How carbon pricing can decarbonise European heavy industry

To decarbonise heavy industry, the EU needs a high and stable carbon price, an end to free emission permits, a level-playing field with foreign competitors, and support for green investment.

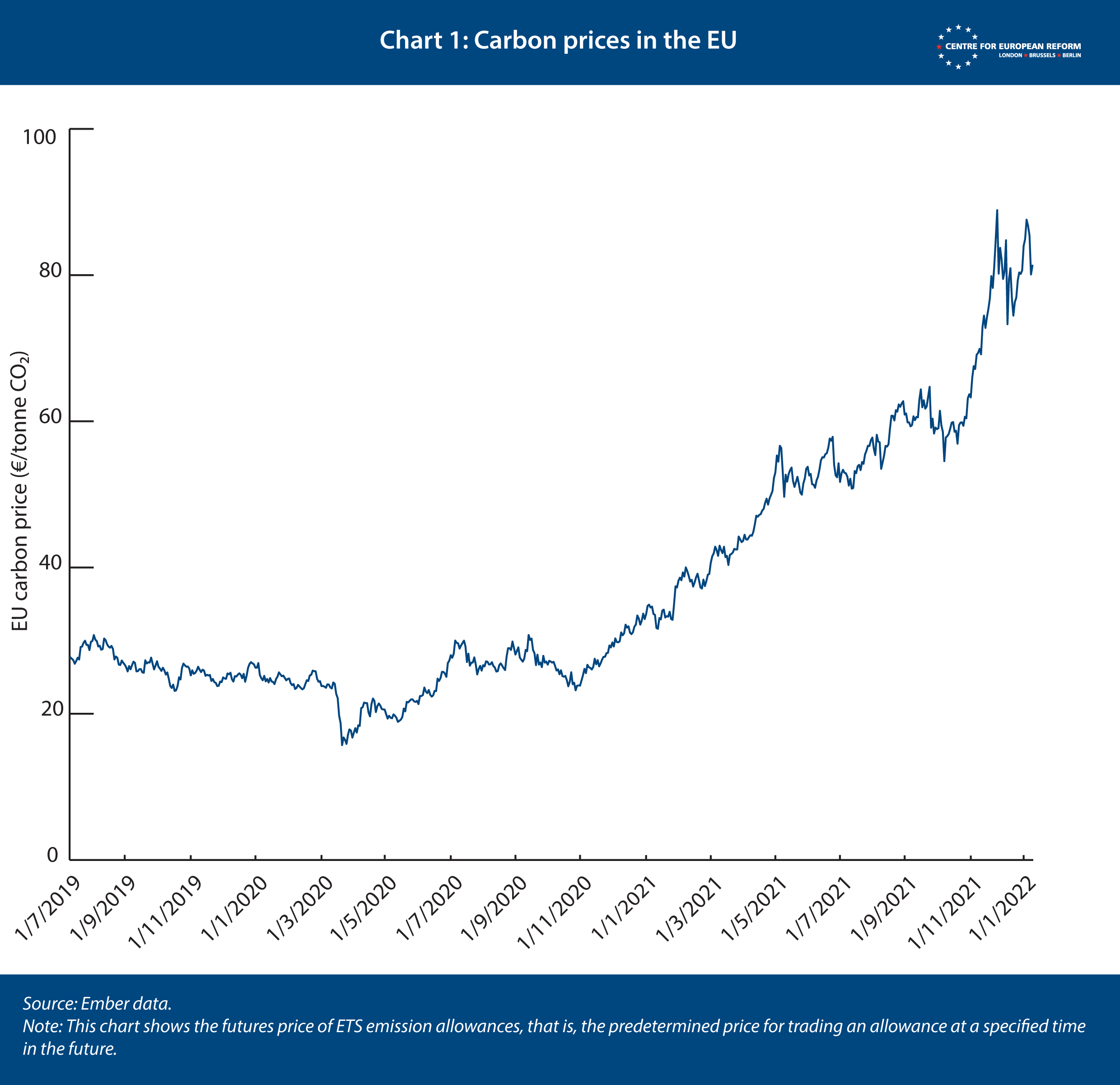

Prices on the European carbon market continue to climb, as Europe’s climate targets – and its policies – have become more ambitious. That is a welcome change from the first 15 years of the EU’s Emissions Trading Scheme (ETS), when heavy industry found that emitting carbon was so cheap that reducing emissions was not worth the hassle. A carbon price that bites is a necessary tool to reach the EU’s climate goals. But a high price poses a challenge for Europe’s heavy industry, which competes globally with producers who are not (yet) subject to comparable carbon pricing.

Prices on the European carbon market continue to climb, a welcome change from the first 15 years of the EU ETS, when emitting carbon was so cheap that reducing emissions was not worth the hassle for heavy industry.

Since 2005, the ETS has capped carbon emissions from over 10,500 installations in the European power sector, and in energy-intensive industrial sectors such as oil refining, iron and steel, cement, and more. The cap covers about 36 per cent of total European emissions and is gradually tightened every year to reduce them. The cap is enforced via permits to emit, which are traded on carbon markets, leading to a price for carbon emissions. The problem is that, while the energy sector has cut its emissions by 15 per cent since 2005, the carbon price has, so far, not driven down carbon emissions from heavy industry in a comparable way. That is because between 2012 and 2018, carbon prices remained under €10 a ton, in part because of a surplus of emission permits on the market, and in part because industrial installations under the ETS still enjoy free permits for carbon emissions.

To prevent prices for carbon from falling too low, the EU recently created the so-called market stability reserve (MSR) to stash away the surplus of allowances that was flooding the carbon market. In effect, because the MSR is designed to withdraw or release allowances when their number in circulation goes beyond certain pre-defined thresholds, the ETS has become an unconventional cap-and-trade system: while generally cap-and-trade systems allow the price to fluctuate freely, the MSR introduces an indirect lower and upper bound on carbon prices.

A carbon price that bites is necessary to reach the EU’s climate goals. But a high price poses a challenge for Europe’s heavy industry, whose global competitors are not (yet) subject to comparable carbon pricing.

The ‘Fit for 55’ climate and energy package, announced by the European Commission in July 2021, contains proposals for further reforms to the ETS. First, it lowers the cap on emissions to bring the ETS in line with tougher climate targets. Second, it tightens the conditions under which industrial plants can claim free permits, paving the way for their gradual phase-out. These proposed changes point in the right direction, but they are neither sufficient nor speedy enough to accelerate the decarbonisation of heavy industry to meet 2030 emissions reduction goals. To do this, the EU needs to ensure a high and stable carbon price and eliminate free emissions permits sooner. But the Union should just as rapidly create a level-playing field with foreign competitors and use ETS revenues to support investment in low-carbon innovation. The next sections discuss each of these recommendations.

Ensure a sufficiently high and stable carbon price

For a carbon price to provide an effective and predictable incentive for businesses, it has to be sufficiently high to make low-carbon technologies competitive with carbon-intensive ones, and it should not be too volatile.

Short-term volatility has been a minor issue since the introduction of the MSR. After the European economy came to a halt during COVID-19 lockdowns in 2020, the carbon price dipped a little but quickly rebounded. But some member-states, such as Spain and Poland, have accused financial investors of causing volatility by speculating about future prices. The European Securities and Markets Authority (ESMA) recently indicated that the number of active parties on the carbon market had increased since 2018, but that the share of transactions on the futures market involving financial institutions had remained low and relatively constant. This did not point to speculation being a major issue, ESMA argued. More participants and higher liquidity of the market are more likely to allow energy firms or industry to ‘hedge’ their position, taking out a form of insurance against prices rising faster than anticipated in the future.

Tightening the emissions cap is a good start to give clarity on the long-term trajectory of carbon prices. The carbon price has increased considerably throughout 2021, reaching an all-time high of €90 per tonne of CO2 in December 2021 (see Chart 1). At this price, the cost of electricity produced from solar and wind power is already lower than that of gas- and coal-powered plants. But that may not be enough to decarbonise industry. The problem is that some industrial processes need high heat that cannot easily be produced from electricity: Agora Energiewende, a think-tank, estimates that most low-carbon technologies needed in the steel, chemical and cement sectors will only be economically viable if the price of carbon is higher than €100 per tonne of CO2 in 2030, and up to €400 for some technologies, such as green hydrogen from electrolysis.

Member-states should swiftly approve the Commission’s proposals to lower the ETS emissions cap and speed up the reduction in the number of permits on the market. If the member-states insist on a slower pace, even steeper emissions cuts will be needed in the future to meet the EU’s 2030 and 2050 emissions goals. Delaying reform of the ETS would also create uncertainty about the long-term trajectory of carbon prices, which could discourage investments urgently needed to drive down emissions. The lifetime of installations like steelworks and cement kilns is around 55 years: this means that investment today has to be green. The EU should also impose a gradually increasing price floor in the ETS, which would provide investors with further certainty about where carbon prices are headed, and indicate a benchmark cost of carbon for sectors that currently do not face it.

But as long as heavy industry is shielded from carbon prices, they can do precious little to prompt decarbonisation. The Commission should also accelerate the phase-out of free allowances to heavy industry.

Get rid of free allowances sooner rather than later

Free ETS allowances are granted to heavy industry to prevent job losses associated with ‘carbon leakage’, which happens if polluting businesses move their production from the EU to other countries with no carbon prices, or lower ones, and less stringent environmental regulations. That argument for free permits has some merit: heavy industry is in theory easier to offshore than power generation.

In 2013, heavy industry received 80 per cent of its allowances for free. Since then, the allocation of free allowances has been tied to benchmarks which identify the lowest possible carbon emissions for the production of 54 industrial goods. Installations meeting low-emissions, high-efficiency benchmarks receive more free allowances. High-emissions plants, instead, must buy enough permits on the carbon market. The aim is to push industry as a whole to invest in decarbonisation to get closer to sectoral benchmarks. The Commission proposes to introduce more frequent revisions of sector benchmarks, so free allowances are reduced more rapidly as technological progress accelerates, and to make free allocation to industrial players conditional on the green investments they make.

Benchmarks are an improvement on the prior system, which amounted to no-strings-attached freebies. But giving industry free permits is neither efficient nor just, and it translates into unfair extra profit for certain plants. Between 2008 and 2019, energy-intensive industries reaped an estimated €30 to 50 billion in windfall profits. In some cases, firms received more free allowances than they needed, which they sold at a profit. In other cases, firms passed on their purported carbon costs to consumers, according to their exposure to competition and other features of the market. Charging consumers for the carbon costs of a product, despite receiving the carbon permit for free, is rational for firms as long as consumers still pay for their products, yet it undermines the fairness of the ETS if it goes beyond preserving production at risk of offshoring.

Handouts of allowances are a ‘free lunch’, the size of which depends on the carbon price – thus, increasing carbon prices make free allowances even more valuable. For example, the steel industry estimated that a carbon price of €60 per tonne would require the industry to spend €2.6 billion per year to purchase emissions permits. While this is substantial, steel manufacturers currently have to buy only about 20 per cent of their permits to comply with the emissions cap, given that they receive the rest for free.

Some industrial players argue that higher carbon prices may drive some plants out of business, or force businesses overseas, if their small profit margins are eroded further. This would also mean shedding jobs in Europe. Importantly, costly and urgent investment in decarbonisation may not happen if domestic producers struggle to compete internationally.

In reforming the ETS, the EU has to find the right balance. It needs to ensure carbon prices that are high enough to prompt fast decarbonisation in carbon-intensive industries, and it needs to create a level-playing field between domestic heavy industry and foreign producers who do not face similar costs and regulations.

Create a level-playing field with foreign competitors through a CBAM

To create a level-playing field, the EU has proposed a carbon border adjustment mechanism (CBAM), which will be piloted between 2023 and 2025, and fully implemented as of 2026. That scheme would charge foreign producers of selected ETS goods (cement, iron and steel, aluminium, fertilisers and electricity) a carbon price, derived from the EU’s market price, to export to the EU. This means that both domestic and foreign producers would face the same carbon price when selling to EU customers.

To avoid trade disputes when implementing CBAM, the EU should consult with international trade partners and the WTO. Developing countries are concerned that the financial and bureaucratic costs of CBAM would make exporting to Europe prohibitively expensive for their industry. The CER has suggested solutions to address this concern, particularly using CBAM revenues to support decarbonisation efforts in least developed countries.

At the same time, some industrialised countries are likely to be hostile to the measure. Non-European G20 countries made firmer commitments on climate action in the run-up to the Glasgow COP26 climate conference, but not all are committed to carbon prices. For example, the United States pledged to halve its greenhouse gas emissions by 2030 relative to 2005 levels, and is considering its own version of a CBAM – though it remains unclear how that would be designed given there is no US-wide federal carbon price.

Once CBAM is fully operational, there would be no need to shield European industry from international competitors by giving them free ETS allowances. That is why the Commission proposes to combine CBAM with the gradual phase-out of free emission allowances for heavy industry between 2025 and 2036, when they will be entirely eliminated in CBAM-covered sectors. The 2036 sunset date is not sufficiently ambitious: 2030 would be more appropriate, in line with the goal to curb EU emissions by 55 per cent by 2030 relative to 1990 levels. The EU also needs to strike a balance in how the costs of decarbonisation are shared between households and businesses: delaying the full exposure of heavy industry to carbon prices to 2036 would be politically difficult, given that the introduction of Europe-wide carbon prices in consumer-oriented sectors such as road transport and buildings is proposed to take place in 2026. Once CBAM is implemented, all carbon allowances should be auctioned rather than given out for free, in order to avoid double protection of heavy industry.

Rather than subsidising industry with free allowances, the EU should support it by scaling up its support for green innovation and investment.

Some businesses argue that phasing out free allowances would endanger profits (and jobs). With CBAM in force, and without free allowances, some European exporters fret that they will be forced to charge prices that are higher than world prices, and EU companies will lose competitiveness internationally. One solution could be export subsidies, but these are inefficient too, and would fall foul of WTO rules. Rather than subsidising industry with free allowances, the EU should support it by scaling up its support for green innovation and investment.

Use ETS revenues to support investment in low-carbon innovation

Since its inception, the ETS has worked best at promoting innovations that were close to being profitable rather than encouraging ‘moonshot’ innovations, which require more substantial R&D budgets. For example, carbon prices have helped replace coal power plants with gas and renewables. But it was substantial subsidies for renewable energy that initiated the boom of solar and wind in Europe in the first place. Those subsidised investments brought down the costs of renewable technologies substantially, and made them much more competitive with fossil-based power generation. Carbon prices then did the rest. Learning from this experience, the EU should directly support heavy industry investment in decarbonisation.

Increasing public investment for R&D and for commercial deployment of low-carbon industrial technologies would amount to transferring some of the risks and costs of innovation investment from industry to taxpayers. The rationale for this type of intervention is similar to that of public support for vaccine development: the benefits of those inventions do not all accrue to the innovators but to society more broadly, and as a result, the private sector may not invest enough in innovation without public money.

The EU directly supports investment in industrial decarbonisation with the Innovation Fund, introduced in 2020 and funded through ETS revenues. The Innovation Fund will absorb ETS revenues from the auction of 450 million allowances between 2020 and 2030 (valued at over €40 billion at the current carbon market price). The Fit for 55 package aims to increase this by another 200 million allowances (50 million from the current ETS, and 150 from the proposed new ETS covering buildings and road transport). Demand for innovation funds is high: the first round of proposals bidding for Innovation Fund cash far exceeded the amount of money on offer. While the value of the fund will increase as carbon prices grow, more investment support to speed up the transition of heavy industry is needed. The EU proposal to devote the entirety of the ETS revenues that member-states receive to climate investment goes in the right direction – but more of that should go towards innovation.

The EU proposal to devote the entirety of the ETS revenues that member-states receive to climate investment goes in the right direction – but more of that should go towards innovation.

Most green technologies for heavy industry are not financially viable at the current carbon price and will be more expensive than their ‘brown’ counterparts for some time. In order to speed up their market deployment, comparable to the successes in renewable power generation, the Commission wants to use the Innovation Fund to finance 'carbon contracts for difference' (CCfDs).

CCfDs give innovators a guaranteed carbon price to work with. Industrial firms will only invest in a new green production method if they expect carbon prices to be sufficiently high to make it viable. This is where public institutions should provide a guaranteed future carbon price through CCfDs. If the market price is below that fixed price when the contract expires, the firm receives the difference. This contract reduces the risks that industry faces when investing in emerging, costly decarbonisation technology. As CCfDs are potentially expensive for governments, not all may be ready to bear the fiscal risk. Hence it is a good idea for the EU to fund these contracts via the Innovation Fund, and for an EU-wide institution to be the counterpart of investors in such contracts, particularly as CCfDs would finance industrial innovation of common interest to all member-states.

All these proposed changes to the ETS and to the use of its revenues are necessary to ensure that, from now on, carbon prices push industry to build or upgrade plants only if they are compatible with net-zero emissions. Carbon-intensive plants would lead to unsustainably high emissions, and risk quickly becoming liabilities, taking a toll on the competitiveness of EU business. Heavy industry must urgently move away from business-as-usual.

Elisabetta Cornago is a senior research fellow at the Centre for European Reform.

This paper is published in partnership with the Open Society European Policy Institute.

Add new comment