Why the EU's recovery fund should be permanent

- In the paper that follows, we provide a comprehensive assessment of the €720 billion Recovery and Resilience Facility (RRF) – also known as the EU’s recovery fund. We assess its macroeconomic effects, how important it could be for the EU’s climate ambitions, and its effects on growth. Our assessment is broadly positive.

- The recovery fund is neither the macroeconomic damp squib of its critics, nor the Hamiltonian moment of its champions. The big net recipients from the fund – Italy, Poland, Spain, Romania and other Southern and Central European countries – will receive transfers of between 0.6 and 1.9 per cent of GDP per year to 2026. These grants could bring Southern Europe’s public investment rates closer to those seen in the 2000s, if they are used for additional spending (and not to replace existing spending plans). As long as the spending is additional, it will appreciably raise growth rates – an impact that will peak in 2023 and 2024.

- The fund is not large enough to be a climate game-changer, however. Total spending on climate under the fund will be €45 billion a year, while according to the EU and member-states’ own estimates, public investment will have to reach approximately €460 billion a year across the EU to meet 2030 emissions targets. The French government has estimated that its France Relance plan will only reduce emissions by 1 per cent by 2030.

- Member-states have made many sensible reform proposals to improve Europe’s fraying social cohesion. These include measures to reduce the large number of young people and women on temporary contracts in some countries. Many member-states are investing in childcare capacity, which will raise employment rates, household income and tax revenues. However, the recovery fund may only be spent on one-off investments, so member-states will also need to raise current spending, funded through taxation. More nursery places will require the states to fund more childcare workers’ salaries, for example.

- Member-states’ plans for the other big spending line – ‘digitising’ the economy and state – contain some sensible proposals, especially to improve citizens’ access to public services and grants for early-stage ventures and research in digital technology. But some projects, such as cloud computing, and chip design and manufacturing, are already dominated by Asian and American companies, and the EU’s chances of creating successful rivals are slim.

- Conditionality under the fund is likely to be far more effective than under the EU budget. Unlike the EU budget – the Multiannual Financial Framework (MFF) – the recovery fund has a continuous system of conditionality, with tranches of money being disbursed after reform and investment milestones have been met.

- The recovery fund should be made permanent, and after the current fund ends in 2026, larger. To meet climate targets, EU governments, businesses and households will need to invest more than €1 trillion annually throughout the 2020s, and the recovery fund provides cheaper funding than many governments achieve when borrowing on their own account. Joint borrowing and transfers between member-states are justified because climate change is a cross-border issue. To make an appreciable difference to the fight against climate change, the RRF should provide at least €230 billion of the €460 billion public investment needed annually, to ensure that Europeans collectively bear a chunk of the costs of climate action; climate action is achieved with the lowest possible borrowing costs; richer member-states pay more; and national parliaments and taxpayers have ‘skin in the game’.

- A larger recovery fund would have more sizeable macroeconomic benefits. The structural forces reducing interest rates, inflation and growth have not gone away. Higher public investment is a key tool to raise spending across the economy.

- We also recommend that the recovery fund’s superior form of conditionality is extended to the MFF, and applied to regional development spending and farm subsidies. Waste and cronyism, particularly but not only in Hungary, Bulgaria and Romania, would be curbed by stronger oversight by the EU’s institutions. Some farm payments undermine the EU’s climate goals by subsidising a high-emissions sector, and national governments retain too much power over who receives subsidies.

- The second half of the policy brief consists of country reports on the recovery plans of the eight largest recipients of recovery fund spending: France, Germany, Greece, Italy, Poland, Portugal, Romania and Spain. Click on these countries in the map below for some key facts and figures, and for links to the country reports.

The EU’s new recovery fund – formally the Recovery and Resilience Facility (RRF) – started disbursing money to member-states in the summer of 2021. The €723.8 billion fund will be spent by the end of 2026, and amounts to 0.8 per cent of EU GDP on an annual basis. For the first time, the EU will be borrowing collectively to fund investment across the EU. The fund will also involve transfers of resources from richer member-states to poorer.

Sceptical commentators have suggested that the recovery fund will not make an appreciable difference to growth.1 The fund’s champions have dubbed it a ‘Hamiltonian moment’, after the American Founding Father’s successful campaign to federalise US states’ debts from the War of Independence.2 The truth lies somewhere in between.

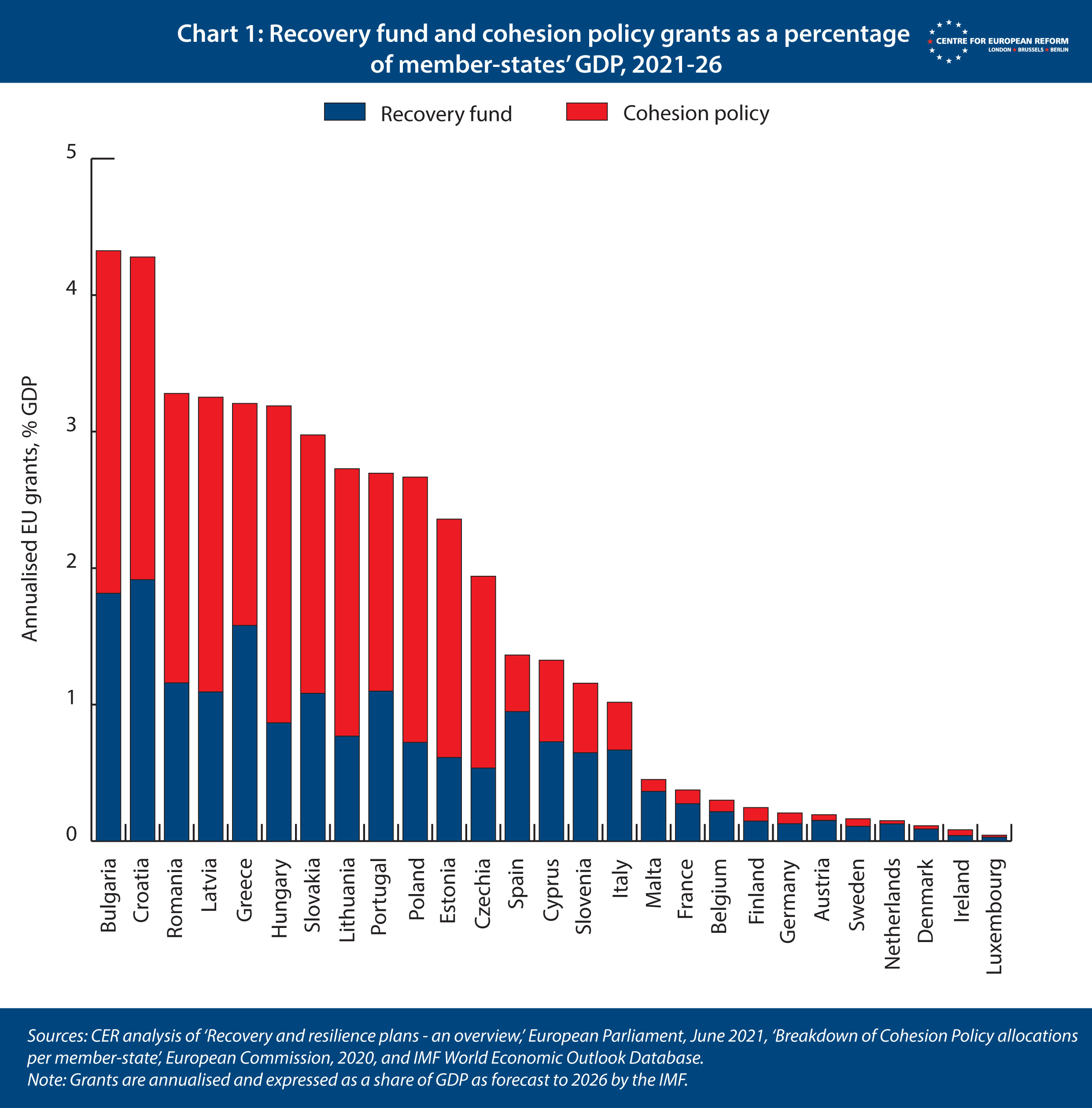

The heavy skew of grants and loans towards member-states in the east and south – means the fund could raise growth significantly in the parts of the Union that need it most. Less developed economies in Central and Eastern Europe will receive between 0.5 and 1.7 per cent of GDP per year in grants between 2021 and 2026 – which could speed the modernisation of their energy and transport infrastructure. Czechia and Estonia will only receive 0.5-0.6 per cent of GDP because the formula for determining grants disfavours them: their unemployment rates have been low for five years, and their GDP per capita is higher than their peers in Central and Eastern Europe. Bulgaria, Croatia and Romania have higher unemployment and are poorer, so will receive more than 1 per cent.

Eurozone members in Southern Europe, still struggling with higher unemployment and higher debt levels as a result of the euro crisis and the pandemic, will receive between 0.6 and 1.6 per cent of GDP per year. Since the average EU member-state grows at around 2 per cent a year, the fund will make a noticeable difference. Central and Eastern European countries will receive further large transfers from the EU budget’s Cohesion Policy (see Chart 1). The recovery fund and Multiannual Financial Framework (MFF) combined will entail a substantial redistribution of income from richer to poorer member-states.

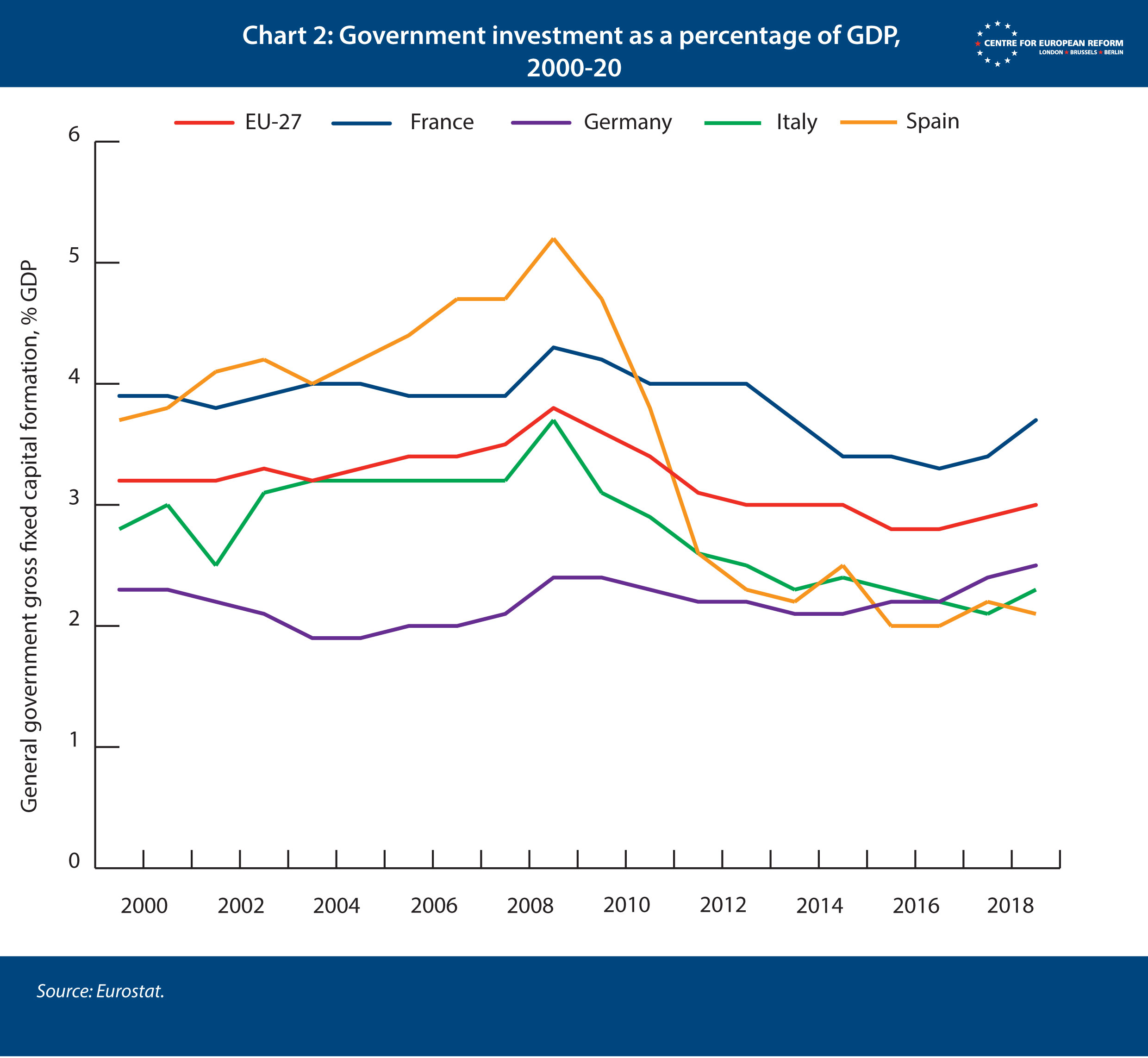

The investment stimulus that the fund provides has a good macroeconomic rationale. Over the last decade, the EU suffered from a prolonged shortfall in aggregate demand, showing up in the slow recovery of the employment rate alongside persistent low inflation. That is despite the European Central Bank (ECB) reducing interest rates below zero and buying government bonds in order to stimulate spending. The main reason for the shortfall in demand was that fiscal policy was too tight. Some countries, especially in Southern Europe, cut back spending and raised taxes to stabilise public debt, and Northern European countries were unwilling to stimulate their economies. The most effective way for governments to stimulate demand is to invest – as opposed to raising public sector pay, for example – because public investment can boost private investment if projects are well-judged. A new railway that shortens journey times between cities will raise commerce between those cities. But despite low yields on government debt – in Southern Europe, at least after the ECB intervened in 2012 – many European governments reduced investment as a share of GDP in the 2010s as part of their austerity programmes (see Chart 2). Meanwhile, Germany had plenty of fiscal space to invest more, but failed to do so.

With the ECB keeping borrowing costs low through quantitative easing (QE), even highly indebted governments in Southern Europe have fiscal space to invest, irrespective of the recovery fund. Yet there are two reasons why the fund is helpful in any case. First, the fact that the EU is borrowing collectively means that recovery fund spending is not immediately added to member-states’ debts: the money will be repaid by member-states in part according to their relative GDP per capita when bonds expire, with repayments continuing into the 2050s. Second, if interest rates rise significantly (which, as discussed below, is unlikely but cannot be entirely discounted), the fund provides a stream of finance that is independent of national financial conditions.

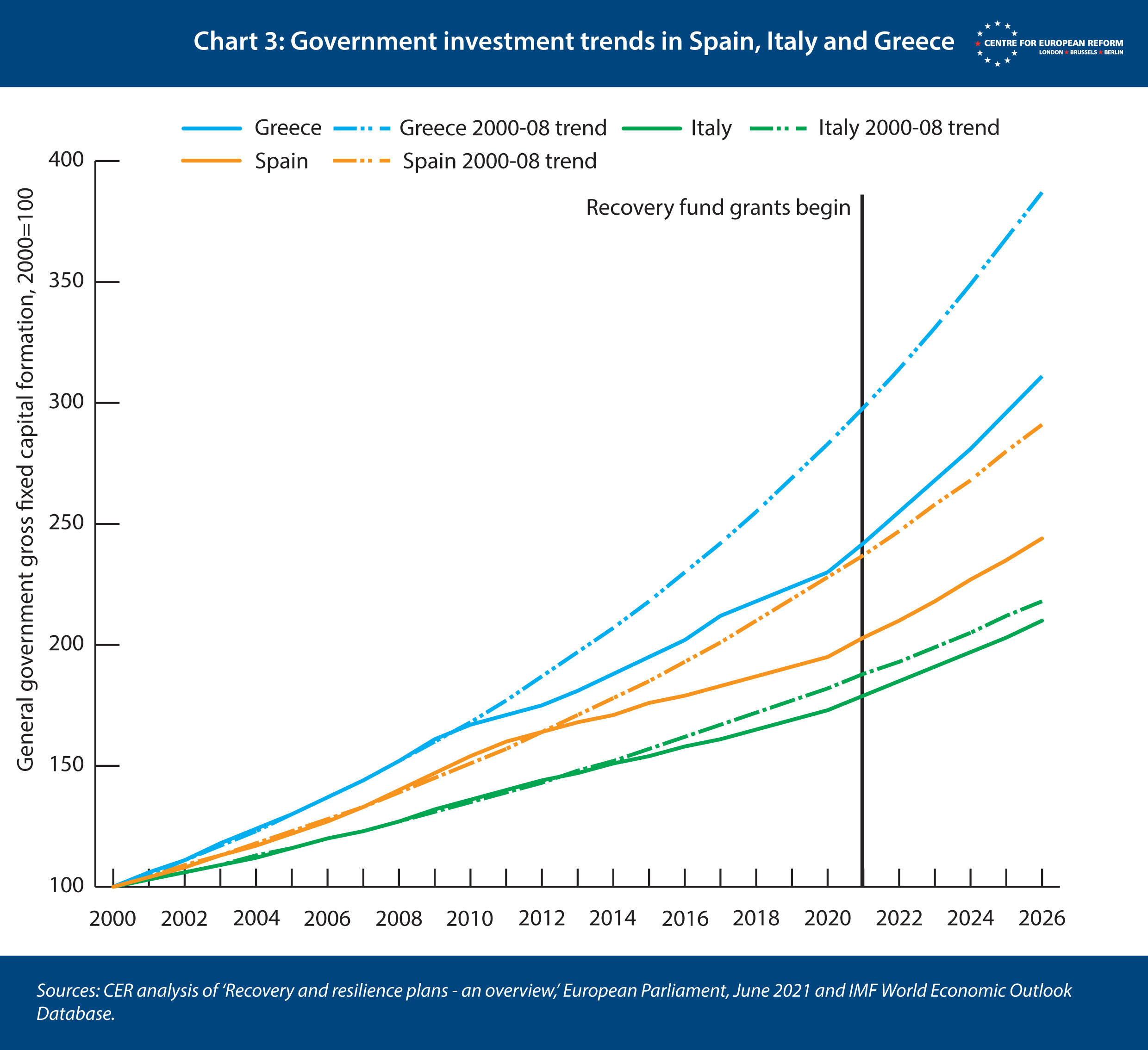

If Southern European governments use recovery fund grants for additional spending (as opposed to replacing investment that would have happened anyway), they will arrest the slide in public investment that began in the 2010s. Chart 3 shows the path of government investment in Greece, Italy and Spain as compared to the pre-crisis trend. Large gaps developed between 2009 and 2020, in part because GDP fell and in part because governments cut investment as a share of GDP. The forecast period on the chart assumes that each country’s RRF grants are added to the average investment rate in the 2010s. While the grants do not close gaps with the pre-crisis path of public investment, they bring Greece, Italy and Spain’s investment closer to their pre-2008 growth rates.

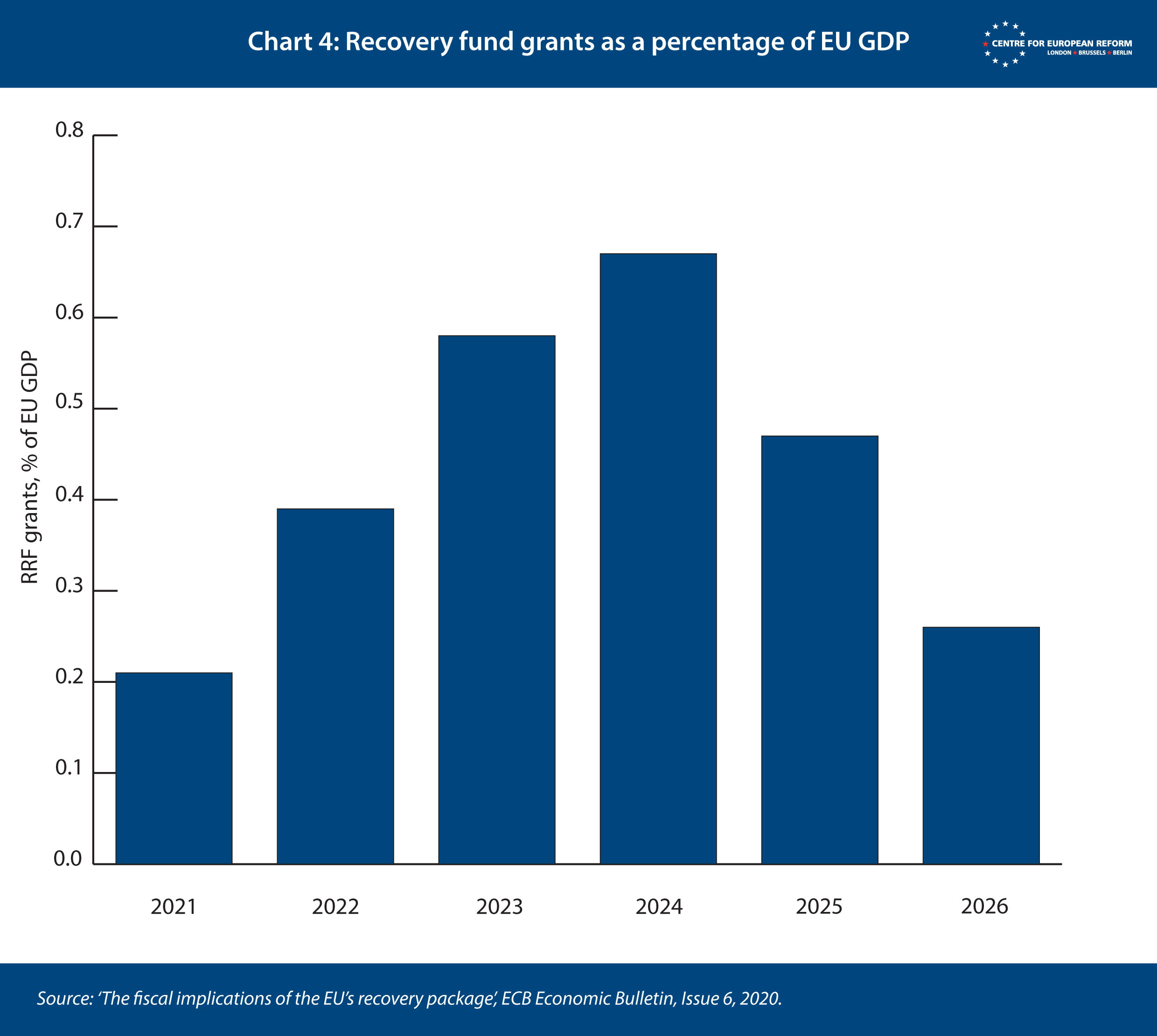

Perhaps more by luck than by design, the investment stimulus provided by the recovery fund is well-timed. It takes time to select and plan investment projects, and money is more likely to be wasted if that process is rushed. And at the time of writing, pandemic-induced shortages of raw materials, components and labour also mean that a rapid rise in public investment spending this year – and possibly next – might crowd out private sector activity, sucking workers and equipment into, say, construction and telecoms from other sectors, and raising inflation. Once the pandemic has receded – hopefully over the next six months, as vaccination programmes and acquired immunity mean that waves fall in size and lethality – stimulus in the form of higher government investment is more likely to raise growth rather than diverting resources that would otherwise have been deployed by the private sector. As Chart 4 shows, disbursements of RRF grants will start rising in 2022, to reach a peak of 0.7 per cent of GDP in 2024.

Yet by 2024 the European economy will have surpassed its 2019 level of output, and the IMF does not think that the pandemic and its aftermath will reduce future growth rates in advanced economies.3 Does that mean that the recovery fund is unlikely to perform the main function of fiscal stimulus – to close a gap between output and potential? A eurozone budget that provided rapid stimulus to member-states that were hit by shocks would be ideal. Euro members do not have the safety valve of an independent currency, nor a common budget to provide a rapid reaction to downturns. But it proved too difficult politically and legally to create a counter-cyclical budget at the eurozone level. A long-term investment programme at the EU level is a good second-best, for two reasons.

First, interest rates were low across the developed world going into the pandemic, and low inflation was a particular problem in Europe. The main reason for prolonged output gaps in Europe was excess global savings chasing a limited number of investment opportunities, driving interest rates down. There are good reasons to believe that situation will persist after the pandemic. Despite the shortages in supplies and labour, core eurozone inflation in the summer of 2021 remained below target, reaching 1.9 per cent in September. Europe’s ageing population will continue to save and keep interest rates low.4 There is little sign that China, whose population is also ageing, is decisively shifting towards a consumption-led growth model. The size of Joe Biden’s spending bills is being whittled down by US Congress. All that suggests that a long-term investment programme in Europe will be helpful, because the structural forces dragging down inflation and interest rates have not gone away.

Second, an EU-level programme could protect investment spending from fiscal retrenchment at a national level. A stream of investment expenditure financed by the EU, but which does not vary with the economic cycle, provides more indebted governments with greater ability to borrow and spend. For countries such as Italy with high debt ratios, this will make fiscal policy more counter-cyclical, and have a small positive effect on their borrowing costs.

The fund will improve growth rates in weaker economies, as long as it is not undermined by austerity.

The greater danger than too-loose policy is that the EU might tighten its collective fiscal stance too rapidly. The EU’s fiscal rules are currently suspended, and are due to be reimposed in 2023. These rules set limits on structural deficits, and mandate that countries’ fiscal stances reduce debt ratios to 60 per cent of GDP. The structural deficit is an estimate of annual borrowing while controlling for the economic cycle: if the gap between real and potential output is large, European policy-makers claim that the rules allow member-states to borrow and spend enough to stabilise economies. However, the European Commission’s estimates of structural deficits are often hard to understand. In 2019, the Commission claimed that the gap between real and potential output in Italy was 0.2 per cent, exactly the same as Germany’s, despite Italy’s dire growth performance in the 2010s and high unemployment rate.5 Member-states with debt ratios over 60 per cent of GDP must reduce them by one-twentieth per year. Together, those rules mean that Italy must rapidly return to a sizeable fiscal surplus – reducing its ability to invest in, say, sustainable transport or clean energy – to stay in compliance with the EU’s fiscal rules.

In sum, the fund will improve growth rates in less developed and slow-growing parts of Europe, as long as the public investment is additional and is not undermined by spending cuts and tax rises in other areas. In the section below, we discuss the extent to which the recovery fund will help with the EU’s biggest priorities – to reduce greenhouse gas emissions, hasten the use of new digital technologies, and make European societies less unequal.

Europe’s three challenges: The green transition, the digital revolution, greater social cohesion

The green transition

Under the recovery fund’s rules, member-states must allocate at least 37 per cent of total expenditure to the ‘green transition’: the effort to shift away from a carbon-intensive economy and towards a decarbonised economy in which waste is minimised and recycled as much as possible. It is a huge task that has to be done at pace, with big cuts in emissions needed in the 2020s to keep global warming within 1.5 degrees Celsius, as enshrined in the Paris Agreement.

The EU has recently approved more ambitious 2030 climate targets, and it plans to achieve net carbon neutrality by 2050. In a modelling scenario based on a mix of regulation and carbon pricing policies, the European Commission estimates that average annual public and private investment of €1,040 billion is needed between 2021 and 2030 to meet 2030 climate goals.6 Of this investment, €120 billion must be spent on the energy supply side (energy grid, power plants, new fuels) and €920 billion on the demand side (industrial, residential, services and transport sectors). Overall, the largest share of investments is required in the transport sector, which alone will require €622 billion.

In the latest National Energy and Climate Plans – documents member-states must submit to the EU institutions under the EU’s climate policy – around 45 per cent of investment needs are labelled as public investment for the energy transition, to cover things like transport and energy distribution infrastructure.7 This means the EU needs around €460 billion in annual public investment to meet its 2030 climate goals. (That is total investment, as opposed to extra investment needed to achieve climate goals above regular public expenditure on new plants and infrastructure.)

How much of a step forward is the RRF in this respect? On an annualised basis, the RRF provides €120 billion per year, in grants and loans, to EU member-states. If, as required by the European Commission, 37 per cent of funds go into climate investment and reforms, the total would be about €45 billion per year: still an order of magnitude smaller than the total annual public investment needed EU-wide to meet climate goals. So, the RRF is an important step forward, but national governments will also have to increase their own, nationally financed investment efforts, and use regulations, taxes and subsidies to raise private investment too.

Climate investment under the RRF could be well-timed. Investment in existing, mature technologies will support the economy and create well-paying jobs to support the recovery from the pandemic. Examples of such interventions can be found in the Italian plan, which features generous tax credits for energy efficient home retrofits, and in the Greek plan, which supports investment in energy storage to balance the impact of intermittent renewables.

Climate investment through the RRF is one-tenth the total EU annual public investment needed to meet climate goals.

From the ‘resilience’ perspective, if European countries want to develop and maintain leadership in low-carbon technologies – from renewables to electric vehicles and batteries – they need to encourage R&D as well as early-stage industrial ventures. For instance, Germany is investing in domestic car battery production, to retain the primacy of its automotive sector. Italy is supporting innovative renewable energy such as new offshore wind technology. Portugal plans to invest in R&D for renewable hydrogen, leveraging its abundant renewable energy resources. Some co-ordination at EU level could allow larger cross-country conglomerates to emerge, exploiting economies of scale: France and Germany have joined forces to develop hydrogen solutions for hard-to-decarbonise sectors, including trucks. The jump in natural gas prices in autumn of 2021 should also prompt EU soul-searching over its dependence on imported hydrocarbons, especially from Russia, which uses the supply of gas as a geopolitical tool.8

Most funds are going into sustainable transport and charging stations (€75 billion), followed by clean technologies and renewables (€47 billion) and energy efficient buildings (€42 billion).9 Member-states are rightly spending more on infrastructure such as charging stations and power grids. However, more subsidy is needed to encourage households and businesses to take up building insulation in order to meet EU energy efficiency goals: the European Commission estimates the investment gap for residential energy efficiency at €115 billion per year in the 2020s.10

Retrofitting buildings uses mature technology that can quickly contribute to the recovery. It will reduce households’ energy bills as well as greenhouse gas emissions. Higher government subsidies should be accompanied by training to provide more skilled workers for the growing energy efficiency industry. The amount of investment allocated to buildings efficiency over the next five years is not set in stone, even though all RRF funds have now been allocated to specific spending lines and the amounts cannot be changed (unless specific projects are not achievable due to ‘objective circumstances’, in which case recipients can submit amended plans). Member-states should use more national funding to increase subsidies for energy efficiency.

While the RRF currently runs until 2026, the energy transition will continue beyond that. Subsidies for low-carbon goods and services – such as electric vehicles and retrofits – should reduce their prices by speeding innovation and creating supply capacity. As these goods and services become more affordable, after 2026 the share of public financing could be reduced, with private financing stepping in to a greater extent. The extent to which this is possible will differ across countries, because their markets vary. Grants for building retrofits or for electric vehicles should be larger for poorer households and smaller businesses. Governments could announce now that subsidies will fall over time, to encourage households and businesses to invest in efficiency and electrification as soon as possible. And in the second half of the 2020s and in the 2030s, public investment in infrastructure, from electricity storage to charging stations, will have to grow, particularly in Central and Eastern Europe.

The digital revolution

The EU has good reasons to invest collectively in stopping climate change, but the rationale for EU investments in the digital economy is weaker. France and Germany are both pushing for ‘strategic autonomy’ in the digital economy, because they view EU imports of US and Asian technology as a source of geopolitical and economic weakness. Yet it is not apparent that the state can lead the development of a digital economy through public investment.

As part of the EU’s ‘projects of common European interest’ – a form of state aid that is co-ordinated at the EU level – Germany and France are collaborating on investment in cloud computing, and microelectronics, in an attempt to close the gap that has opened up with the US and Asia. Some RRF money will be used to finance these projects.

In cloud computing and data infrastructure, the EU and member-states are together investing up to €10 billion.11 The project’s centrepiece is the Gaia-X cloud computing platform. Gaia-X will provide a set of standards for cloud providers and other companies for the storage and processing of data, and is backed by European companies such as Orange, BMW, Bosch and EDF. Gaia-X is supposed to make it easier for individuals, companies and the public sector to share data securely and comply more easily with money laundering regulations. Its backers also say that the platform will allow companies to process data within their own jurisdiction, rather than having it stored in another member-state or outside the EU. These benefits will probably not overcome the US giants’ advantages, however, since some American cloud computing platforms have already made efforts to provide improved data protection in Europe. Their cloud services are already well developed, and economies of scale and first-mover advantage are always powerful forces in digital technology – large data centres are more efficient than small ones,12 and pre-existing cloud providers tend to offer distinct proprietary services, which make it difficult for business customers to switch providers without business disruption.

European attempts to use the recovery fund to challenge US and Asian tech giants may be too late.

The microelectronics project faces a different problem. Given the EU’s strengths in cars, appliances and high technology manufacturing, and the development of internet enabled versions of these products, there is a rationale for seeking to design higher-value semiconductors (and possibly manufacture them). Thierry Breton, the European Commissioner for the Internal Market, has championed the construction of chip factories in the EU, as part of the drive to onshore supply chains in a sector currently dominated by the US, South Korea, China and Taiwan. The global shortage of semiconductors has in part been driven by COVID-19-induced factory shutdowns in Taiwan, strengthening the apparent rationale for more local production. And Germany is spending €1.9 billion on an industrial strategy for its automotive supply chain, including the onshoring of chip and battery production, in an attempt to ensure that the production of higher value components stays in Germany as the transition to electric cars occurs. Electric vehicles are relatively simple products compared with those with internal combustion engines, and a smaller share of the value is in the body of the car than in batteries and chips. Those are currently largely imported from outside Europe.

But China, South Korea, Taiwan and the US are also throwing subsidies worth tens of billions of dollars at domestic production, especially at the latest small-nanometre chips that the EU would like to bring onshore. And over 50 per cent of added value in semiconductors is in the design of chips, with manufacturing only providing 24 per cent.13 There may be a rationale for industrial support for the design of new small and energy efficient semiconductors, in order to ensure that the EU has a foothold in a sector that has become a victim of ‘geoeconomic’ thinking, but manufacturing them in Europe will be uncompetitive without vast, and probably continuous, public subsidies.

More generally, digital markets tend to have very large economies of scale (thanks to the importance of having a lot of user data) and network effects (with platforms with many users attracting more users and advertising in a virtuous circle), which means that they tend towards monopoly or oligopoly. These effects mean that European attempts to challenge tech giants may be too late. The EU would be better off focusing on support for new technology in sectors of comparative advantage (which is why investing in new semiconductors for smart appliances and electric vehicles is not necessarily a bad idea, if potentially expensive).

A more sensible focus is digital skills, upon which countries are spending around 21 per cent of the EU money earmarked for digital investment.14 Portugal will spend €650 million on training people in small and medium sized enterprises in the use of digital technology. Spain will spend €3.6 billion on a ‘National Plan for Digital Skills’. As part of its €1.8 billion investment in digital technology, France will award funds through competitions to early-stage projects in quantum computing, cyber security, 5G ‘sovereignty’ and cloud computing, some of it to train more skilled tech engineers and entrepreneurs in these fields. Government subsidy can encourage young people and workers to invest in science and technology skills, which seem to be undersupplied without government intervention: 28 per cent of Europeans say that their digital skills are not good enough to do their jobs well.15

An important role for government digital expenditure is to improve the efficiency of public services. Happily, governments are planning to spend an average of 32 per cent of the earmarked money for digital on public services, which means they will receive the most money in the digital investment bracket of the RRF.16 Providing access to more public services online will reduce administrative costs and the time citizens and businesses must spend filling out forms and taking them to government offices. Government administrative datasets can be used to better understand trends in public health, labour markets and tax, and to improve the response of public services to changes in demand.

In all, however, the large sums of EU grants that governments will be spending on digital – €67 billion in total – have a weaker foundation than the funds earmarked for climate change. Investment in skills (which may be undersupplied by firms and individuals) and digitising the public sector seem like good bets. Subsidies for technologies of the future and ‘digital sovereignty’ are by their nature more risky. Government is more likely to succeed if it provides funding for early-stage science and technology, in part to build advanced skills (as France and others are doing) rather than ploughing money into cloud, semiconductors and other established digital markets where economies of scale and first-mover advantage are such powerful forces (as France and Germany are also doing).

Government is more likely to succeed by providing funding for early-stage tech, in part to build advanced skills.

Achieving greater social cohesion

Alongside the focus on the climate and digital transitions, most of the member-states’ plans aim to improve social cohesion, through a combination of investments and reforms. The COVID-19 pandemic has made some social problems worse. Women’s employment, already substantially lower than male employment in most of the EU, fell more than men’s during the pandemic as many women left the workforce to care for children and the elderly at home.17 The pandemic had very different impacts on office workers, who could work remotely throughout lockdowns and thus fully retained their salary, and workers in hospitality or retail who were fired or furloughed by businesses which closed during lockdowns, as well as care workers who faced higher risks of COVID-19 contagion while delivering essential services.18

Several member-states plan to support gender equality by addressing long-standing barriers to women’s employment. For example, Italy is addressing weak childcare provision by building a large number of new pre-schools. Such investments may well be transformational as long as governments ensure sufficient funding for childcare in the long-term – not only to build schools but to operate them. These are important steps, but it is worth noting that most RRF investments – such as energy, digital and transport infrastructure, as well as energy efficient construction – tend to concentrate in areas largely dominated by male employees. More effort is needed to integrate the female workforce in the green and digital transitions, including by increasing the participation of women in science, technology, engineering and maths (STEM), vocational education and reskilling programmes connected to green and digital transition jobs.

Other plans aim to help unemployed people re-enter the workforce. For example, Italy and Greece have proposed reforms to job search and training services. Spain is planning to reform vocational education. France is targeting young people that are ‘farthest from employment’ with training programmes.

The pandemic has brought to the surface lingering problems in the healthcare sector, including patchy local healthcare services, which are important for preventative care (COVID-19 was particularly deadly for people with comorbidities, such as obesity and cardiovascular problems). Several plans aim to change that: Italy is building local healthcare centres, Romania is investing in e-health and telemedicine services, and Greece is reforming primary healthcare and establishing a home healthcare system. Higher public investment both in education and healthcare will require higher budgets for operational costs in order to staff newly established institutions.

The disparities between richer and poorer regions have been widened by COVID-19, because poorer regions have more workers in high-contact jobs, fewer office workers and more people in ill-health.19 These regions may fall further behind as the energy and digital transitions pick up speed. For this reason, for example, some RRF plans address regional disparities by devoting more investment to poorer areas, which often include rural areas suffering from depopulation. Italy is channelling €82 billion to the Mezzogiorno (the bottom third of the ‘boot’) over the course of the recovery fund, including support for female and youth employment (which are lower than in the rest of the country) and strengthening transport infrastructure. Spain will try to tackle the multiple issues that have led to the depopulation of rural areas, including insufficient transport, telecoms and public services.

Some regions, such as mining areas, are particularly vulnerable to the changes in industrial geography that the energy transition is bringing about, and the plans try to smooth transitions in these regions. For example, Poland is setting up a Special Development Fund to support mining areas.

The recovery fund and the EU budget

The macroeconomic case for the recovery fund is strong, as is its focus on restructuring the European economy through investment in climate and (with some caveats) digital. The long-standing European budget – the MFF – by contrast, needs further reform.

In macroeconomic terms, the MFF is larger than the RRF, standing at 1 per cent of EU GDP. But unlike the recovery fund, the MFF involves no borrowing by the EU, and is financed by payments from member-states and by some of the EU’s ‘own resources’ – money like tariffs and a share of VAT that legally belongs to the EU, but is collected by member-states. This means that the budget does not help to reduce the surplus of savings over investment in the EU – it largely passes cash from one member-state to the other. As a result, it could do more to raise spending and thus interest rates and inflation across the EU, all of which had been too low before the pandemic, and are likely to be afterwards too.

Some parts of the Common Agriculture Policy actively undermine the EU’s climate goals.

The MFF, like the RRF, is redistributive, so it raises expenditure in countries in Southern and Central and East Europe that are net recipients. As shown in Chart 1 above, under the EU’s cohesion policy, newer member-states – and Portugal and Greece, the two poorest pre-2004 members – receive between 1.4 and 2.5 per cent of GDP annually in spending. That is because most of the money goes to regions within countries whose GDP per capita is lower than the EU average. However, unlike the RRF, a good deal of regional spending under the cohesion policy is determined by regional governments, not central government. Small businesses, charities, and local governments can apply for the funds from regional government; their projects are assessed and then the money is committed and spent.

This funding structure causes two problems. The first is that it takes time to plan and build new roads and bridges, for example, so often payments are delayed beyond the official budget period. According to European Commission data, as of September 2021 Poland had spent only €26 billion of €48 billion of planned expenditure under the European Regional Development Fund for the 2014-2020 budget period.20 (In Poland’s case, most of the remaining €22 billion will ultimately be spent, but several years after the MFF has ended.) The RRF, by contrast, is being pushed through by central governments on the basis of their national plans, and must be spent by 2026. This allows RRF spending to have some countercyclical effects.

The second problem is that scrutiny of MFF spending is weaker than under the RRF. The RRF process started with the European Council agreeing the size of the fund and its priorities. Member-states then worked up recovery and resilience plans for scrutiny by the European Commission. Poland’s recovery plan had still not been signed off at the time of publication, after a stand-off with the European Commission over steps taken by Poland’s government, led by the populist Law and Justice party, to curb the independence of Poland’s judiciary, and, in the Commission’s view, the government’s failure to establish strong enough anti-corruption measures. And Romania’s first and second drafts of the plan both failed to pass muster, because there was not enough focus on green investment and information on costs was missing. Once plans are agreed, as Romania’s has now been, the first tranches of money can be disbursed – so-called ‘pre-financing’. Further tranches are paid out when the Commission is satisfied that pre-agreed milestones – particular reforms and investments, in the main – have been passed. If initial milestones are not passed, member-states must return the pre-financing.

By contrast, the MFF’s conditionality mechanisms are largely ex ante, with money being disbursed as long as member-states have put together strategic plans that meet the EU’s environmental, economic and social goals, and as long as member-states gather data and perform analysis on whether the money is being disbursed according to the plans.21 That is in part because national governments have closer relationships with regional authorities than the European Commission, and so are in theory better able to hold them accountable. New rule-of-law conditionality, agreed after Poland and Hungary threatened to veto the MFF and recovery fund, will allow the Commission to withhold funding if member-states breach the rule of law in a way that compromises the management of EU funds. Governments would be subject to the mechanism if they water down independent powers to investigate and prosecute corruption, for example. But as its name suggests, this conditionality aims to stop downright corruption as well as breaches of the rule of law, as opposed to raising the quality of legitimate reforms and spending.

An additional problem is that the cohesion policy of the MFF has variable effects on growth in the poorest regions of the EU. In a study examining the 2007-13 MFF, Sascha Becker and colleagues compared regions that receive structural funds because their GDP per capita was below 75 per cent of the EU average, to those who just missed out by being above that threshold. On average, they found that one euro of structural funds led to an extra €1.21 in GDP. However, in a second paper, they found big variations in that effect between regions. Those regions with higher levels of education and better perceived quality of government – largely in Northern Europe – did better than the poorer regions of France, Italy, Malta and Portugal.22

Finally, some parts of the Common Agriculture Policy (CAP) actively undermine the EU’s climate goals. In the 2014-20 budget period, the EU spent €275 billion on farm subsidies that had no environmental conditionality attached, compared to €130 billion where green measures were needed to receive the money. Meanwhile, greenhouse gas emissions from agriculture were flat over that period.23 And the European Court of Auditors found that CAP funds earmarked for climate action had little impact on emissions.24 In the 2021-27 period, among other reforms, farmers will be rewarded with subsidies for ‘eco-system services’, such as reducing soil erosion and flooding, but member-states retain some latitude to define ‘eco-system services’ and how farmers are rewarded.

Recommendations

Make the recovery fund permanent

The recovery fund was conceived in the midst of the first wave of COVID-19: an emergency that had the potential to kill many people and threaten Europe’s financial system, and one which would be more painful for some member-states than others.25 Formally, it was a one-off measure to deal with the pandemic. But the RRF should be made permanent, for three reasons.

1. The EU will need between 1 and 2 per cent of GDP in additional public and private investment annually to reach net zero greenhouse gas emissions by 2050.26 Climate change is a cross-border phenomenon, so the EU has a collective interest in ensuring there is no free-riding by individual member-states. That is why it should continue to provide collective funding for the energy transition, with tough conditions to reduce wasteful spending and green-washing. Borrowing for some of the funding for that transition is also sensible, because it shares the cost between generations, and reduces the need for a sudden leap in taxes, which could stoke a political backlash.

2. Low interest rates, if they persist, mean that the ‘hurdle rate’ for government investment projects to generate returns (in the form of higher GDP and tax revenues) is lower than in the past. By borrowing collectively, the EU’s member-states are channelling surplus savings into a targeted investment programme. That programme has conditions: member-states must enact reforms to reduce constraints on growth.

3. Some member-states will face worse recessions than others in the future, just as Southern Europe was hardest hit by the euro crisis and the pandemic. The euro means that one potential pressure valve – a devaluation of the currency – is not available. And high debts in Southern Europe mean governments have less fiscal capacity to offset recessions. The RRF, if it were permanent, would provide a constant stream of income to governments, which they can use for investment and which would not be cut in downturns.

The recovery fund’s governance should be used for the EU budget

If the RRF is made permanent, its advantages over the MFF – including what the money is spent on, and it being financed by collective borrowing, rather than immediate payments by member-states – should make it the main instrument for governing EU expenditure. The RRF’s system of governance should be applied to cohesion spending and the CAP, for three reasons.

1. The RRF has a better system of governance. Investment and reform plans are determined jointly by member-states and the EU institutions, in accordance with the overall objectives of the EU. Conditionality continues year by year, rather than being largely upfront. This will help to bear down on the waste and corruption that has dogged farm subsidies and regional funding. In 2019, the New York Times uncovered oligarchs in Central Europe buying land, sometimes with the connivance of governments, in order to be awarded subsidies.27 Eighty per cent of farm spending goes to the largest 20 per cent of farms. Strengthening oversight of MFF spending will make political buy-in from Northern member-states more likely.

2. Investment in climate action and, to a lesser extent, digital technologies and other forms of structural transformation of the economy are more important to future prosperity than farm payments, which subsidise a high-emissions sector of the economy. If it proves impossible to reduce farm subsidies significantly to make space for investment in these public goods, overall EU spending needs to be bigger to accommodate more investment.

3. As income differences between newer and older member-states reduce and infrastructure in the least developed member-states improves, the structural funds, which are predominantly a development tool, will become less important. The RRF process is better designed for economic transformation to counter climate change and to ensure that recessions do not curb government investment.

This reform would not require treaty change. Article 312 of the Treaty on the Functioning of the EU says that the MFF must be in balance, unlike the RRF, which is financed by borrowing. But the MFF’s spending priorities and the way conditionality operates are determined by an EU regulation, which is ordinary legislation. Thus the MFF part of a combined EU budget could always balance, while the RRF part of the budget could be financed by borrowing as well as tax revenues or transfers by member-states.

Using the recovery fund’s governance for the MFF would not require treaty change.

The key is that the conditionality and spending priorities of the MFF become more in line with climate and development goals and less susceptible to mis-spending and corruption. That can be done without treaty change. Article 312 is silent on governance arrangements, so the RRF’s system could be applied to the MFF.

Reform the fiscal rules to support the recovery fund

A return to the fiscal policies of the 2010s would reduce growth and might undermine the economic and political benefits that the recovery fund has the potential to provide. Government investment was a victim of the last austerity round, because politically it is one of the easier budget lines to cut. The EU’s fiscal rules should be reformed to allow governments to maintain higher debt ratios: they are easier to afford, given the structural fall in interest rates globally. They should also allow more borrowing for government to invest, irrespective of the stage in the economic cycle, especially given the sizeable public investment needed to adapt to and mitigate climate change.

The next recovery fund should be doubled in size

Climate change is a global problem: just as setting targets to address it at EU level is the best way to go about it, co-ordinating investment efforts and raising funds to finance those investments is more efficient at EU level.

As noted above, over €460 billion in public investment will be needed annually to meet the EU’s 2030 climate targets. For this reason, we recommend that the RRF should continue to operate beyond 2026, and that its next instalment should be much bigger, so that it provides at least half of the €460 billion needed annually for climate investments. That would mean that it would have to be at least €1.4 trillion over the six years from 2026, or twice as large as the current fund.

A 50/50 mix of nationally-funded and RRF-funded public investment would reduce the cost of climate action through collective borrowing at the EU level. It would make it harder for some member-states to free-ride on others’ climate change efforts, by providing funding that is specifically earmarked for the climate transition, with oversight by the EU’s institutions. Transfers from richer to poorer member-states would make EU-level climate targets more politically acceptable in Central and Eastern Europe: for these countries, the RRF would cover more than half of their required climate investments. Blending national and European co-financing would ensure that vigorous national-level debate would continue on how to best fund climate action, involving parliaments and civil society.

To finance the recovery fund, the EU needs a stable tax base

In order to finance this permanent RRF, the EU needs more ‘own resources’ – taxes and other payments that are collected by national institutions but that legally belong to the EU collectively. However, they should not solely be the resources that the European Commission has proposed.

The RRF has been financed by issuing EU bonds. The Commission has proposed to pay the EU’s creditors through several new sources of revenue: its initial proposal involved earmarking part of the revenues from a new carbon border adjustment mechanism (CBAM), the EU Emissions Trading Scheme (EU ETS) and a levy on digital business activities. While the first two proposals were tabled in July 2021, the proposal for a digital levy has been postponed. The Commission is also considering proposals for additional own resources from taxes on business but has not yet tabled detailed plans.

There are a few problems with the Commission’s proposals. First, revenues from the CBAM and ETS will shrink over time, because if they are effective they will reduce carbon emissions: this does not make them ideal as long-term budget resources. And due to its slow phase-in, CBAM would start raising revenues only at the end of its transition period, in 2026. What is more, climate action requires polluting to become more expensive, and it helps politically if tax revenues from environmental taxes and other price-based mechanisms – such as the EU ETS and CBAM – are clearly linked to subsidies and investment in low-carbon alternatives. The recovery fund provides some ‘hypothecation’ through its 37 per cent target for climate related expenditure. It would make sense to finance that 37 per cent share using ETS and CBAM revenues – but not the full RRF. Some revenues should be passed to the EU, and some of the remaining revenues should be spent by member-states to support low-carbon innovation and to help poorer people with the cost of the climate transition.

Second, discussions around the digital tax levy were frozen during international negotiations on a global minimum corporate tax rate and on a fairer reallocation of corporate tax revenues between countries. A precondition of the international agreement is that no new digital services taxes or similar measures can be introduced. The Commission plans to resume its proposal in October, but designing such a levy in a way which does not jeopardise the international agreement will be technically and politically difficult.

The recovery fund as it stands is too small, and it will end before Europe is halfway to net zero.

The Commission has made vague reference to additional potential own resources such as a financial transaction tax, and a financial contribution from businesses. These types of financial tools might provide greater financial sustainability, given their longer time horizon. However, while proposals for both a financial transaction tax and a common corporate tax base have been discussed on and off for years, at this stage there has neither been an agreement on how to take them forward, nor a proposal on the share of revenues which could be devoted to the EU. Detailed proposals are far off: they will be tabled by June 2024.

A higher share of VAT revenues would, like corporate or financial transactions taxes, provide a more stable tax base for the EU. Under the current system for funding the EU, member-states pass a share of VAT revenues to the European Commission (with a formula ensuring that poorer member-states pay less). If the EU is to have more responsibility for investment, it is important that it has access to a long-lived fiscal instrument rather than short-term price incentives to change behaviour – which is what the ETS and CBAM are.

Any permanent recovery fund will differ from the plan we have outlined above: it will be the product of bargaining between 27 member-states. But if enacted, our outline would make a significant difference to climate change, and the EU must respond collectively to the climate emergency. 2026 may seem far off, but the recovery fund as it stands is too small, and it will end before Europe is halfway to net zero. The EU’s leaders should start work on a permanent recovery fund before it is too late.

The next sections analyse the recovery and resilience plans submitted by the eight EU countries that will absorb over 80 per cent of the RRF grants. These are France, Germany, Greece, Italy, Poland, Portugal, Romania and Spain.28 The analysis also takes stock of the impact of the COVID-19 pandemic in each country, and assesses their prior economic performance and success in reducing greenhouse gas emissions.

2: Anatole Kaletsky, ‘Europe’s Hamiltonian moment’, Project Syndicate, May 21st 2020.

3: ‘World economic outlook’, International Monetary Fund, October 2021.

4: Christian Odendahl, ‘Europe shouldn’t worry about inflation’, CER insight, July 20th 2021.

5: Robin Brooks and Jonathan Fortun, ‘Campaign against nonsense output gaps’, Institute of International Finance, May 23rd 2019.

6: European Commission, ‘Stepping up Europe’s 2030 climate ambition. Investing in a climate-neutral future for the benefit of our people’, Commission staff working document. Impact assessment accompanying the document communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, September 17th 2020.

7: The share of public investment (as opposed to private investment) is estimated to be higher in Central and Eastern Europe than in Western and Southern Europe, respectively at 60 per cent and 37-39 per cent. European Investment Bank, ‘Investment report 2020/2021: Building a smart and green Europe in the COVID-19 era’, 2021.

8: Ian Bond, Elisabetta Cornago and Zach Meyers, ‘Why have Europe’s energy prices spiked and what can the EU do about them?’, CER insight, October 28th 2021.

9: Bruegel dataset, updated on July 14th 2021, European Union countries’ recovery and resilience plans.

10: Fi-compass, European Structural and Investment Funds, ‘The potential for investment in energy efficiency through financial instruments in the European Union’, June 2020.

11: ‘What is GAIA-X and what do I need to know?’, Squire Patton Boggs, November 2020.

12: ‘Google’s hyperscale data centres and infrastructure ecosystem in Europe’, Copenhagen Economics, September 2019.

13: Antonio Varas and others, ‘Strengthening the semiconductor supply chain in an uncertain era’, Boston Consulting Group, April 2021.

14: Zsolt Darvas, J. Scott Marcus and Alkiviadis Tzaras, ‘Will European Union recovery spending be enough to fill digital investment gaps?’, Bruegel, July 20th 2021.

15: ‘Insights into skills shortages and skill mismatch’, European Centre for the Development of Vocational Training, January 2018.

16: Zsolt Darvas, J. Scott Marcus and Alkiviadis Tzaras, ‘Will European Union recovery spending be enough to fill digital investment gaps?’, Bruegel, July 20th 2021.

17: International Labour Organisation, ‘Building Forward Fairer: Women’s rights to work and at work at the core of the COVID-19 recovery’, July 2021.

18: BMJ, ‘Healthcare workers 7 times as likely to have severe COVID-19 as other workers’, December 8th 2020.

19: Christian Odendahl and John Springford, ’Three ways COVID-19 will cause economic divergence in Europe’, CER policy brief, May 2020.

20: ‘European structural and investment funds data, 2014-2020 EU payments’, European Commission, accessed September 27th 2021.

21: Jorge Núñez Ferrer and others, ‘The EU budget and its conditionalities: An assessment of their contribution to performance and reforms’, Centre for European Policy Studies, September 2018.

22: Sascha Becker and others, ‘Going NUTS: The effect of EU structural funds on regional performance’, Journal of Public Economics, 2010; and ‘Absorptive capacity and the growth and investment effects of regional transfers: A regression discontinuity design with heterogenous effects’, American Economic Review: Economic Policy, 2010.

23: John Springford, ‘The EU budget needs climate proofing’, CER insight, November 4th 2019.

24: ‘Common Agricultural Policy and climate: Half of EU climate spending but farm emissions are not decreasing’, European Court of Auditors, July 2021.

25: Christian Odendahl and John Springford, ‘Three ways COVID-19 will cause economic divergence in Europe’, CER policy brief, May 2020.

26: Florence Jaumotte and Gregor Schwerhoff, ‘Reaching net zero emissions’, International Monetary Fund, July 22nd 2021; and ‘Net zero by 2050: A roadmap for the global energy sector’, International Energy Agency, May 2021.

27: ‘The money farmers: How oligarchs and populists milk the EU for millions’, New York Times, November 3rd 2019.

28: European Commission, ‘Recovery and Resilience Facility: Maximum grant allocations’, 2021.

Elisabetta Cornago is a research fellow and John Springford is deputy director of the Centre for European Reform

November 2021

This paper is published in partnership with the Open Society European Policy Institute.

View press release

Download full publication