The cost of Brexit to December 2018: Towards relative decline?

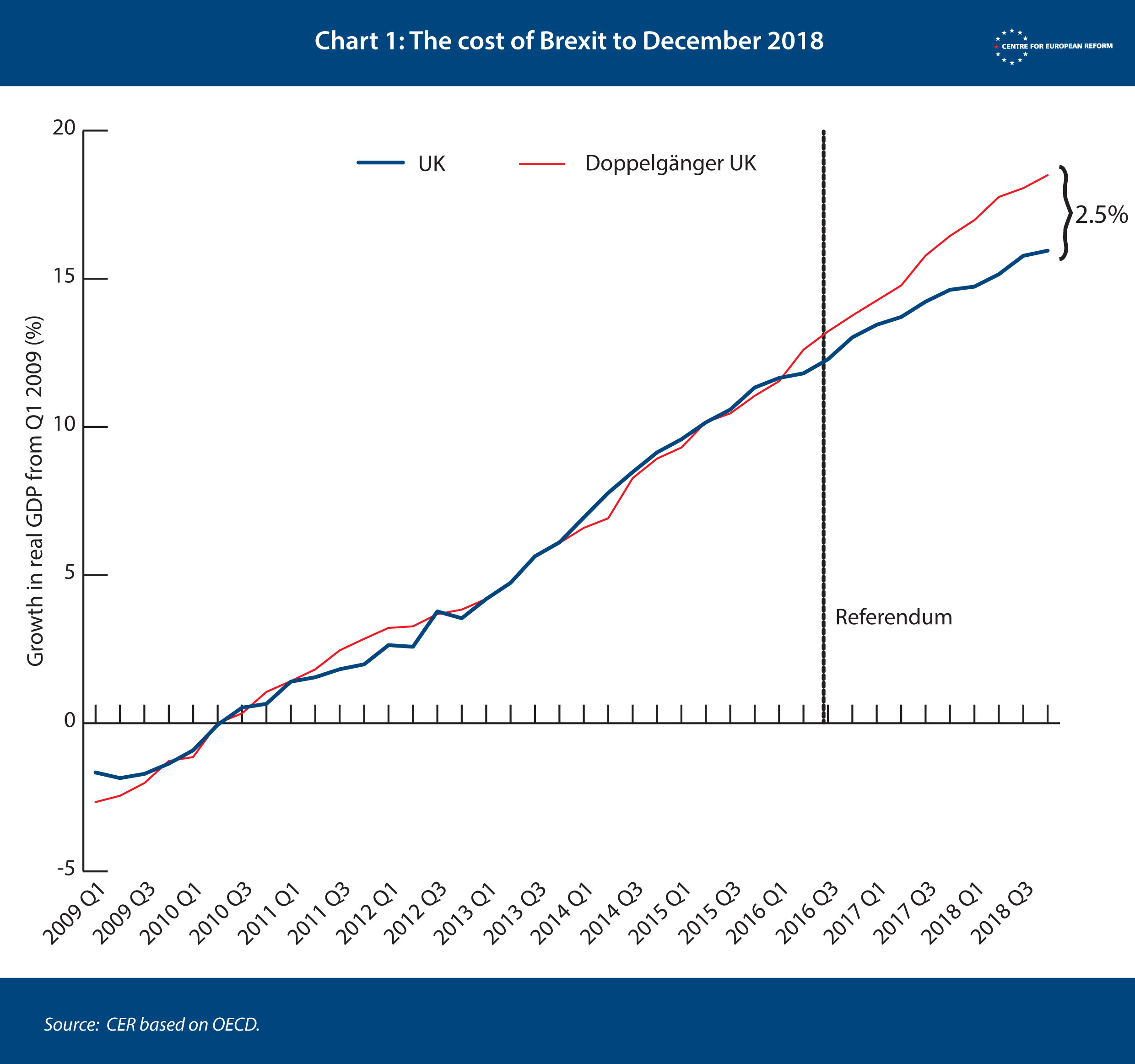

The UK economy is 2.5 per cent smaller than it would be if Britain had voted to remain in the European Union. The knock-on hit to the public finances is £19 billion – or £145 million a week. The latest update of the Centre for European Reform’s cost of Brexit calculation, which covers the period from the referendum to the fourth quarter of 2018 shows a slight increase compared to our third quarter estimate, which put the cost at 2.3 per cent.

The cost of Brexit to date is borne of uncertainty about the future relationship between Britain and the EU, and reflects the gridlock in Westminster which has led to a delay in the planned March 29th departure date. Britain’s decision to leave the EU has damaged growth, largely thanks to higher inflation and lower business investment. The UK missed out on a broad-based upturn in growth among advanced economies in 2017 and early 2018. And the economic cost of the decision so far is sizeable. In this note, I will briefly outline the latest results, and then propose some political lessons that we should learn from Britain’s economic experience since the referendum.

The fiscal cost of Brexit is £19 billion a year, a little less than the annual government spending on transport in England.

Our estimate has grown slightly because UK growth underperformed that of our ‘doppelgänger UK’ –a group of countries whose economic characteristics match Britain’s (principally the US, Germany, and Luxembourg). As these countries did not hold a referendum in 2016, we can compare them to the UK to assess the cost of Brexit. The countries in the doppelgänger were selected by a computer program based upon the similarity of their economies to Britain’s. The data the program used to make its selection includes quarterly real GDP and other economic indicators, such as inflation and the size of different economic sectors, starting in the first quarter of 2009. Once the doppelgänger has been selected, we can chart how it compares to the real UK, both before and after the referendum. (More information about the method we use is available here.)

Chart 1 shows that the doppelgänger closely matched the economic growth of Britain until the referendum vote, but then the two series diverged. The cost of Brexit is the difference between the doppelgänger’s growth and the UK’s actual growth data. Our latest estimate shows that the economy is 2.5 per cent smaller than it would have been if Remain had won. The Treasury estimates that 1 per cent of foregone GDP results in £7.6 billion of extra borrowing annually – so the cost to the public finances is £19 billion. That is a little less than 1 per cent of GDP, and is also a little less than the government spends on transport in England each year.

What political lessons should we draw from this analysis?

First, listen to experts. While the pre-referendum Treasury forecast got the immediate impact of Brexit wrong, independent forecasters got it about right. Brexiters have been wrong about nearly all aspects of Brexit – from their prediction that the EU would give Britain a good deal because German business lobbies would demand one, to their argument that new trade deals with countries outside Europe would be swiftly negotiated. Sensible MPs and the public should duly ignore their claim that leaving the EU without a deal wouldn’t result in enormous disruption.

Second, Brexit uncertainty has been bad for the economy. This seems like a truism, but in the immediate aftermath of the referendum, growth continued at a decent clip as consumers ran down their savings. Now, consumption has slowed. Foreign direct investment into the UK has slumped, and corporate investment fell for four consecutive quarters from January 2018. People are delaying major spending decisions until the outcome of Brexit is clearer. Uncertainty will continue to weigh on the economy, but a softer Brexit, with Britain remaining in the customs union, and preferably the single market – or a decision to remain in the EU altogether – would mean that some of that investment would come back, raising growth.

Third, Brexit puts a speed limit on the economy, and slow-growing economies tend to be more politically fractious. The UK missed out on the global mini-boom in 2017 and 2018, with nearly all advanced economies bar Britain experiencing faster growth than they had previously. Brexit will curb growth in the future, because trade and investment with the EU will fall. Increasingly prosperous societies tend to be more peaceful ones: political polarisation and support for hard right politics rises after financial crises. Low growth leads to more antagonistic politics, as the rich, poor, young and old fight for shares of a slowly-growing pie. An ageing society needs more spending on health and social care, and weak growth makes dilemmas over public expenditure more acute. Workers have to pay a larger share of their incomes in tax to help care for the elderly. The rich resist attempts to make them pay more, and find it easier to avoid tax than the poor. Immigrants get blamed for congested infrastructure and large class sizes. The young get angry at attempts to make them pay higher fees for their university education.

Britain risks a similar fate to Italy: a comparatively prosperous country in the 1980s, but one that suffered relative economic decline as political gridlock rendered it unreformable.

Fourth, Brexit is a distraction from pressing issues. Under normal circumstances, the dire economic record of Theresa May’s government would be a much bigger public issue. Britain is home to some of the poorer regions in Western Europe. It is less productive than its peers in Northern Europe, and that gap has been growing. But Brexit has consumed all of the political oxygen, and a hung parliament and a distracted government and press have made it impossible to make major policy changes to confront poor economic performance. If the UK decides to go ahead with Brexit, it will continue to neglect the most important duties of a state – to make citizens more secure and more prosperous. The negotiations over a trade deal with the EU are scheduled to conclude in December 2020, but they will almost certainly take longer, because the deadline is only 21 months away. Whoever is prime minister will have to spend most of their political capital on seeing the negotiations through, leaving less time for other policy initiatives. Britain risks a similar fate to Italy: one of the most prosperous countries in Europe in the 1980s, but one that suffered relative economic decline, as political gridlock rendered it unreformable.

In sum, Brexit has not been an economic success so far. There is no hope that it will be in the future. The divisions that Brexit has unleashed may make the UK poorer still. Over-reach by the European Research Group (a group of hardline, eurosceptic Conservative MPs) which has refused to accept May’s withdrawal agreement until very late in the day, alongside signs that the British public is regretting Brexit, represent an opportunity to reverse course. Although revoking Article 50 would be best for the economy, it is neither feasible nor politically desirable in the current circumstances. Those MPs who still care about national prosperity should seize that opportunity by steering Britain towards a softer Brexit, or holding a referendum and campaigning for Remain.

John Springford is deputy director of the Centre for European Reform.

Comments

Add new comment