Press

Schengen's 'black swan' moment?

19 December 2011

E!Sharp

Europe's leaders are - understandably - focused on the euro crisis, pretty much to the exclusion of all else. But policy-makers should beware another calamity in 2012: a possible breakdown of the EU's Schengen zone of passport-free travel. Undoubtedly, these two troubled flagships of European integration share parallels. For a...

What have the Eurocrats ever done for us?

18 December 2011

The Sunday Times

Simon Tilford, chief economist at the CER, a broadly pro-Europe think-tank, said: "In areas where the EU has no role, Britain is a highly regulated place. We cannot blame that on the EU." He cites Britain’s poor infrastructure, for example, as a more serious obstacle to growth.

Why Ireland should ratify any eurozone treaty early

18 December 2011

The Sunday Business Post

EU officials are putting the final touches to the first draft of a 'fiscal stability' treaty to be ratified by eurozone countries by the end of 2012. The treaty - which commits each euro government to run balanced budgets in perpetuity - will be one of the oddest ever signed...

Britain and France: Seasonal greetings

16 December 2011

The Guardian

As Simon Tilford of the CER argues, the fiscal compact agreed in Brussels and about which a draft version circulated yesterday hard-wires pro-cyclical, fiscal austerity into the institutional framework of the eurozone.

EU foreign policy must not become a casualty of the euro crisis

16 December 2011

EU Observer

Dear EU leaders,

We are seriously concerned about the impact that the current eurozone debt crisis is having on the external relations of the Union.

The first casualty is the time available for foreign policy. We recognise and support your efforts to overcome the current crisis but it is...

We are seriously concerned about the impact that the current eurozone debt crisis is having on the external relations of the Union.

The first casualty is the time available for foreign policy. We recognise and support your efforts to overcome the current crisis but it is...

Das Eigentor

16 December 2011

Die Zeit

Auch Simon Tilford, glaubt, dass Cameron die City unnötigerweise isoliert hat. »Gerade weil London von der Transaktionssteuer mehr betroffen gewesen wäre als alle anderen Finanzplätze, ist es unwahrscheinlich, dass Deutschland und Frankreich sie jemals durchgesetzt hätten«, sagt er.

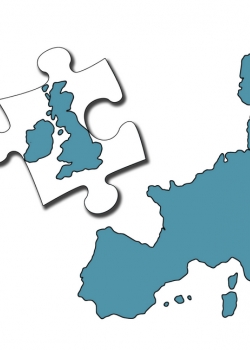

Who wins from David Cameron's veto - Britain or the EU?

14 December 2011

Public Service Europe

Director of foreign policy and defence at the CER Tomas Valasek points out that "Britain has become toxic by association" in Europe, meaning that "ideas which it sponsors will be resisted on principle, not on merit ... The UK veto played into Sarkozy's hands and cemented the dominant role of Germany and France in the new fiscal union, to the alarm of the central Europeans. Britain's actions have also shifted power in the EU from small to big states. The inner core will continue to shrink.

UK-EU bustup: the price for CEE

14 December 2011

The Economist

Tomas Valasek of the Centre for European Reform has written an excellent and gloomy analysis of the wider damage caused by David Cameron's botched negotiations. One point is that Britain's likely absence from European economic decision-making will tilt the balance towards French etatism. Another is that small countries will be eezed by big ones when decisions are made on an intergovernmental basis, rather than through EU institutions. Many from the EU-10 think that they are not welcome (at least from a French point of view) in the real core of Europe.

Ireland warns of damage from British EU opt-out

14 December 2011

Reuters

"Diplomatically speaking, we're in a much poorer position because Britain is not in the room," said Hugo Brady, of the CER. "They were quite willing and quite happy to be the difficult partner so you could hide behind them in diplomatic negotiations ...

Eurozone debate divides government

14 December 2011

The Prague Post

"My view is a little bit more cynical," said Philip Whyte, a senior fellow at the CER. "What does the deal really mean? It means tighter policy coordination and the application of fiscal rules throughout the eurozone.

David Cameron has left the City more, not less, vulnerable to EU law

14 December 2011

The Guardian

There are many puzzles about the British government's tactics at last week's EU summit. One is why it chose to identify the City of London as the "vital national interest" that needed special protection. The City, after all, is the most unpopular "national champion" that the UK possesses. It accounts...

La place du Royaume-Uni en Europe est fragilisée

13 December 2011

La Croix

"La Suède, la Pologne, le Danemark ou encore les Pays-Bas se sentent trahis", explique Charles Grant, directeur du Centre for European Reform.

Europe gets austerity, but with few signs of growth

13 December 2011

NPR

"Fiscal austerity in the eurozone has now become part of the crisis rather than a solution to it," says economist Simon Tilford. The debt burden of troubled eurozone countries is growing faster than their economies. "So this is the absolute worst of all worlds: fiscal austerity, contracting economies and a dramatic increase in the burden of the debt relative to the size of the economy ...

La City s'inquiète après le veto de Cameron

13 December 2011

Le Figaro

"Cette position va considérablement compliquer la tâche du gouvernement, estime Simon Tilford, économiste au CER. Ayant perdu la confiance de ses partenaires européens, Londres va avoir plus de mal à résister à toute législation menaçant la City."

West meets east

13 December 2011

Financial Times

Charles Grant of the CER, suggests that France and Germany may decide to pursue deeper fiscal integration in the eurozone via a new treaty that would include current members and aspiring "pre-ins". "Although Europe is facing this new division between the euro countries and the non-euro countries, which is important, a large number of the central European countries should be on the integration side of that division ... But those countries will have to accept the Germanic view of the world in terms of fiscal discipline and austerity."...

Investors brace for bank verdict on EU plan

12 December 2011

The Wall Street Journal

"Britain is as isolated as it's ever been in the 25 years I've been following the EU," said Charles Grant, director of the pro-EU CER. "If I had to put money on it now, I think Britain will leave the EU in the next 10 years."

Briten hadern mit der neuen isolation in Europa

12 December 2011

Frankfurter Allgemeine

"Cameron hat mit Kanonen auf Spatzen geschossen. Er hat die anderen verärgert, ohne für Großbritannien etwas zu gewinnen", urteilt Simon Tilford, Chefökonom des CER in der britischen Hauptstadt. ...

Follia,in cinque anni via dell'Ue

12 December 2011

Il Mattino

Londra. "Foolish". Assurda, dissennata, imprudente. La decisione presa da David Cameron preoccupa Simon Tilford, capo economista della prestigiosa think tank britannica Centre for european reform. La mossa del premier è incomprensibile, sostiene Tilford, e danneggerà la Gran Bretagna ma, in parte, anche la Ue.

Semi-detached island nation faces EU isolation

12 December 2011

Reuters

"He's thrown some meat to the eurosceptics who like to see the British PM wielding the veto. (But) it is going to make it harder to defend British interests," said Simon Tilford of the CER. "Cameron has played a bad hand poorly.

Angela Merkel and the euro crisis: Women in leadership

12 December 2011

Newsweek

Katinka Barysch of the CER says "Now that the government talks about new treaties and institutions, it looks more in charge. Politically, the strategy is working: almost two thirds of Germans now approve of Merkel's management of the euro crisis."