How to make the new emissions trading system work for consumers

Extending the Emissions Trading System to buildings and road transport can cut emissions and help poor households if all revenues are devoted to income support and green investment.

In the EU, not all CO2 emissions are considered equal: heavy industry and electricity producers face an EU-wide carbon price under the EU Emissions Trading system (EU ETS), but road transport and the heating of buildings do not. All EU member-states tax fuel, but levies vary. And some member-states have their own national carbon taxes.

This is about to change. The EU’s ‘Fit for 55’ programme – a set of policies to cut carbon emissions by 55 per cent by 2030 relative to 1990 levels – includes a proposal to create a new system to cap and trade carbon emissions from two major laggard sectors, road transport and buildings, which account for about 25 per cent and 15 per cent of EU-wide greenhouse gas emissions respectively. (I have previously written about the proposed reform of the existing ETS here.)

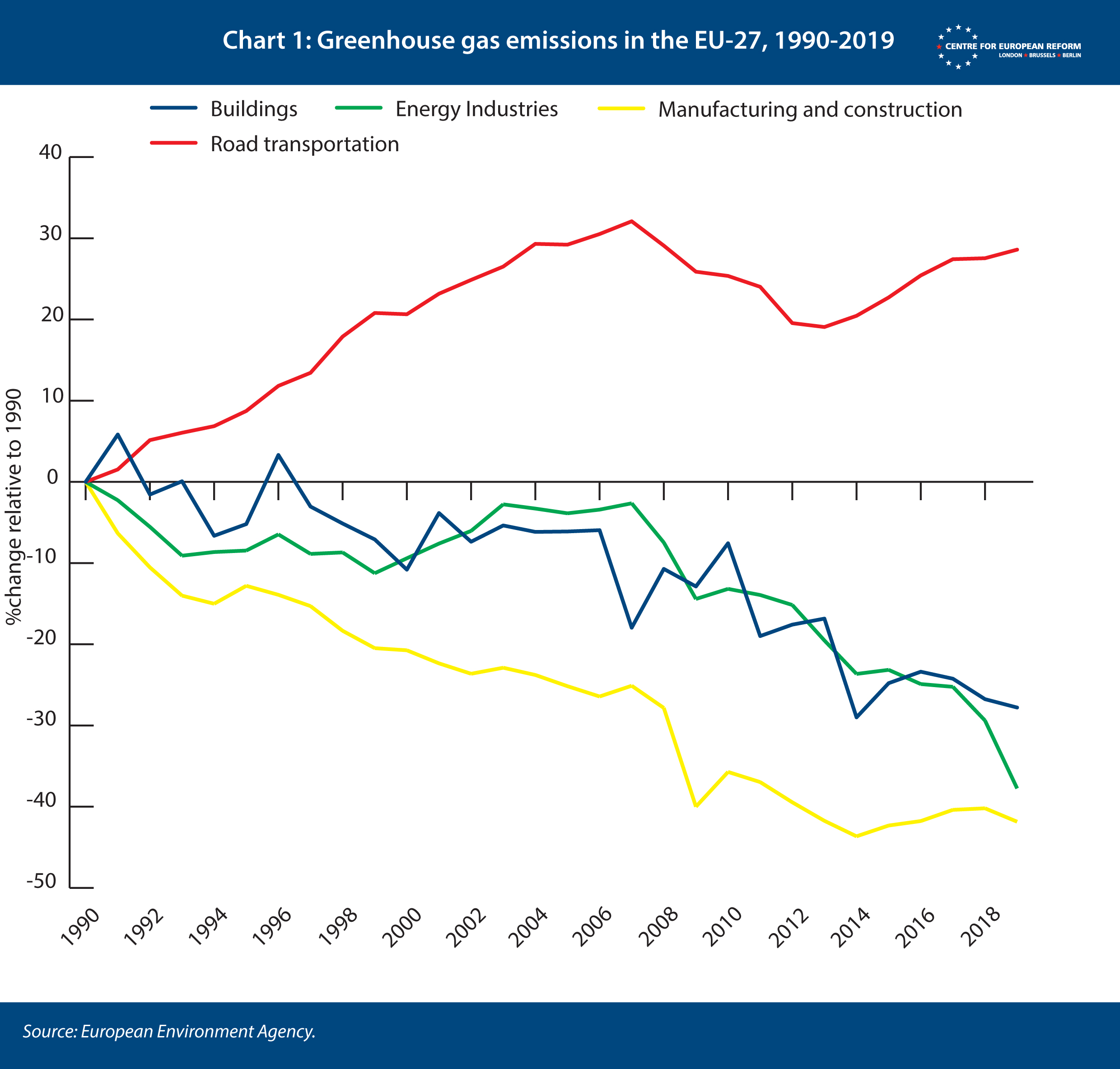

Manufacturing and energy industries, currently covered by the EU ETS, have cut greenhouse gas emissions since 1990 by about 40 per cent, while decarbonisation in the commercial and residential building sector has not been as fast, with emissions reductions below 30 per cent. However, road transport has increased emissions by almost 30 per cent (see Chart 1). The new ETS aims to reverse that trend in transport and accelerate decarbonisation in buildings, cutting combined emissions from these sectors by 45 per cent by 2030 relative to 2005 levels.

How carbon pricing in road transport and buildings will work

Under the Commission’s proposals, in 2026 the EU’s new ETS (let us call it ‘ETS2’) would cap emissions from road transport and heating and gradually tighten the cap year by year. Intermediaries such as companies selling fuel for cars and heating (as opposed to final consumers such as households and businesses) would be required to show compliance with regulation by surrendering pollution permits.

In the existing ETS, heavy industry receives a number of emissions permits for free, on the grounds that its international competitiveness might be damaged by carbon leakage. Conversely, in ETS2 there will be no freebies: all permits would be auctioned. This is because there is no reason to think that households would leave the EU due to carbon pricing.

The behavioural impacts of carbon pricing

Under the new system, fuel retailers will largely pass the carbon price onto their customers, so final consumers will face higher prices for fossil fuels for transport and heating. But, while commercial consumers like shopkeepers might be able to pass on higher energy costs at least partly by raising their own prices, households will not be able to do that. Further, richer, urban households will cope better than poorer, rural ones, because they have more money to cope with higher energy costs or are better able to adjust their behaviour.

Both transport and heating are essential needs, but different people meet those needs in different ways. Some cycle and have a heat pump, others drive a car to work and still burn oil at home. How households respond to an energy price increase will thus differ. In cities there are plenty of options to move around – walking and cycling, public transport, private cars or scooters. If the price of motor fuel increased due to carbon pricing, city dwellers could quickly adjust their behaviour by shifting to other means of transportation. Sparsely populated areas, on the other hand, often have fewer transport alternatives. Driving a private car is much more convenient in some rural and suburban areas, so households there are more vulnerable to fuel price increases than their urban counterparts.

For these reasons, fuel demand weakly responds to price increases (or, as economists say, is inelastic): as the price of gasoline at the pump goes up by 1 per cent, gasoline demand drops less than proportionally, by only about 0.3 per cent in the short term (immediate response, up to one year after the price increase) and by 0.8 per cent in the long term (beyond one year after). Demand for heating fuels is even less responsive: when natural gas prices increase by 1 per cent, gas demand drops only by an estimated 0.2 per cent in the short run and 0.7 per cent in the long run. Households could respond to price increases by lowering their thermostat or limiting heating time. But without support to help consumers cope with higher prices, carbon pricing could cause a political backlash against decision-makers and possibly climate action more broadly.

Governments are subsidising insulation & electric cars, but in the short-term, vulnerable energy consumers will feel the pain.

The main aim of carbon pricing is to reduce emissions – but the way in which these emissions cuts are achieved matters politically. In road transport, higher fuel prices should encourage drivers to opt for electric vehicles and bikes instead of cars with combustion engines. Infrastructural changes are also necessary to make behaviour change feasible: in urban areas, more public transport and bike lanes could reduce dependence on private vehicles; in rural areas, if viability of public transport is a challenge, charging infrastructure for electric vehicles will be critical. In the buildings sector, carbon pricing aims to encourage investment in energy efficiency, including better insulation and a shift from fossil fuels to more efficient electric heating.

Governments are subsidising insulation and electric cars, but transformative renovations in buildings and new transport infrastructure take time, meaning that in the short term, vulnerable energy consumers will feel the pain.

The distributional impacts of carbon pricing

Carbon prices have a larger impact on lower-income households, on households living in energy-inefficient buildings with carbon-intensive heating systems and on users depending on fossil-fuelled vehicles. These categories can overlap, but need not necessarily – a lower-income household living in a small apartment in an urban setting may be less affected than a middle-income household living in an old house in a rural area.

Carbon prices have a larger impact on lower-income households, on households living in energy-inefficient buildings with carbon-intensive heating systems and on users depending on fossil-fuelled vehicles.

The most commonly used types of heating fuel vary across the EU – as does their carbon intensity. In Poland, for example, coal provides over 40 per cent of residential space heating; oil and petroleum products are the main energy source for space heating in Ireland, Greece and Cyprus; and natural gas is the main space heating source for another 8 member-states, including Germany, France and Italy.

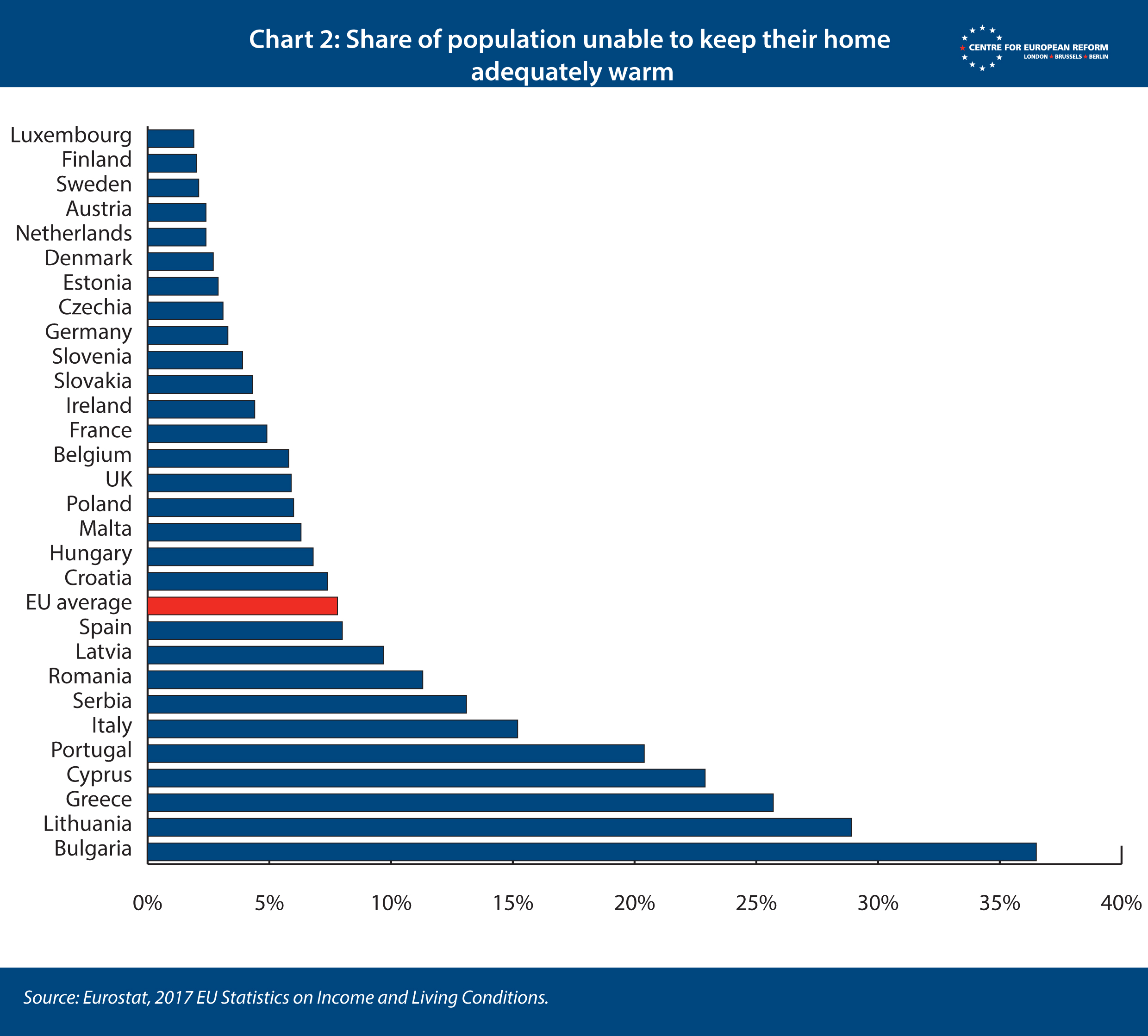

Energy poverty affected 31 million Europeans in 2019, and this will have increased recently because of the unprecedented spikes in gas prices. While on average, 7.8 per cent of the EU population was not able to adequately heat their home in 2017, the share in poorer countries was higher (Chart 2). Energy poverty also varies across urban and rural areas, and in 11 EU countries, including France, Hungary and Romania, the difficulty in keeping homes warm was higher in sparsely populated areas than in densely populated ones.

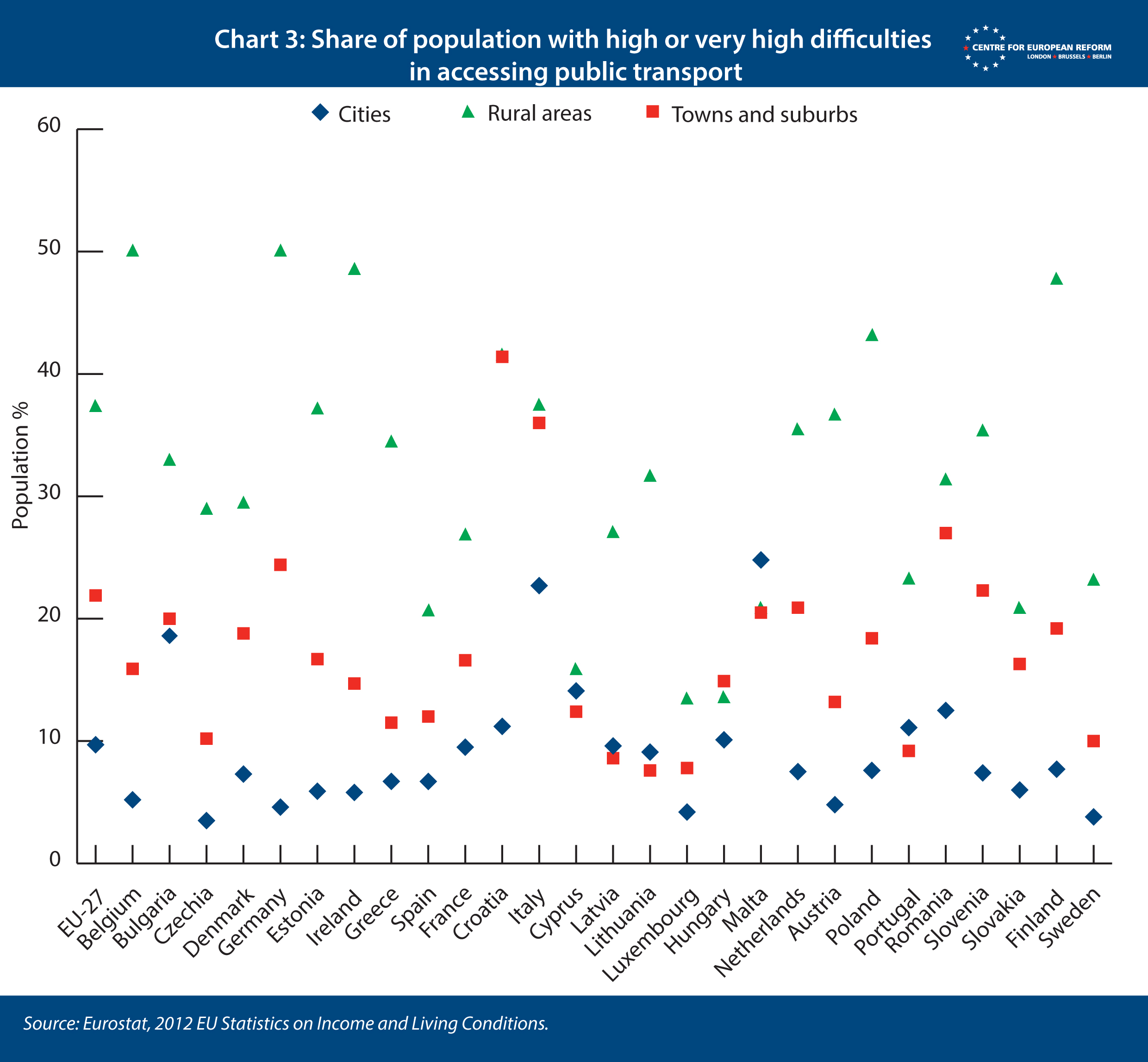

Transport poverty is also a multifaceted problem, with some people unable to afford any transport (owning a car or paying public transport fees), while others living in remote areas or peripheral urban neighbourhoods have no access to public transport services. About 40 per cent of the EU population in rural areas has difficulties accessing public transport. Only 20 per cent of those living in towns or suburbs and 10 per cent of those living in cities encounter the same problem (Chart 3).

Mitigating the distributional impacts of carbon pricing

An EU-wide carbon price created by ETS2 would have different impacts across the Union because of differences in per capita income levels, dependence on private vehicles and the carbon intensity of heating. On its own, carbon pricing on road transport and building heating would be regressive, meaning that it would hit the poorest worst. But if the EU makes good use of the revenues raised by pricing carbon emissions, it could turn ETS2 into a progressive policy, benefitting more vulnerable households and businesses.

If the EU makes good use of the revenues raised by pricing carbon emissions, it could turn the new ETS on road transport and heating into a progressive policy, benefitting more vulnerable households and businesses.

There are several ways to redistribute carbon pricing revenues. Switzerland, for example, gives two-thirds of its carbon tax revenues back to households and businesses, while the remaining third is earmarked for green investment. After introducing carbon pricing, Sweden lowered the level of income taxes and social security contributions.

The Commission’s proposal for ETS2 wants to earmark part of the ETS2 revenues for a Social Climate Fund (SCF), which would be used to finance temporary income support measures (like cash transfers to households, or vouchers for energy bills). It would also provide investment subsidies for households and businesses to adopt green transport and heating technologies, such as building renovations, heat pumps and low-carbon transport. The Fund would target specific social groups, as opposed to the entire EU population: consumers, transport users and micro-enterprises at risk of transport and energy poverty.

The fund would start operating in 2025, one year before the proposed entry into force of the ETS2, financed by anticipating the auctions of emissions permits. To access funds, member-states would need to prepare social climate plans, which the Commission would assess and approve. Plans would need to detail the specific measures and investments they aim to finance, as well as milestones and targets for implementation by 2032. The plans would also need to provide regional estimates of the effects of ETS2 on households and micro-enterprises.

The SCF would receive 25 per cent of revenues from the new ETS over its 2025-2032 budget cycle, for an estimated €72 billion. Under the proposal, member-states are required to match that amount, contributing at least half of the estimated costs of their social climate plans, including by auctioning allowances under the new cap-and-trade scheme: this would bring the fund to an estimated €144 billion. Under the SCF, transfers would be paid out to countries according to a set of criteria such as income per capita; the share of the population at risk of poverty, with particular attention to rural areas; the carbon intensity of households’ heating options; and energy poverty indicators such as the share of the population with arrears on utility bills.

The EU’s proposal is a good start, but does not go far enough in compensating vulnerable households and businesses.

1. All ETS2 revenues should be devoted to the Social Climate Fund.

Under the European Commission’s proposal, the SCF would be given 25 per cent of ETS2 auction revenues, while the remaining 75 per cent would go to member-states who would be obliged to finance climate and energy projects with the money. However, this does not ensure that funds go to vulnerable energy consumers. All ETS2 revenues, and not only 25 per cent, should be devoted to the Social Climate Fund. This would bring the SCF to an estimated €288 billion over 2025-2032, or €36 billion per year – though this would vary according to the carbon price. Member-states should contribute to the SCF to cover part of the costs of their social climate plans via their general budget, but poorer member-states should contribute less than 50 per cent of the total costs, and richer ones more (as opposed to the Commission’s proposal that all countries pay 50 per cent).

All ETS2 revenues, not only 25 per cent, should be devoted to the Social Climate Fund. This would bring the Fund to an estimated €36bn per year.

If carbon prices reached €80 per tonne in 2030, estimated EU-wide carbon costs for households could amount to €633 billion between 2025 and 2040, or about €40 billion per year. A larger SCF would provide income support to more households, and it would help more energy consumers reduce their dependence on fossil fuels. For example, €275 billion per year is needed in additional building renovation investment to meet EU 2030 climate goals: the SCF would ensure that poorer households get help insulating their homes.

2. The Social Climate Fund should start sooner.

It is crucial that investment support via the SCF is frontloaded, so that it starts providing subsidies for green transport and heating to poorer households well before the ETS2 starts to bite. The current Commission proposal aims for the Fund to go live in 2025, but the quick launch of the Recovery and Resilience Facility tells us that the EU can be speedier than that: the SCF should start operating in 2024. That would give poorer Europeans two years to invest in reducing fossil fuel consumption before ETS2 starts. And the SCF should continue beyond 2032, the date the Commission proposes it should end, to help households and businesses decarbonise to 2050.

The quick launch of the recovery fund tells us the EU can be speedy: the Social Climate Fund should start in 2024, not 2025.

3. The EU should clearly communicate that all revenues from ETS2 are devoted to supporting citizens and businesses in the green energy transition.

The Social Climate Fund’s aims are good, but it is important that people know that it is there to help them. Making SCF transfers visible is fundamental, as is ensuring that consumers understand their connection to the ETS2 and to carbon prices. Without clarity on this link, popular support for carbon pricing may falter.

Transfers could be either unconditional or specifically aimed at relieving pressure on energy and fuel expenditures, such as energy vouchers. However, vouchers specifically tied to fuel expenses for driving or heating may dampen the incentive to reduce such fuel consumption. Making SCF transfers unconditional would be better, so that vulnerable households are free to spend them as they wish.

4. The new ETS should be designed to avoid excessive carbon price fluctuations.

Cap and trade systems target a specific level of emissions, but that means that prices for emissions permits can fluctuate. The ETS2 proposal includes the idea of a ‘market stability mechanism’ to stabilise the price, just as it was introduced in the original ETS. It is a good way to prevent short-lived carbon price spikes, but it is not suitable for large price fluctuations. If such fluctuations were to happen, final consumers would feel the burden: unlike businesses exposed to the existing ETS, households cannot hedge their exposure to carbon prices.

Instead of the market stability mechanism, the EU should introduce a price corridor, to give households some certainty on the band within which carbon prices will be in the future. Concretely, it would amount to establishing a floor and a ceiling for the carbon price: if the market price stepped outside this corridor, the market stability mechanism would intervene. This resembles the German emissions trading system for road transport and buildings: when the system started in 2021, German ETS permits were sold at set prices of €25 per tonne of carbon. The set price will increase to €55/tonne by 2025, and in 2026 emission permits will be auctioned within a price corridor of €55 to €65/tonne.

5. All policies concerning road transport and buildings should be aligned with climate targets: carbon pricing is a piece of the puzzle.

Largely unpriced carbon emissions are not the only market failure preventing decarbonisation in road transport and buildings. While energy taxes vary widely across EU member-states and between fuels, in most member-states existing energy taxes favour fossil fuels such as natural gas instead of electricity: tax levels inconsistent with climate goals blur the price signals that consumers see in their bills and at the pump, ultimately discouraging efficiency investment.

The EU should ensure that both new carbon prices and existing energy taxes on heating and transport fuels encourage decarbonisation. Energy taxes are set at national level, but the EU is reviewing its energy taxation directive and should use that opportunity to increase minimum tax levels and ensure that they are set according to carbon content.

Finally, market-based policy instruments such as carbon prices and energy taxes are only one part of the many policy measures needed for decarbonisation of road transport and buildings. Regulations such as vehicle emissions standards and energy efficiency building standards are also needed. Just as vehicle emissions standards will mandate an end to internal combustion engines in 2035, there should be a sunset date for fossil-fuel heating of buildings.

Elisabetta Cornago is a senior research fellow at the Centre for European Reform.

This paper is published in partnership with the Open Society European Policy Institute.

Add new comment