Why the EU's recovery fund should be permanent: Country report - Germany

COVID-19

Germany locked down at an early stage of the first wave in March 2020, which meant that it suffered fewer hospitalisations and deaths than most other countries in Western Europe. Deaths in the autumn and winter waves of the disease were lower than its peers, too. Its fiscal response to the pandemic was one of the biggest in Europe: the state paid the wages of millions of workers, keeping the formal unemployment rate below 5 per cent. Germany’s pre-existing Kurzarbeit scheme meant that it already had systems in place to pay people not to work. The state extended 100 per cent guaranteed loans to many businesses without many conditions, which meant they received the funds quickly. The IMF and the ECB forecast that Germany will reach its pre-pandemic level of output in mid-2022, but the economy is forecast to still be around 2 per cent smaller in 2024 than its pre-pandemic path of output.1

Greenhouse gas emissions

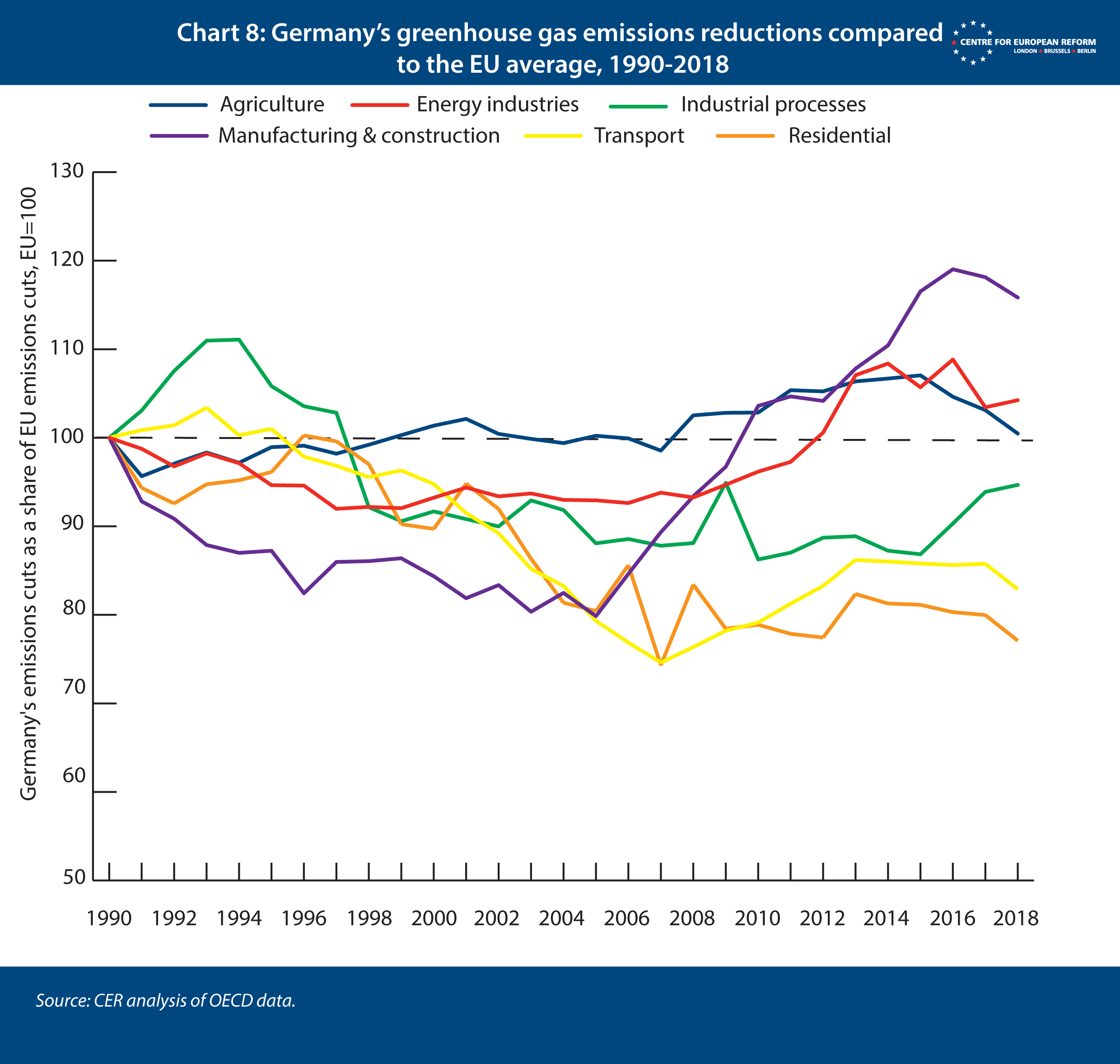

Germany’s total emissions had fallen by 31 per cent from their 1990 level by 2018, and reached the 2020 target of a 40 per cent reduction thanks to the COVID-19 pandemic.2 The country’s performance is only a little better than the EU average: Chart 8 shows how rapidly Germany has cut emissions from six sectors of the economy compared to the average pace of cuts in the EU (the dotted line on the chart). Perhaps surprisingly for a country which does not impose speed limits on its motorways, Germany has reduced emissions from the transport sector faster than the EU average, and it has been among the best performers in reduced emissions from residential buildings.

But its efforts in energy generation (after the decision to close down its nuclear power plants), and manufacturing and construction have been worse than the EU average. In the 1990s, reunification helped to reduce pollution from the manufacturing, construction, agriculture and energy generation sectors rapidly, as communist-era plants and machinery in the eastern Länder were decommissioned. But since the mid-2000s sectoral emissions have not improved (agriculture) or have risen (manufacturing and construction). The energy generation sector made significant gains only from 2014, despite feed-in tariffs for renewable energy being introduced in 1998.

Long-term economic performance

Over the last decade, Germany’s economic performance has been solid but unspectacular. It had a comparatively good financial crisis, with export sales of its capital goods such as machinery and vehicles to fast-growing emerging economies, especially China, providing external demand during the recovery. Unemployment fell steadily to 3 per cent on the eve of the pandemic. But the improvement in living standards has been disappointing.

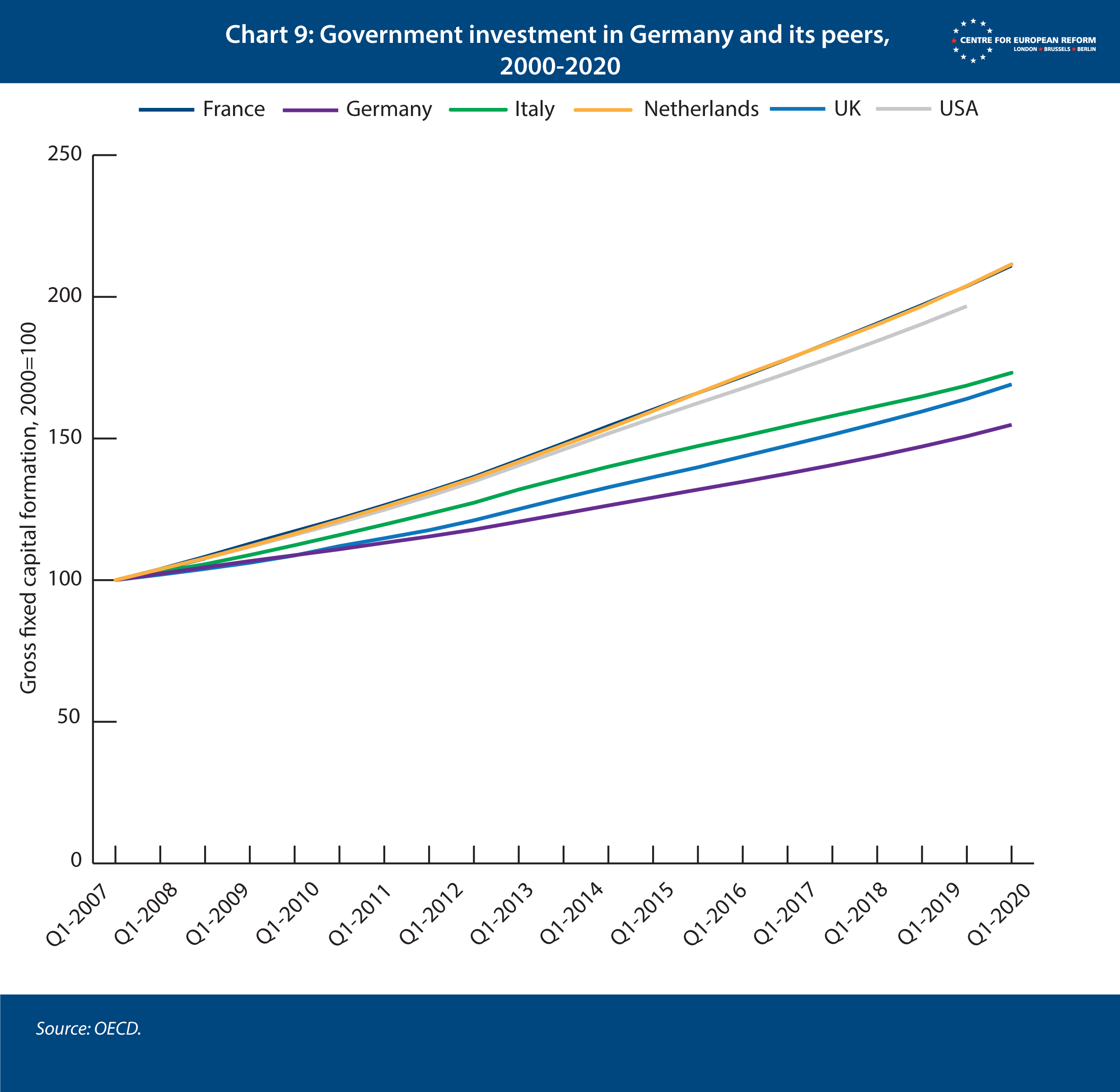

Productivity growth has been around the OECD and EU average, with GDP per hour worked rising around 0.9 per cent a year between 2009 and 2019. As a result, real earnings growth has been slow, only rising by a little over 1 per cent annually.3 Public investment has been a victim of Germany’s strict fiscal rules, growing at a rate far lower than in its peers (see Chart 9). And weak corporate sector investment rates have meant growth in the private sector capital stock has also been disappointing, at less than 1 per cent a year.4

As the German economy reopens after the pandemic, like many countries it is struggling with higher inflation and labour shortages in some sectors. Bottlenecks should ease as workers return and supply chains

re-establish themselves, but Germany’s deep integration into global supply chains, with total trade exceeding 80 per cent of GDP – an unusually high number for an economy of Germany’s size – means that its economy is particularly exposed to shortages of commodities, components and energy.

Over the longer term, it is also vulnerable to geopolitical competition between the US and China, if that leads to a further degradation in economic relations between the two superpowers, or if China decides to make it tougher for German companies to build plants in the country. And its ageing population means that productivity growth is needed to ensure that working age people can provide enough tax revenue for health and pensions spending. Higher public and private investment, as well as tax and benefit reforms to reduce saving and raise consumption, will be needed to reduce the economy’s reliance on exports as a source of growth.

Germany’s recovery plan

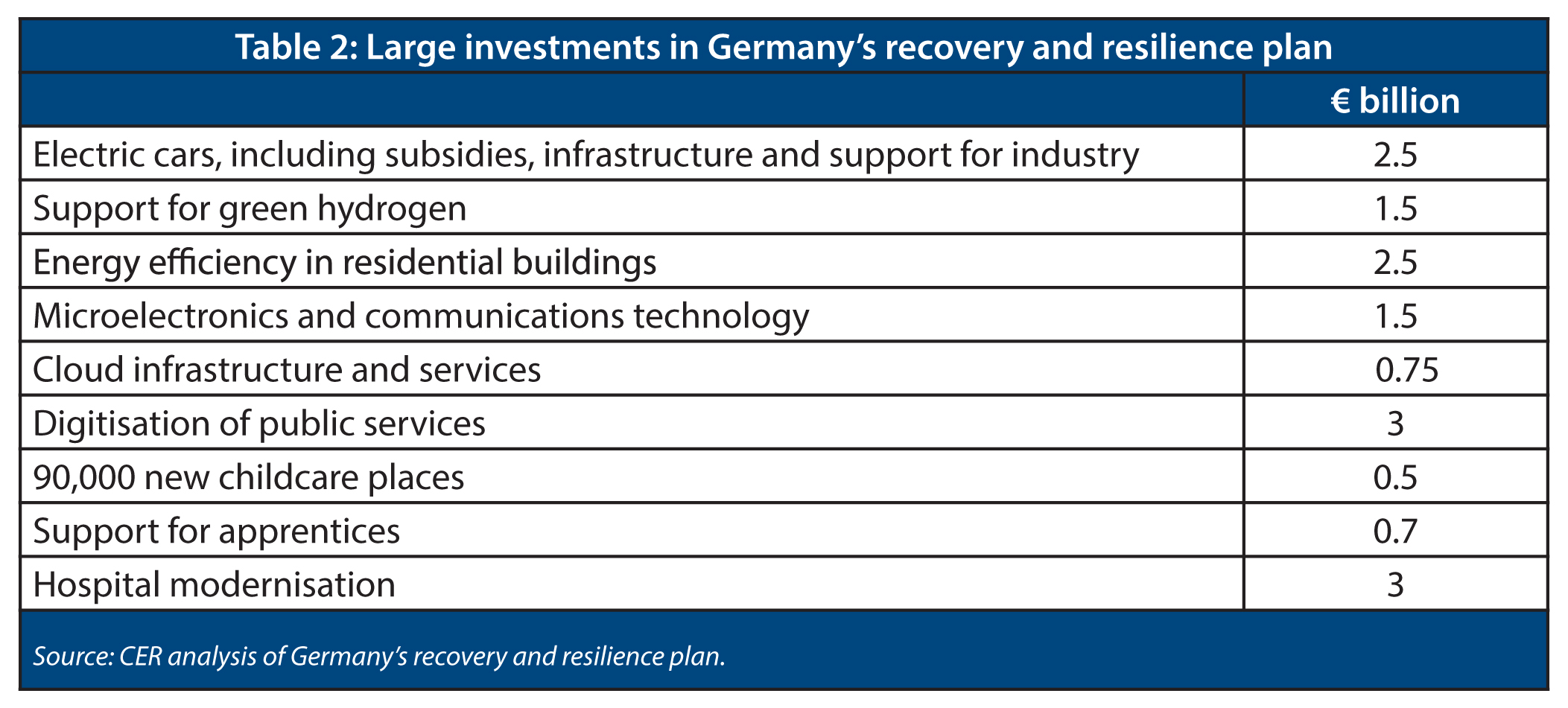

Germany had already announced two sizeable fiscal packages before publishing its recovery plan under the RRF. The summer 2020 package combined standard countercyclical stimulus – a €20 billion VAT cut – with measures to continue to support workers and firms through the pandemic. Its autumn 2020 package was more focused on long-term investment. Together, the packages announced before Germany’s recovery and resilience plan was published in April 2021 amounted to €130 billion. Its recovery plan includes many measures that had already been announced, and only adds another €10 billion in new investments.5 Altogether, the RRF will provide €26 billion in grants to Germany.

Germany has a good record of reducing emissions from buildings, which by 2018 were 41 per cent lower than emissions in 1990, and will spend €2.5 billion on buildings efficiency measures by 2026. However, according to one estimate, €6-10 billion of public support for energy efficiency measures will be needed annually in order to ensure that the cost of retrofitting buildings does not lead to higher poverty rates among poorer renters.6

Similarly, money for decarbonising the transport sector is fairly limited. Germany will provide €1.1 billion to subsidise the purchase of electric or hybrid cars (sales of the latter will need to cease within fifteen years if Germany is to meet its targets for decarbonising the transport sector). Only €0.7 billion will be provided to extend the country’s electric vehicle charging infrastructure.

Germany is using most of the money to fund an industrial strategy that is clearly intended to improve innovation in the country’s sizeable manufacturing base, on the one hand, and attempt to improve the country’s patchy record in creating new digital technology on the other. This is a legitimate thing for government to invest in: European countries generally lack the huge pools of risk capital and university-industry links that the US enjoys; and government funding for early-stage technological development is needed, especially in new forms of energy. But Germany’s investments are unlikely to raise near-term economic performance.

€10.5 billion will be spent on developing hydrogen technology, with €1.5 billion for R&D in green hydrogen: the International Energy Agency’s attempt to map a path to net zero argued that hydrogen would be needed to provide zero carbon power in sectors that may be hard to electrify, such as heavy industry, long-distance trucking, shipping and aviation. However, engineers differ on whether ‘blue’ hydrogen (hydrogen production in which carbon dioxide is captured and stored underground) or ‘green’ hydrogen (which is made without carbon dioxide being released) will be too expensive compared to battery technology.7

Germany is also making some risky bets on digital innovation. €1.9 billion will be spent on improving the automotive supply chain, including the onshoring of chip manufacture and design, in an attempt to ensure that value added in vehicle manufacture remains in Germany as the transition to electric cars occurs. Electric vehicles are relatively simple compared to ones with internal combustion engines. A large share of the value is in batteries and chips which are currently mostly imported from outside Europe. And as part of the EU’s ‘projects of common European interest’, Germany and France are collaborating on investment in microelectronics, cloud computing and data processing – sectors already dominated by South Korea, China and the US. In the case of cloud computing, it is hard to see the benefit of a European champion when the technology is already mature and there is a pre-existing, well-contested market led by US tech giants.

2: ‘Germany’s greenhouse gas emissions and energy transition targets’, Clean Energy Wire, August 16th 2021.

3: OECD, GDP per hour worked; Destatis (Germany’s Federal Statistical Office), index of real earnings.

4: Alexander Roth and Guntram Wolff, ‘Understanding (the lack of) German public investment’, Bruegel, June 2018.

5: ‘Green recovery tracker report: Germany’, Wuppertal Institute and E3G, May 2021.

6: Sven Bienert, ‘Wissenschaftliche Plausibilitätsprüfung: Der errechneten öffentlichen Förderungslücke zur Erreichung der Klimaziele durch energetische Gebäudesanierungen im Mietwohnungsbau’, Regensberg University, June 2020.

7: ‘After many false starts, hydrogen power might now bear fruit’, The Economist, July 2nd 2020.

Elisabetta Cornago is a research fellow and John Springford is deputy director of the Centre for European Reform

November 2021

This paper is published in partnership with the Open Society European Policy Institute.

View press release

Download full publication