The EU should abandon chip nationalism

With the US aggressively throttling China’s chip capabilities, the EU wants to protect itself by subsidising its own domestic chip manufacturing industry. But Europe has better and more realistic alternatives.

Europe’s supply of semiconductors is vulnerable – and the EU knows it. Politically symbolic sectors like car manufacturing have already been hit hard by global chip shortages. Europe’s car companies initially cancelled orders for new chips from foreign chip manufacturers as pandemic lockdowns began. When demand recovered, car-makers found they were sent to the back of chip manufacturers’ queues. In some member-states, car production plummeted by over a third. Europe’s car industry has been slower than elsewhere to recover.

Europe’s supplies will only become more precarious. Growth in demand for electric (and future autonomous) vehicles means auto manufacturers will need more advanced chips in future. That could vastly limit Europe’s potential suppliers, since only Taiwanese firm TSMC and Korean firm Samsung can produce these chips. And Europe will almost certainly suffer collateral damage from rising US-China tech rivalry. After years of limiting China’s access to cutting-edge chip technologies, the Biden administration has just taken much more aggressive steps to stop China producing its own cutting-edge chips – which will harm important European firms that supply chip equipment to China, and could drive up prices since Europe currently sources a large proportion of its chips from China. Chinese retaliation could cause monumental disruptions, since China remains the leading supplier of several inputs essential to the chip-making production process.

All this means that European companies must adapt to growing supply chain risks. Rather than leaving it to businesses to manage their own risks, the EU instead wants to spend big to reduce Europe’s vulnerabilities. The centrepiece of this strategy is the EU’s Chips Act proposal, soon to be adopted by the EU law-making institutions. The Act would allow member-states to subsidise chip manufacturing plants which are ‘first of a kind’ in Europe, aiming to double the EU’s share of global production capacity to 20 per cent by 2030, including 20 per cent of cutting-edge chips. In a supply crisis, the European Commission could also force these subsidised EU chip manufacturers to reprioritise their orders, for example to meet the needs of businesses in the single market.

Onshoring manufacturing to any significant extent, especially for cutting-edge chips, is not financially plausible. It is also unnecessary.

The EU remains understandably leery of depending too much on the US, which is currently constructively engaging with the EU on tech policy, but could easily return to a Trump-style isolationist approach. However, this ‘chip nationalism’ will not help the EU. Onshoring manufacturing to any significant extent, especially for cutting-edge chips, is not financially plausible. It is also unnecessary: the EU does not have straightforward unilateral dependencies, and European businesses can already diversify their suppliers. And the EU chip industry benefits from global trade: 80 per cent of the suppliers to European chip firms are outside the EU, as are two-thirds of EU chip firms’ customers. The EU law-making institutions are likely to agree to make subsidies under the Chips Act more flexible, so they can better deliver what EU customers need. But the EU would achieve more by securing trade in chips with like-minded allies and by helping to nurture EU leadership in new technologies.

Start with the price of onshoring. Subsidising plants which are ‘first of a kind’ in Europe means fighting against a long-term trend. In the 1990s, European firms made nearly half the world’s chips by value; now Europe produces less than 10 per cent. If firms are locating their plants in other countries, those countries probably have enduring competitive advantages over Europe or are prepared to lavish vast subsidies to compensate. South Korea will spend $65 billion of public funds to support local manufacturing; the US, $53 billion; Japan, $4.57 billion. Competing would therefore require vast public investment in Europe. A cutting-edge manufacturing plant costs upwards of $10 billion. Industry figures estimate the EU’s ambitions could therefore cost hundreds of billions of euros to achieve: far more than the €43 billion in investment the Commission believes the Chips Act could generate. Despite China spending hundreds of billions of dollars with the goal of self-producing 70 per cent of its semiconductor needs by 2025, China can currently only self-supply 16 per cent of its needs. The EU’s efforts have had far less firepower: in 2013, the EU committed €10 billion in public funding to increase the EU’s global market share to 20 per cent by 2020. While this supported some important new innovation in areas like chip design and manufacturing equipment where the EU already had strengths, the EU’s global share of chip production still declined. Trying again, on a larger but still insufficient scale, would be wasteful, especially at a time when there are growing demands on member-states’ budgets, and when other countries are driving up demand and thus competition for the necessary skills and resources.

Europe’s relationships with other countries in the chip value chain are also not characterised by simple unilateral dependencies, which onshoring would help address. The semiconductor value chain is global and complex. Among other things, it requires a supply of rare earth metals and gases; the production of wafers on which chips can be etched; chip designs to be prepared (often by firms which outsource the production of those designs to specialised chip manufacturers); access to software-based design tools; manufacturing equipment and tools; and for manufactured chips to be assembled, packaged and tested. There are over 50 steps in the value chain in which firms from one region hold more than 65 per cent of global market share. Eliminating one or two foreign chokepoints in that chain will not suddenly make Europe immune to external political or economic pressure. After all, Europe already has leverage. For example, Dutch firm ASML is the only firm globally which can supply chip-makers like TSMC with the lithography equipment necessary to make the most advanced chips. Yet this strength has not helped the EU defy US pressure to stop ASML selling its cutting-edge machines to Chinese customers.

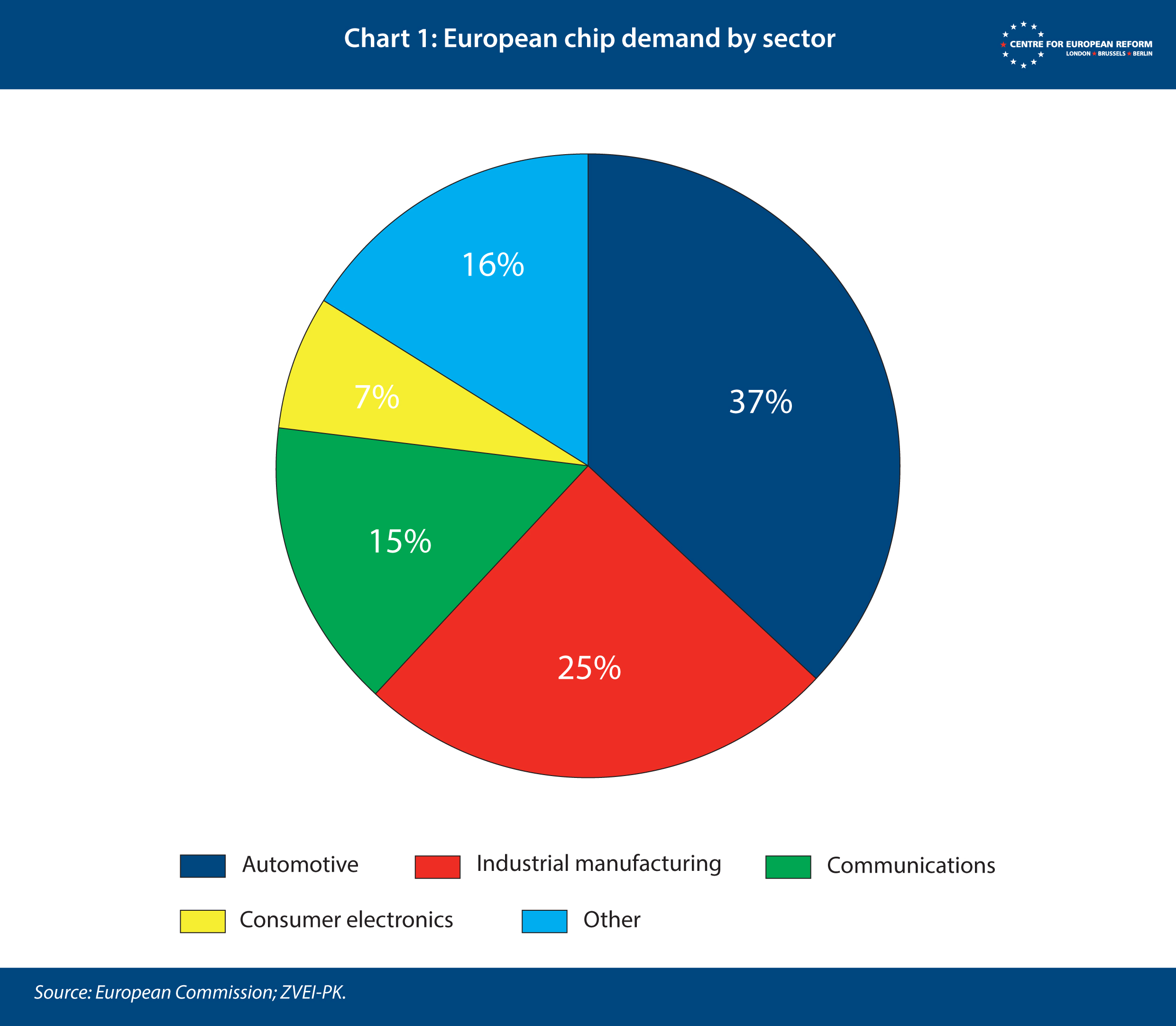

Finally, European businesses that need chips can diversify their suppliers today if they want to. As Chart 1 shows, more than three-quarters of Europe’s chip demand is from car-makers, industrial users and sellers of back-end communications equipment like Nokia and Ericsson (neither of which sell consumer handsets anymore). These users rely far more on legacy chips than cutting-edge ones.

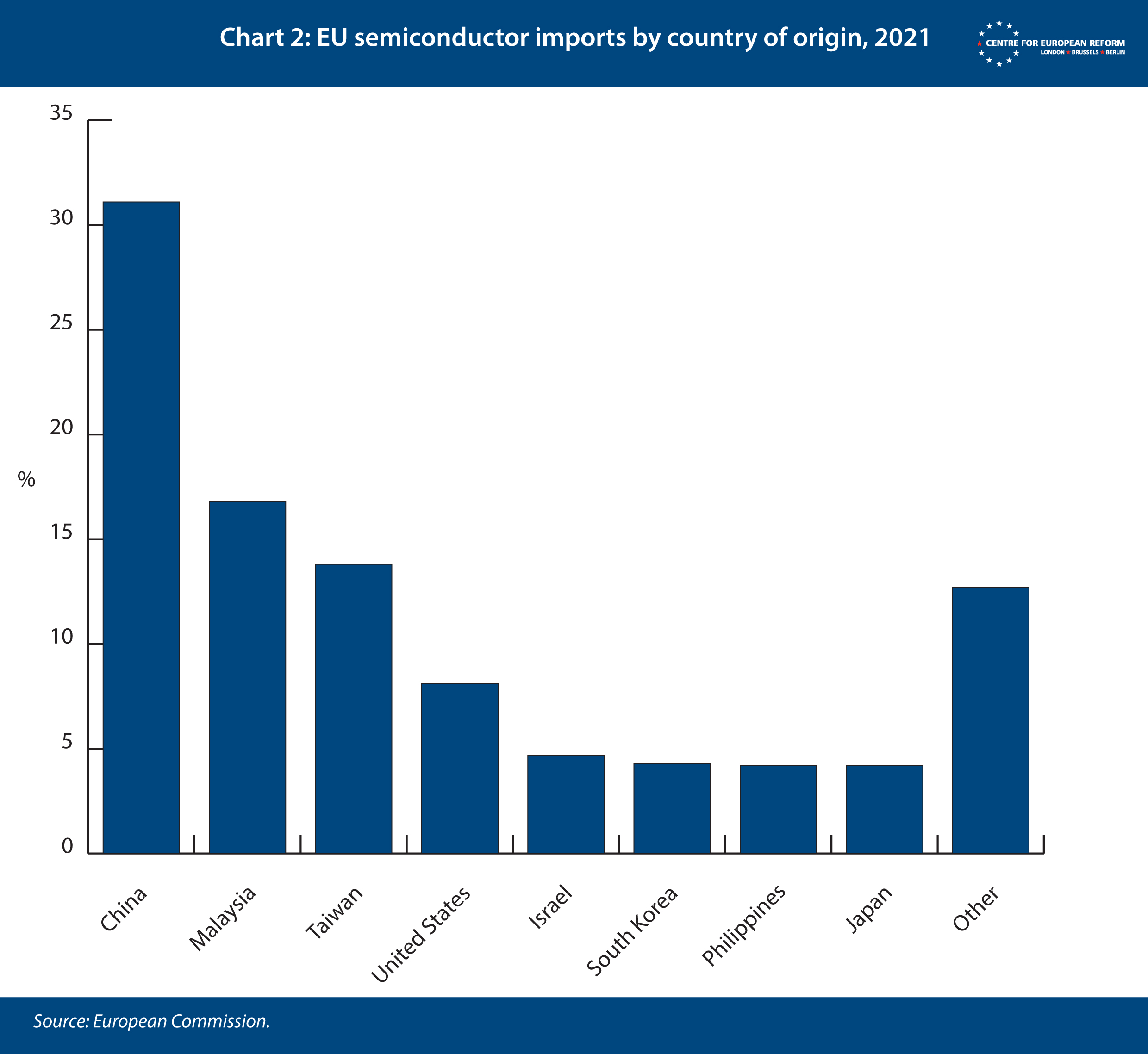

Europe has existing and planned factories, thanks to firms like Bosch and Infineon, to supply these needs. Japan, the US, and various other countries all have the capability to supply Europe too. Chart 2 shows that EU businesses are taking advantage and importing chips from a range of destinations: the largest supplier, China, represents less than a third of the total. Suppliers for cutting-edge chips are less diversified, and are currently only produced in Taiwan and South Korea. But they are mostly needed for high-end consumer electronics like smartphones which, as Chart 1 shows, Europe barely produces at all. While European car manufacturers will need higher-end chips as technologies like autonomous driving are deployed in the coming years, by then they will be supplied from a wider range of manufacturers and geographic regions, including Intel and TSMC’s planned factories in Arizona.

European businesses can therefore mitigate their supply risks using existing trailing-edge chip-making plants.

The EU has more efficient alternatives than subsidising new competing plants in these circumstances. European companies could, for example, enter into long-term purchase commitments with existing or planned plants in Asia and the US. The EU’s trade policy could prioritise this objective with multiple partners, so EU firms can help keep themselves hedged against political risks: such as a need to decouple further from China or a future isolationist US. For this plan to be worthwhile for the EU, the EU’s global partners must compromise too. They should agree not to control supply chains or limit exports to the EU during crises (and the EU should revisit its own unhelpful proposals to limit exports during emergencies, which feature both in the Chips Act and in other recent EU initiatives). The EU’s partners could even make their subsidies for domestic chip-makers conditional on those chip-makers giving European chip designers the chance to buy up minimum levels of production capacity. In this way, important European industries should have the inputs they need and emerging European chip designers would have a real chance at succeeding even if the EU does not have its own cutting-edge chip factories. The US also needs to genuinely engage with the EU about its future trade and tech policy. The EU and US worked closely together to develop tech sanctions targeting Russia, thanks in large part to the EU-US Trade and Technology Council. This coordination helped project EU-US unity, made the sanctions more effective, and minimised unexpected collateral damage for the EU. This dialogue also needs to encompass any future chip-related sanctions against China.

Europe’s partners should be prepared to offer these commitments to avoid a subsidy race with the EU. EU partner countries’ new domestic plants would then be more viable, less public subsidy would be necessary, and the EU and its partners would compete less for scarce resources and skilled talent.

The EU would not need to abandon the sector: it should merely stop trying to compete head-on with global industry leaders. Instead, it should fund new technological niches where Europe has, or could have, potentially durable competitive advantages – or at least would have a technological head start over other regions. Fortunately, there are several ways the Chips Act could achieve this. One is by broadening the definition of ‘first of a kind’ facilities, so that it encompasses a broader range of manufacturing innovations, such as new manufacturing equipment or facilities to make specialised chips. The EU member-states seem likely to broaden the types of projects which can receive subsidies before they finalise the Chips Act. Flexibility entails the risk that state aid will be invested poorly. But, in this case, it would be an improvement, allowing EU member-states to fund specialised projects where relatively small subsidies could have more impact.

The EU should also expand funding for the Chip Act’s ‘Chips for Europe’ initiative. This initiative includes a platform to improve EU firms’ capabilities in designing chips, ‘pilot lines’ to help take chip designs beyond a lab environment and into pre-commercial manufacturing, funding for developing quantum chips, and centres to improve chip-related skills. Europe has leadership in specialised areas which the Chips for Europe initiative could leverage: power semiconductors (used in high voltage systems), sensors, industrial chips, and emerging areas like photonics which transport photons rather than electrons over a chip. Selecting niches will inevitably involve picking losers among the winners. But it is better than making a single big bet on an area where the EU has direct competitors that it will not realistically outspend.

Unlike for chip manufacturing, the Commission is ready to foot the bill for the Chips for Europe initiative. But the funding is less than it seems. Only €5.8bn of the announced €11bn budget will be direct EU funding. More than half of this has been taken from the EU’s other research programmes such as Horizon Europe, where the money would mostly have been spent on chip projects anyway. The remaining €5.3bn is expected to be volunteered by EU members, for example from their pandemic recovery funds or national budgets, or to be funded by the private sector. Even if the full budget materialised, the Chips for Europe initiative would still punch below its weight: the US’s own Chips Act promises $13.2 billion in research, development and upskilling alone, for example.

The Chips Act is unlikely to deliver the financial firepower to ensure Europe can compete globally, or to significantly increase Europe’s strategic autonomy.

The EU’s headline-grabbing aim is to lavish subsidies on domestic chip manufacturing. This is an odd strategy given the EU’s growing concern about foreign countries’ subsidies. But the Chips Act is unlikely to deliver the financial firepower to ensure Europe can compete globally, or to significantly increase Europe’s strategic autonomy. Rather than stubbornly seeking to onshore production in which it has no comparative advantage, European businesses should bear the costs of dealing with political risk. The EU, on the other hand, should focus on helping industry exploit the niches where it has a lead.

Zach Meyers is a senior research fellow at the Centre for European Reform.

Add new comment