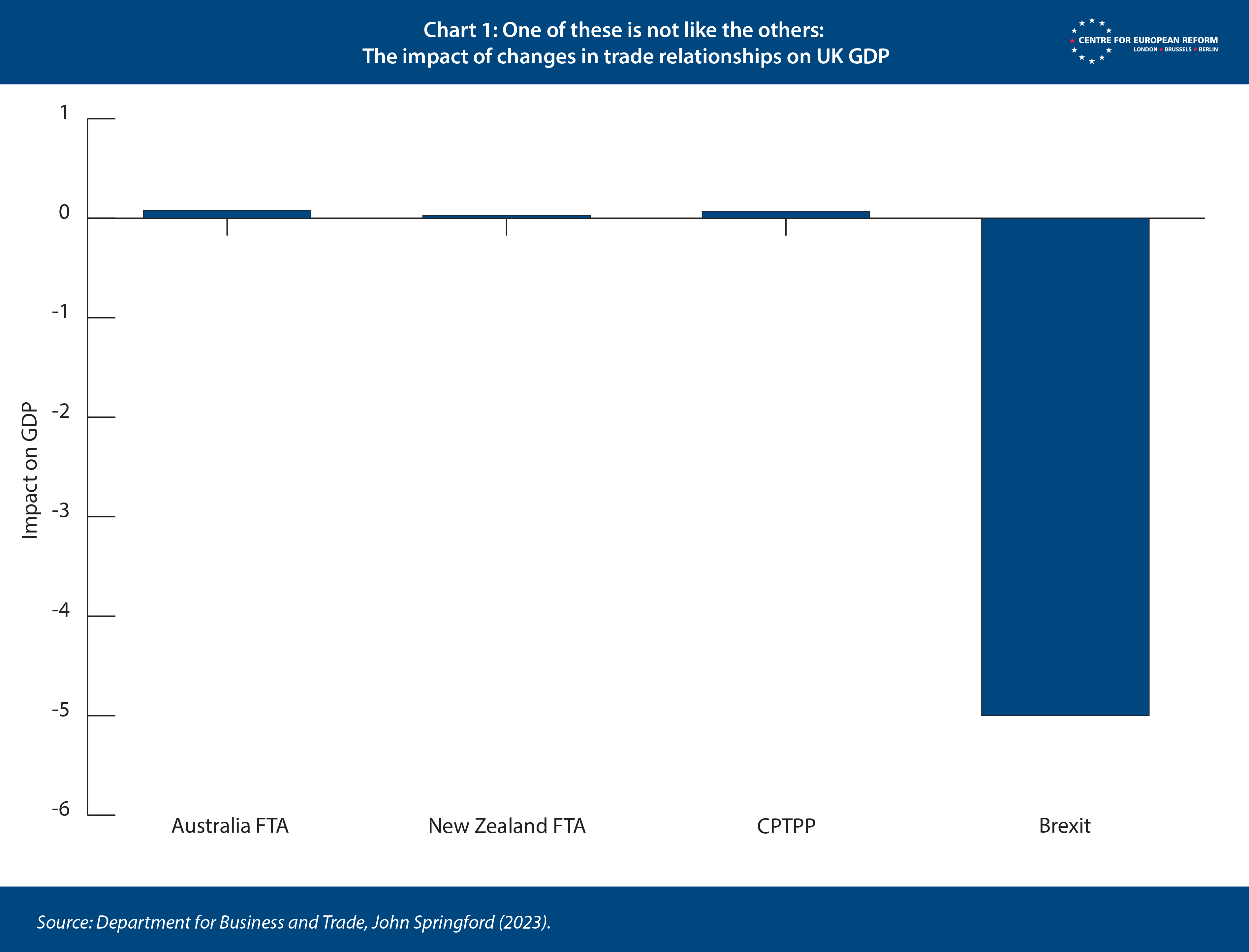

More fundamentally, there was never any possibility that FTAs could offset the very substantial cost of leaving the single market. Though FTAs are helpful, their overall economic impact is minor. Indeed, there is a stark contrast between the post-Brexit government rhetoric about ‘Global Britain’ and the government’s own impact assessments: London estimates a long-term boost to GDP of 0.08 per cent by 2035 from the UK-Australia agreement and 0.03 per cent from the New Zealand agreement. As for the CPTPP, the estimate of a 2 billion pound boost to trade by 2040 amounts to less than 0.07 percent of UK GDP, mostly because the country already has an FTA with most CPTPP members. In comparison, although estimates vary, the immediate cost of Brexit so far could be as high as 5 per cent. These Brexit costs have been already incurred, while the benefits of new FTAs will only accrue over a very long time period up to 2040. Though FTAs foster trade and economic growth, and the UK should continue to actively pursue them, their limited economic impact means that they could never compensate for leaving the EU or bear the weight of post-Brexit hopes.

The impact of free trade agreements largely depends on how much trade the countries involved do and the extent of liberalisation any trade deal achieves. Countries trade more with other economies the larger and closer they are, as if pulled in by their gravity (which is why economists call this the gravity model of trade). The UK trades a great deal with the EU because its economy is both very large and very close, and much less with New Zealand because it is very far away and has a small economy. Intuitively, this makes sense because large economies both have more goods and services to export and a larger demand for imports, and it is easier and cheaper to trade with neighbours than the other side of the planet, for example because transport costs are lower.

Regarding the extent of liberalisation, the EU single market essentially removes all barriers to trade for goods and does far more for services than most FTAs. These two factors explain the enormous contrast between the very large cost of Brexit and the nearly undetectable projected boost to GDP from new FTAs concluded so far. This should set expectations for the potential gains from trade agreements.

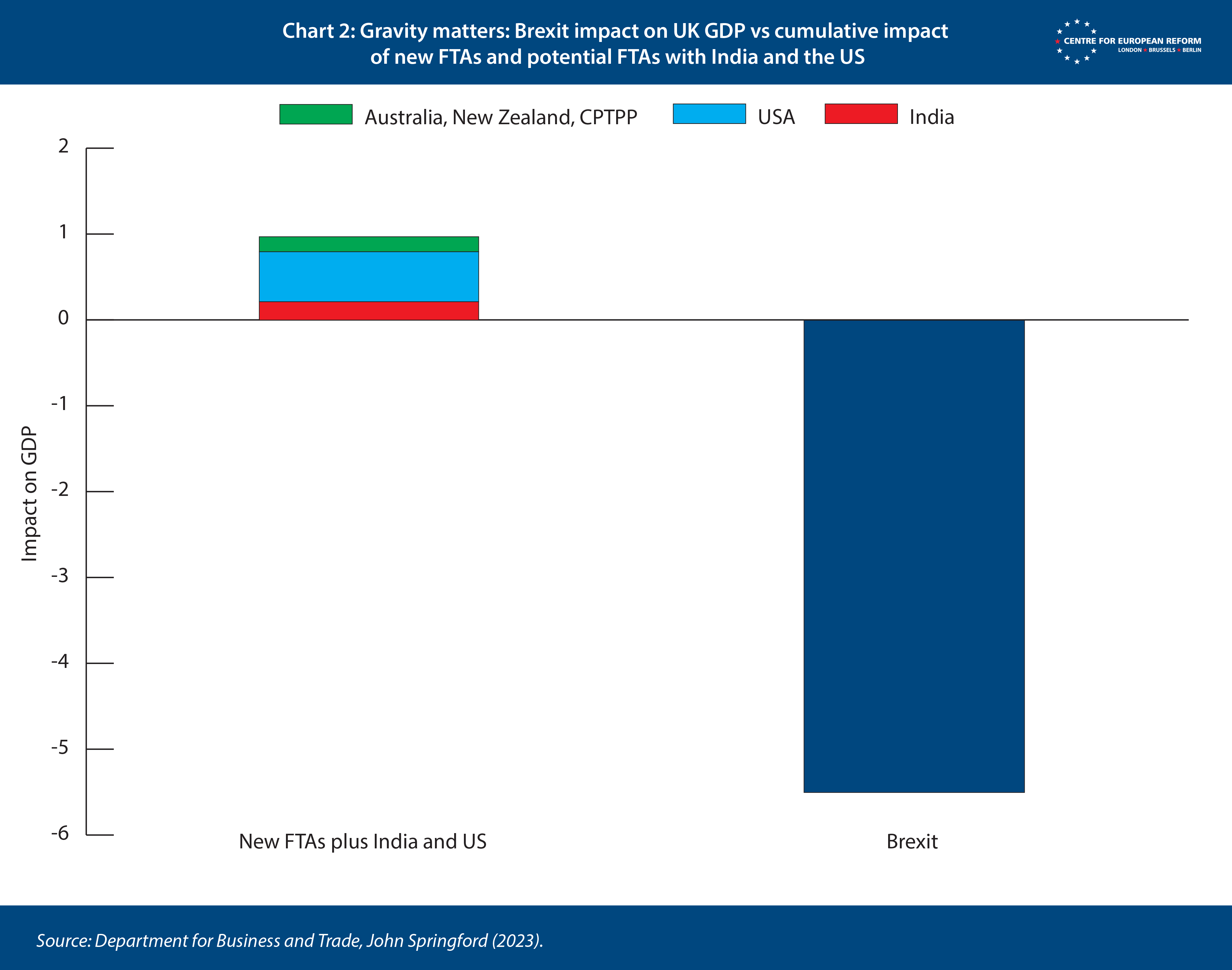

A simple overview of the large economies shows the limited potential gains from further UK FTAs. A trade deal with China, let alone Russia, would be politically unthinkable given Putin’s war on Ukraine and trade tensions between China and the West. Through the TCA, the UK already has secured an FTA of a high international standard with the EU, albeit with much reduced market access compared to EU membership. As for the rest, the most promising FTA is with India, currently under negotiation. India is a large and fast-growing economy with high trade barriers, so in theory there could be large benefits to an agreement. However, India is also a notoriously difficult negotiating partner, and reaching an agreement will be difficult, not least due to India’s demand for more access to Britain for its workers. Initial UK estimates indicate that an ambitious agreement with large tariff reductions could lead to a 0.2 per cent increase to GDP while more modest reductions would lead to a 0.1 per cent gain.

The world’s largest economy – the US – is not currently inclined to negotiate FTAs, but that could change in the future, particularly given generally good UK-US relations. The UK has not estimated the impact of an agreement with the US. However, the UK’s CPTPP impact assessment notes that the accession of the US along with Laos, Cambodia and Indonesia would further increase the CPTPP boost to GDP from £2 billion to £19.5 billion. Generously ascribing all that increase to the US joining gives an approximate figure of £17.5 billion or 0.6 per cent of UK GDP as a reasonable estimate of the impact of a possible agreement with the US – a very significant sum for an FTA.

The gains from trade agreements are fairly limited. Adding up the impact of the already agreed FTAs and the possible ones with India and the US would give the UK a total boost of around 1 per cent of GDP in the long run, a small fraction compared to the impact of Brexit. Other potential FTA partners for the future include the South American countries in Mercosur (though Argentina will be an obstacle). But this would not change the overall picture: FTAs are a useful tool for the UK to eke out marginal increases in growth and can sometimes be very helpful for individual companies, but they cannot by themselves provide the significant boost to national income that EU membership did. To see why, it is useful to look at both the structure of UK trade, the contents of FTAs and how they differ from single market membership.

The United Kingdom is unusual for a large country because it relies heavily on the export of services. In 2022, services were as much as 49 per cent of total UK exports. The equivalent figure for the EU that year was 34 per cent; for the US it was 31 per cent. Goods are more tradeable, but the UK has a strong niche as an international provider of financial, legal, and business services, among others. The problem, however, is that unlike the single market, FTAs generally have a very limited impact on services trade.

For services, the barriers to trade are regulatory in nature. These include, for example, legal requirements about who can provide certain services, what local presence is needed, and ownership or citizenship requirements. However, instead of increasing market access, FTAs generally just stop countries from introducing new restrictions, which is why impact assessments are replete with terms such as “providing greater legal certainty”. Countries already have committed to a certain level of openness in the WTO, and FTAs either reaffirm or raise those commitments. The Australia impact assessment explains this well:

“The benefits of services liberalisation can come both from ‘applied liberalisation’ (liberalisation in the actual restrictions affecting services trade) or through ‘bound liberalisation’ (commitments to maintain liberalisation at a given level in the future). The difference between the bound and applied restrictions to services trade is often known as ‘water’. FTAs primarily aim to reduce this ‘water’ as countries’ applied regimes tend to be lower than their bound regimes. In other words, FTAs aim to ‘lock-in’ countries’ applied regimes and reduce future policy space which in turn provides greater legal certainty to businesses.”

That is not to say that there is never any genuine liberalisation of services trade. The UK-Australia FTA does relax some requirements for maritime transportation for instance. But countries are generally reluctant to substantially change their regulatory framework for services for the sake of an FTA. The single market is unique internationally in that it provides a fairly comprehensive liberalisation of services while FTAs generally make small changes at best.

The fact that trade barriers for services are exclusively regulatory non-tariff measures makes them hard to quantify, but the impact assessments do try to calculate the potential costs saved in terms of ‘tariff equivalent’, for example, what tariff would have an equivalent effect. This methodology also assigns some value to greater legal certainty. The results are illustrative and generally indicate that FTAs can cut the costs of services trade by a couple percentage points.

The UK is in many ways well-positioned to reap economic growth from its strengths in key services sectors of the modern economy, but ironically less well-suited to relying on FTAs to open up markets.

To be sure, in addition to goods and services, FTAs also include other important areas such as investment and government procurement, these too largely tend to secure existing terms with limited additional liberalisation.

When it comes to goods, lowering tariff barriers remains an important task, but for developed countries, non-agricultural products now generally have tariffs that are in the low single digits. These are high enough to make FTAs worthwhile and can provide companies with a competitive advantage, but not so high as to significantly impede trade. In fact, to qualify for preferences in FTAs, companies have to comply with rules of origin that determine what goods, for example, are considered British for the purposes of FTAs. In many cases the cost of compliance with rules of origin may not be worthwhile, especially for companies that only export occasionally. For developing countries, tariffs tend to be higher. India, for instance, levies an average tariff of 14.7 per cent on non-agricultural goods. Higher tariffs raise the potential gains from FTAs, although developing countries also tend to offer less liberalisation. According to UK estimates, the cost-savings from non-tariff measures also help add value to FTAs, often more so than the removal of tariffs, though as with services this includes the benefit of greater legal certainty.

Two more fundamental realities hamper the UK’s ability to offset Brexit costs with FTAs. First, trade is increasingly driven by international supply chains. An increasing share of trade is in intermediate goods, like textiles, semiconductors and engines, instead of trade in goods ready for consumption, like clothes, computers and cars. Before Brexit, such intermediate goods and services made up over half the UK’s imports from the EU and almost 70 per cent of its exports. UK firms rely on European supply chains to produce many of their products and vice versa, an interdependence that was encouraged by both geographical proximity and single market membership.

Many of the UK’s post-Brexit FTAs put restrictions on the quantity of EU products that can be used and still qualify for tariff reductions with non-EU FTA partners. Similarly, there are restrictions on the amount of UK products that can be used to qualify for reductions in EU FTAs. Not only did Brexit impose a higher cost of trade with the EU, but participation in European supply chains has also been made harder as it is now more difficult to qualify for FTA preferences. Bilateral FTAs are therefore less useful for the UK after Brexit. The UK’s geographic position will always shape how UK trade and producers participate in global supply chains. For example, joining the CPTPP allows UK products to enter into a Pacific-based supply chain, but one where the UK is at a permanent geographical disadvantage. For the UK, the increased ability to participate in Pacific supply chains can therefore not compensate for the loss of access to European ones. This is particularly true for smaller exporters that do not have the resources or volume to plug into supply chains on the other side of the planet.

The UK’s effort to build new trade relations around the world after Brexit has been as successful as it could be, but the economic results were never going to fully live up to expectations. The usefulness of FTAs for services trade is limited, the UK’s geographic position will remain unchanged, and the UK still depends on EU supply chains. UK trade policy should continue to pursue FTAs to help promote growth, but the number of potential partners is rapidly diminishing, which will make new FTAs less important going forward. The UK will therefore have to turn to other venues to promote growth. The most obvious course would be to deepen relations with its most important trading partner: the EU.

Ultimately, good trade policy always begins at home, with investment in infrastructure, research and training that allows companies to flourish. More than any FTAs, addressing the persistent lack of productivity growth and low levels of investment would help redress economic growth and boost British exports.

Aslak Berg is a research fellow at the Centre for European Reform.

Add new comment